Swiss Franc Sold and Pound Bought as Goldman Sachs Exits Sterling Short

- Written by: James Skinner

"The external environment has improved substantially, so we think investors should take profit on our short GBP/CHF trade recommendation" - Goldman Sachs Global Investment Research.

Image © Adobe Stock

Switzerland's Franc outperformed other major currencies to open the new month while Sterling unravelled much of its New Year gains, leading GBP/CHF to fall and prompting strategists at Goldman Sachs to suggest clients exit an earlier advocated bet against the exchange rate.

Sterling was close to the worst-performing currency in the G20 grouping during the opening week of February after Bank of England (BoE) economic commentary and interest rate guidance left buyers of the Pound high and dry in what has been described as a reliably 'dovish' monetary policy decision.

"Last cycle, a UK MP quipped that the Bank of England was behaving like an “unreliable boyfriend” for sending mixed messages on the path of policy," says Michael Cahill, a G10 FX strategist at Goldman Sachs.

"But lately, the BoE has arguably had one of the most reliable reaction functions, seemingly always managing to send dovish signals to the market. This week was no different," he adds.

Goldman Sachs suggested selling GBP/CHF back in December when the European Central Bank (ECB) set out an unequivocally hawkish interest rate stance and the BoE indicated a far less certain outlook for Bank Rate.

Above: Pound to Swiss Franc exchange rate shown at daily intervals. Click image for closer inspection.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

February's policy stance was seen as even more dovish after the BoE lifted forecasts for the economy and warned of upside risks to its inflation forecasts but continued to suggest that a recession is likely and said nothing to discourage the recent decline in market-implied expectations for Bank Rate.

"The policy message was unwavering: MPC members believe that the weak activity outlook should bring inflation down over time. We have argued that this policy stance puts more pressure on the currency," Cahill and colleagues write in a Friday research briefing.

"And it has—Sterling has consistently underperformed its typical beta to cyclical factors, and we expect that to continue. That said, the external environment has improved substantially, so we think investors should take profit on our short GBP/CHF trade recommendation," they add.

The Goldman Sachs team says Sterling is still expected to trend lower against the Swiss Franc in the months ahead but that other currencies such as the Swedish Krona will likely be of more interest to investors and traders.

"Through much of 2022, we called for Sterling to underperform because we thought the BoE’s desire to take a more balanced approach to policy (guarding against high inflation while still trying to cushion consumers from an income squeeze) should put pressure on the currency," they write.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"Now, with lower gas prices partially easing those concerns, we think investors should turn their attention to Sweden," they add.

With Swedish inflation climbing further to 12.3% during December, in contrast to the now-downward inflation trajectory in many other countries, market-implied measures of expectations suggest a high probability of another large increase in interest rates from the Riksbank on Thursday.

The Riksbank raised its repo rate from 0% to 2.5% over five increases last year, the most recent of which was a 0.75% uplift in November, though market-implied expectations suggest investors are uncertain about whether there will be a 0.25% increase on Thursday or a 0.5% increase.

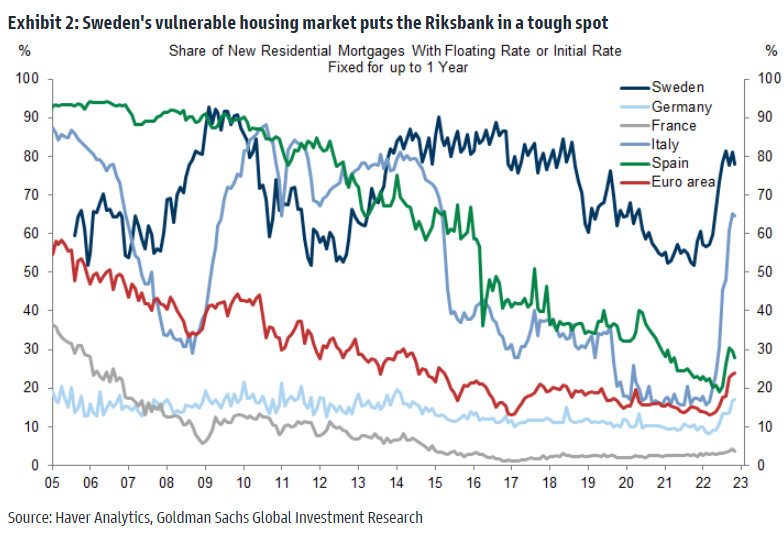

"We have long argued that the combination of relatively less anchored inflation expectations, high indebtedness and a vulnerable housing market puts the Riksbank in a tough spot (Exhibit 2)," Cahill and colleagues say.

"We expect that to translate into more inflation tolerance and “reluctant” hikes, including a more cautious tone at the meeting next week," they add in Friday comments while tipping the EUR/SEK pair as a buy with a target of 12.0.

Above: Euro to Swedish Krona exchange rate shown at daily intervals. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes