U.S. will Dodge Recession says Soc Gen

- Written by: Gary Howes

Image © Adobe Images

"One day, a recession will come, but the current evidence points to upside not downside," says Stephen Gallagher, Head of Research for the Americas at Société Générale in New York.

The call comes amidst ongoing speculation that the U.S. economy is destined for a slowdown that will ultimately result in a recession, thanks in part to expectations for a rapid rise in U.S. interest rates.

The speculation forms a key point of debate for financial markets which continue to grapple with depressed sentiment amidst rising global inflation, war and central bank interest rate tightening.

But Soc Gen update their forecasting models daily and are yet to find cause for alarm as incoming data remain positive, none more so than the strong retail sales figures out on May 17.

April retail sales rose 0.9% and economists suggested the figures show little sign the U.S. consumer is bowing in the face of surging inflation, instead opting to continue running down savings accrued during the pandemic.

"This is not yet evidence of demand destruction. These are substantial gains for an economy with a 3.6% unemployment rate," says Gallagher who also notes the non-farm payroll measure of employment posted a 428k gain in April while industrial production posted a 1.1% month-on-month gain.

But of course the outlook is less certain, particularly given the market now anticipates nearly 200 basis points of rate hikes to come during the remainder of 2022, an expectation the Fed has not fought against.

Raising interest rates raises the cost of borrowing and ultimately slows economic activity, with the intent of cooling inflation. But raise rates too fast and too high and the Fed inevitably risks an overshoot that pushes the economy into decline, in what is known as a 'hard landing' outcome.

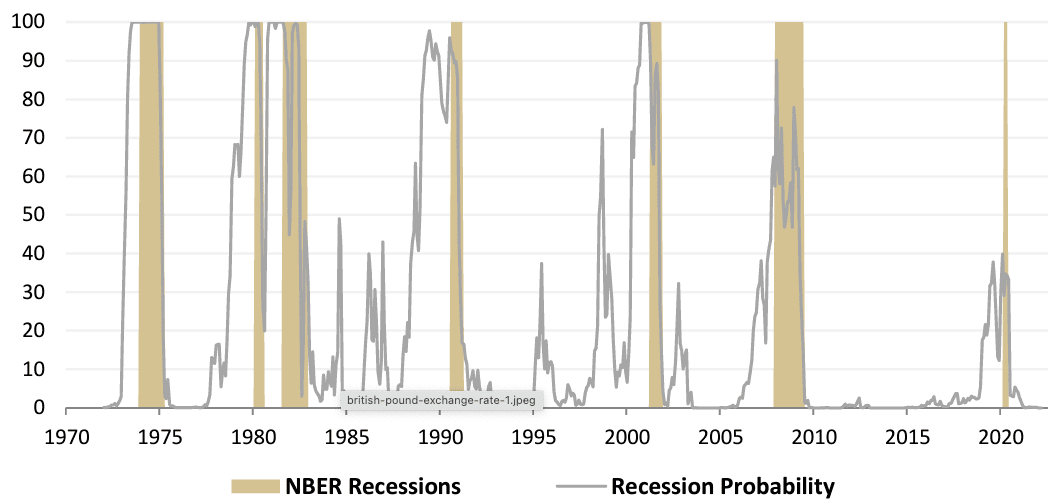

Above: Probability of US recession in next 12 months. Source: SG Cross Asset Research/Economics.

Soc Gen expects the Fed to follow through with "a couple" of 50 basis point rate hikes and commence balance-sheet reduction in June.

"The combination of monetary tightening efforts needs to be watched more than rate hikes," says Gallagher. "On rates alone, monetary policy is not near neutral, and a move to neutral should not challenge growth."

But, he concedes a "limited experience with balance sheet reduction implies we should all be humble".

Corporate profit margins - a key input into Soc Gen's forecasting model - are meanwhile wide enough to suggest a recession is unlikely.

"With historically wide margins, companies remain incentivized to hire and invest. Indeed, hiring demand remains incredibly strong," says Gallagher.

"In time, amid Fed rate hikes, peaking inflation and rising wage pressures (pressuring margins), recession probabilities should rise. The question is when. For now, the Fed believes the economy is resilient to further rate hikes. We concur," he adds.