25bp Cut Needed to Underpin the Federal Reserve's Credibility

- Written by: Gary Howes

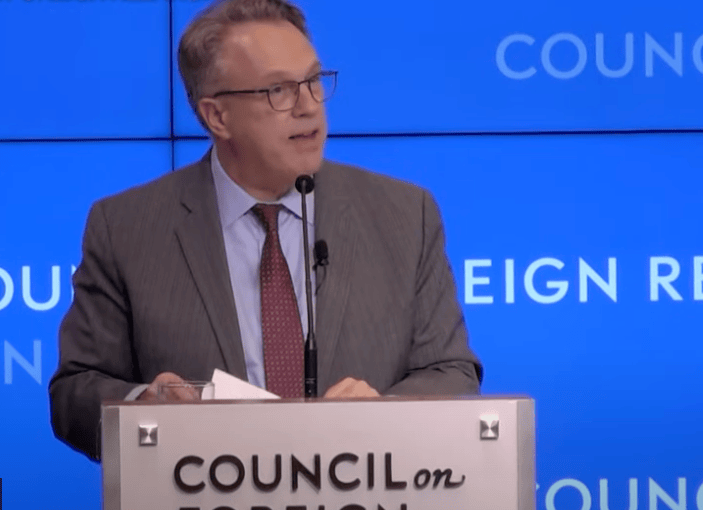

Above: NY Fed President John C. Williams recently pushed back against the need for a 50bp cut in September. Source: Council on Foreign Relations.

The Federal Reserve has a communication problem and risks undermining individuals on the Federal Open Market Committee (FOMC).

This is according to a note from Bank of America that says communication matters and it would benefit the longer-term if it opts for a 25 basis point interest rate cut on Wednesday.

The Federal Reserve is expected to cut interest rates by 50bp on Wednesday, whereas just a week prior a 25bp was all but nailed on. This expectation was a result of weeks of careful messaging from Fed officials, including the Chair himself.

But the odds of a 50bp move spiked last Thursday following reports in the Wall Street Journal and the Financial Times that said a 50bp cut was in play. The authors have high credibility and the market assumption is that the view was leaked by the Fed to finesse expectations towards a bigger inaugural cut.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

And then on Monday, the Wall Street Journal's author delivered a follow-up piece, arguing the Fed should cut by 50bp because Fed communication does not matter in the long run.

"Why communicate if communication doesn’t matter?" asks Aditya Bhave, U.S. Economist at Bank of America. "The fact that the Fed chooses to communicate at all tells us they think communication is important."

Bhave explains that communication helps guide market expectations and prevents large surprises when policy is announced. "The trend under Chairs Yellen and Powell has been toward more transparency, not less."

"We're in the 25bp cut camp," says Padhraic Garvey, Regional Head of Research for the Americas at ING Bank. "It's more measured. It does not give risk assets the juice craved. And in a way, it has the Fed taking back some control by deciding not to bow to the market pressure for a bigger cut."

Bank of America's Bhave argues a 50bp cut would undermine the message from Governor Waller and New York Fed President Williams, who appeared to favour a 25bp cut after the August jobs report. "Cutting by 50bp cut would also validate the ability of outside voices - Fed-watching reporters and former New York Fed President Dudley - to move markets during the blackout period."

Given the risks to communication credibility, what is the Fed to do?

"A 25bp cut would send the message to markets that the Fed is in control of its own message," says Bhave. "Chair Powell could deliver a dovish message that emphasises data dependence and leaves the door open for larger cuts starting as early as November, if warranted by the data. We think this option would make the Fed’s life easier in the long run, even if it leads to significant financial tightening in the near term."