New Data Projections to Justify Big Fed Rate Cut

- Written by: Gary Howes

Image © Adobe Images

Financial markets think the Federal Reserve will go big and cut interest rates by 50 basis points later today and justify the decision on its latest economic forecasts.

The Dollar has come under pressure over recent days as expectations have shifted from a 25bp cut to a 50bp move as the Fed seeks to 'front load' rate cuts to protect the labour market.

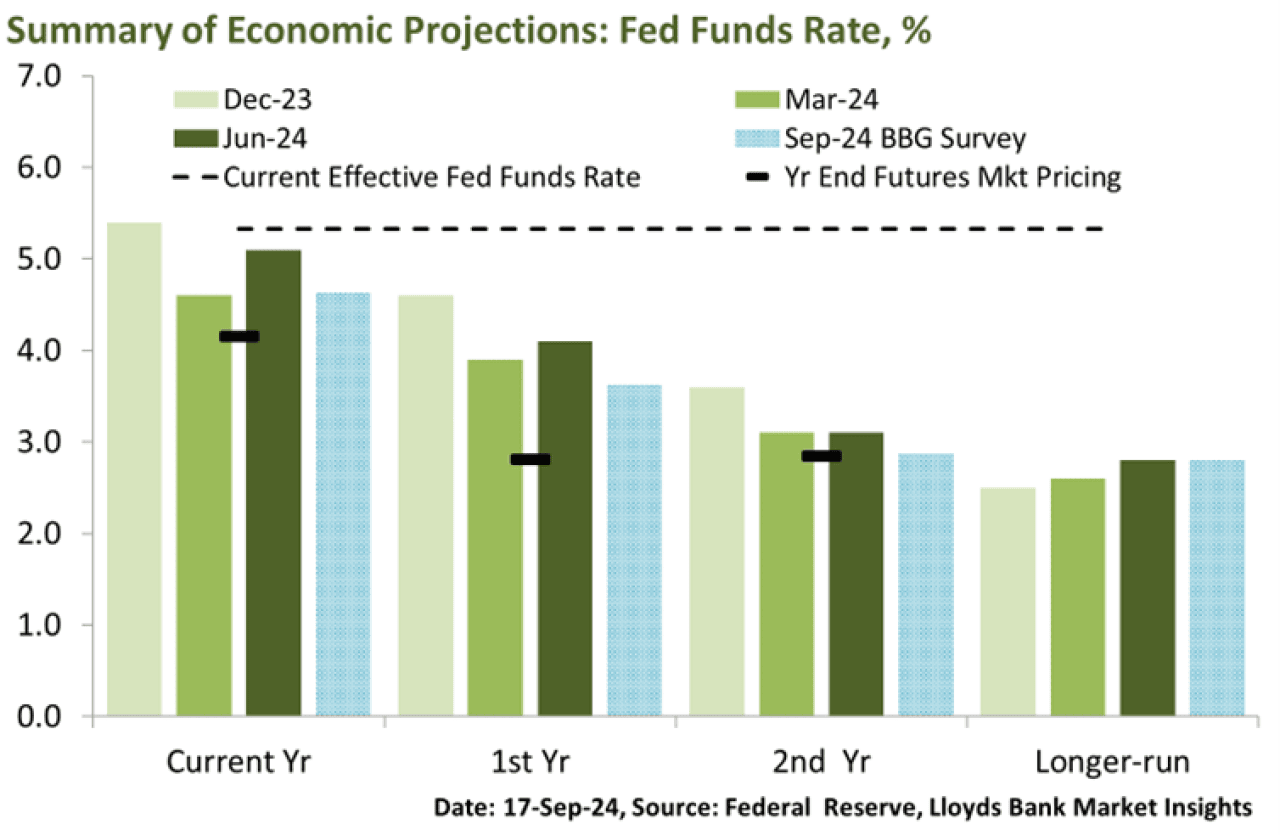

Markets will pay close attention to updates in the Summary of Economic Projections and the dot plot chart that shows where individual members of the Committee think interest rates will move in the coming months.

"Given the improvement in the inflation data over the summer, one could expect a mild downward adjustment to the PCE and core PCE forecasts (reversing the June increase). But to justify a larger (half point) cut it would also seem to need a slight reprofiling of the growth outlook (lower) as well as a rise in the Fed’s assumptions for unemployment, the key component of the other side of the ‘dual mandate’," says Sam Hill, Head of Market Insights at Llyods Bank.

He says the process likely began in June when expectations for the jobless rate next year and across the balance of the horizon were upped by a tenth of a percentage point. "But since then we’ve seen a further rise in the reported jobless rate (to 4.2%) and an extension of the trend for slower hiring," he says.

Hill thinks this ought to bend the Fed’s assumptions for that level higher, certainly over the next couple of years.

"In turn, that would evidence the argument to adjust the currently restrictive monetary policy setting more rapidly, by front loading rate cuts. The market seems more realistic in this regard, compared to the economists’ surveyed," adds Hill.