Euro Propped up by Dreams of a 50bp ECB Rate Hike in July

- Written by: Gary Howes

- July rate hike now very likely

- A 50bp hike is even possible

- This is supportive of EUR

- But if ECB disappoints EUR could retreat

Above: File image of ECB President Christine Lagarde. Photo by Sanziana Perju / European Central Bank.

The European Central Bank is marching towards a rate hike and the market is now considering the prospect of an outsized 50 basis point hike in July, an unfathomable development just weeks ago.

This shift has offered the Euro support, particularly against the Pound which has at the same time seen the Bank of England push back against the market's expectations for a series of rate hikes.

"Relative rates have supported GBP vis-à-vis EUR for quite some time but not anymore with markets pricing in more aggressive ECB rate hikes," says Mikael Milhøj, Chief Analyst at Danske Bank. "Looking forward, relative rates seem more supportive for EUR/GBP".

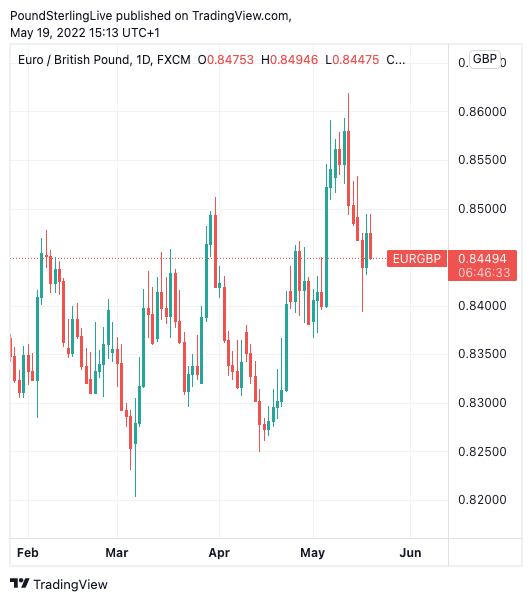

The Euro rallied from £0.8249 on April 14 to £0.8618 on May 12, while of late it has rallied from a recent floor against the Dollar at $1.0349 to $1.0575.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The minutes from the ECB's April policy meeting were released Thursday and showed members of the Governing Council were worried the rise in inflation expectations could become "unanchored".

This describes a scenario were an inflationary shock - in this case via surging energy and commodity prices - becomes embedded more broadly in the economy.

For instance, via businesses hiking the prices on goods and services, while employees could demand higher wages.

Some members of the Council thought that the ECB could not wait for actual wage developments to confirm inflation expectations were rising and the time to raise rates was fast approaching.

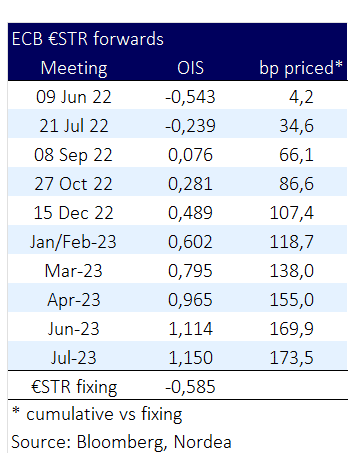

"ECB members have continued to send hawkish signals, prompting the market to price in a clear risk of a 50bp rate hike in July," says Jan von Gerich, Chief Analyst at Nordea Markets.

Image courtesy of Nordea Markets.

"The European Central Bank hawks are calling the shots. The minutes of the ECB’s April meeting just confirmed that the hawks increasingly have the upper hand in discussions. A rate hike in July is no longer uncertain, the only uncertainty is whether it will be 25bp or 50bp," says Carsten Brzeski, Global Head of Macro at ING Bank.

Dutch central bank governor Klaas Knot said in an interview Tuesday the ECB should raise its key interest rate by 25 basis points in July, but should not yet rule out a bigger increase.

"A bigger increase must not be excluded either... a logical next step would amount (to) half a percentage point," said Knot.

The Euro rose sharply against the Dollar on the ay Knot made his comments and EUR/USD pushed higher again on the day the ECB released its minutes. (Set your FX rate alert here).

"We would not exclude the chance of 50bp moves, but find them unlikely for now and see the odds for a 50bp move clearly higher for the September meeting rather than July," says von Gerich.

Nordea notes the market now prices in around 35bp of hikes falling on the July meeting.

"We think at most a couple of basis points of this could be due to expected changes in liquidity conditions, so the vast bulk should illustrate that the market is pricing in clear chance of a 50bp July rate hike," says von Gerich.

Above: The Euro has rallied off April lows against the Pound.

A 50bp hike would have been unimaginable just weeks ago and from a currency perspective much depends on whether or not the ECB actually meets or disappoints against the market's expectations.

For instance, if the ECB pushes back on this pricing the Euro would be liable to give back value to Sterling, the Dollar and other countries. (As it can be assumed that it has of late found support from the shoring up of rate hike expectations).

"The market is pricing in around 105bp of higher overnight rates by the end of the year. As a result, we see the ECB hiking rates at a somewhat slower pace than currently being priced in," says von Gerich.

If the ECB validates these expectations and delivers a 50bp hike while guiding that further hikes are likely, the Euro can gain in value.

But von Gerich believes the ECB would most likely disappoint as the ECB is still adding stimulus via asset purchases, despite surging Eurozone inflation.

"Ending those purchases at the end of June and following that with a 50bp rate increase in July would represent quite a policy U-turn," says von Gerich.

Above: EUR/USD has recovered from multi-year lows, but remains prone to further weakness.

The ECB has consistently maintained it would only ever intend to normalise monetary policy gradually, and hefty 50 basis point hikes look inconsistent with this guidance.

"A 50bp rate hike would risk upsetting financial markets and leading to more financial fragmentation in the Euro area, as already illustrated by the jump in the bond spreads between Germany and Italy," says von Gerich.

Nordea does acknowledge however that were inflation pressures to build further a 50bp hike would be more likely in September.

"Our baseline remains 25bp rate hikes in July and September, followed by another such move in December, but risks are tilted towards the ECB raising rates at every meeting this year, starting in July," says von Gerich.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes