U.S. More at Risk of Recession than Europe says Commerzbank

- Written by: Gary Howes

Image © Adobe Images

The Eurozone economy faces significant supply challenges, but demand in the U.S. economy will be squashed by a very active Federal Reserve to the extent that a recession is now likely in 2023.

"In the U.S., rapidly rising key interest rates threaten to choke off demand and trigger a recession. By contrast, demand in Germany and the euro zone is unlikely to become a problem in view of the ECB's hesitant approach," says Dr. Jörg Krämer, Chief Economist at Commerzbank.

In a weekly update to clients Krämer says Europe faces supply-side problems due to a shortage of intermediate products and personnel, which ultimately limits the scope for the European Central Bank (ECB) to become genuinely restrictive.

"Thus, unlike in the U.S., there is no threat of a classic recession with self-reinforcing downward momentum and massively rising unemployment – with consequences for the financial markets," says Krämer.

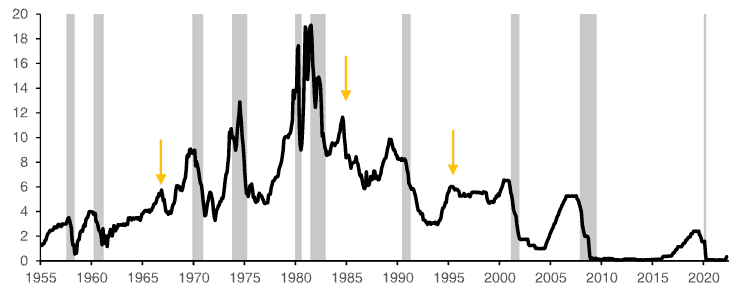

Above: Effective federal funds rate, monthly averages in %. Grey-shaded areas: Recessions as determined by the NBER. Arrows highlight soft landings. "A soft landing does not succeed often." - Commerzbank. Image Source: Fed, Commerzbank Research.

Krämer says when Commerzbank clients ask about the risk of a recession, they look primarily to the U.S.

"After all, the Federal Reserve has set in motion a fairly rapid process of rate hikes," he says.

Markets are currently expecting a further 190 basis points of hikes from the Fed in 2022, with a high water market for the Fed Funds rate set at approximately 3.10% in 2023.

Markets expect at least three further consecutive 50 basis point hikes at upcoming meetings.

"A tightening of the monetary reins such as this puts the brakes on particularly rate-sensitive demand components such as investment and has resulted in recession in three out of four cases since the 1950s," says Krämer.

Commerzbank expects U.S. growth to come to a virtual standstill by the end of next year.

But in Germany and the Eurozone the monetary policy turnaround is likely to be much more muted than in the U.S.

"It is true that a first rate hike is on the horizon for July. But even after that, the ECB is likely to normalise its monetary policy only hesitantly, as wages have hardly picked up so far," says Krämer.

The ECB is marching towards a rate hike and the market is now even considering the prospect of an outsized 50 basis point hike in July, an unfathomable development just weeks ago.

However a number of economists don't see a 50 basis point rise as being likely given it would mark a significant u-turn in policy for a central bank that is still easing policy via quantitative easing.

"We do not expect Germany and the euro area to experience a classic demand-induced recession with a massive rise in unemployment," says Krämer.

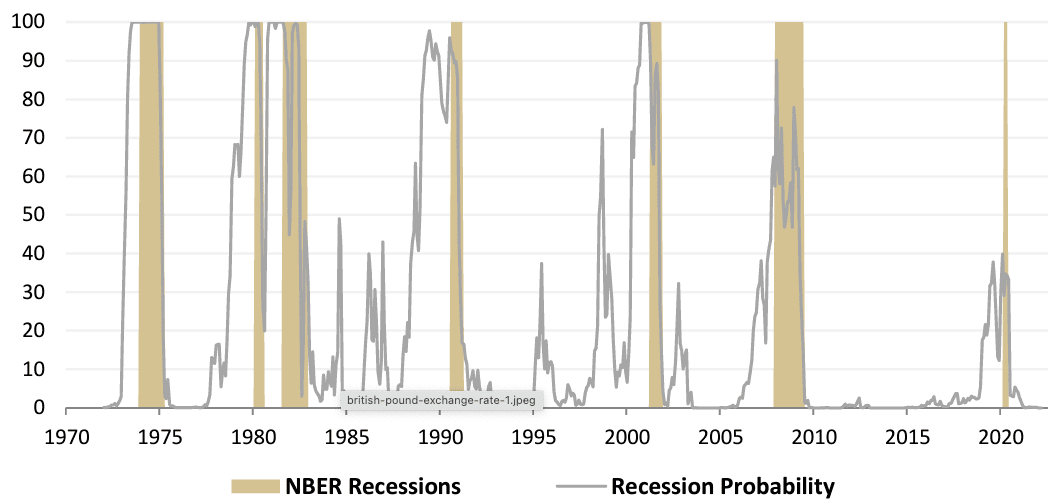

Above: Probability of US recession in next 12 months. Source: SG Cross Asset Research/Economics.

Economists at Société Généale this week meanwhile said their forecasting models are yet to signal an incoming U.S. economic recession as they don't see rising interest rate expectations and inflation triggering significant demand destruction.

"One day, a recession will come, but the current evidence points to upside not downside," says Stephen Gallagher, Head of Research for the Americas at Société Générale in New York.

The U.S. reported April retail sales rose 0.9% and economists suggested the figures show little sign the consumer is bowing in the face of surging inflation, instead opting to continue running down savings accrued during the pandemic.

"This is not yet evidence of demand destruction. These are substantial gains for an economy with a 3.6% unemployment rate," says Gallagher who also notes the non-farm payroll measure of employment posted a 428k gain in April while industrial production posted a 1.1% month-on-month gain.

Soc Gen expects the Fed to follow through with "a couple" of 50 basis point rate hikes and commence balance-sheet reduction in June.

"The combination of monetary tightening efforts needs to be watched more than rate hikes," says Gallagher. "On rates alone, monetary policy is not near neutral, and a move to neutral should not challenge growth."

But, he concedes a "limited experience with balance sheet reduction implies we should all be humble".

Corporate profit margins - a key input into Soc Gen's forecasting model - are meanwhile wide enough to suggest a recession is unlikely.

"With historically wide margins, companies remain incentivized to hire and invest. Indeed, hiring demand remains incredibly strong," says Gallagher.

"In time, amid Fed rate hikes, peaking inflation and rising wage pressures (pressuring margins), recession probabilities should rise. The question is when. For now, the Fed believes the economy is resilient to further rate hikes. We concur," he adds.