Inflation in UK Shops "Rapidly Normalising", But Won't Move Dial on Bank of England Rate Cuts

- Written by: Gary Howes

Image © Adobe Stock

Inflation for goods and food sold in UK shops has fallen back to what is considered to be normal levels by economists at the British Retail Consortium (BRC), but this won't be enough to convince the Bank of England it should cut interest rates next month.

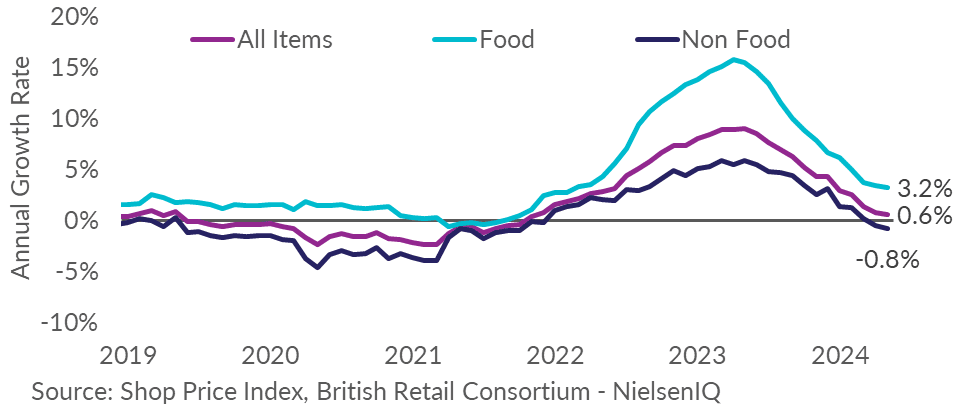

The BRC's latest shop price index revealed inflation is back to what the BRC describes as "normal levels" after it eased sharply to a 30-month low at 0.6% y/y in May.

The consensus estimate was for a reading of 1.0%, which means this represents a sharp undershoot against expectations. The data comes after the headline CPI inflation reading for April surprised to the upside last week at 2.3% year-on-year.

"Shop price inflation has returned to normal levels, at just 0.6%. This was helped by slowing food inflation, with fresh food inflation falling to its lowest level since November 2021," says Helen Dickinson, Chief Executive of the British Retail Consortium.

Non-Food items remained in deflation at -0.8% in May, down from -0.6% in the preceding month. This is below the 3-month average rate of -0.4%. Inflation is its lowest since October 2021.

Food inflation decelerated to 3.2% in May, down from 3.4% in April. This is below the 3-month average rate of 3.5% and is the thirteenth consecutive deceleration in the food category.

Despite clear signs of disinflation, Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman, says shop price disinflation is unlikely to convince the Bank of England to move early with policy rate cuts.

"The BOE is more concerned with high services inflation. Interest rate futures continue to price-in a first 25bps BOE policy rate cut in November," says Haddad.

The Pound fell following last week's inflation release as markets pared expectations for a June interest rate cut at the Bank of England, judging that inflation can't fall to the 2.0% target on a sustained basis as long as services inflation was running close to 6.0%.

Although the disinflation trend is intact on Britain's high streets, the Bank of England will want to see similar trends in travel, insurance, hotels, restaurants, and other service-orientated sectors of the economy before cutting interest rates.