Pound Sterling Retreats as Bank of England Prepares to Step Down a Gear on Rate Hikes

- Written by: Gary Howes

- Hawkish vote split for 50bp hike

- Says inflation has been stronger than expected

- But forecasts show inflation to drop sharply

- Depth of recession to be shallower

- Sterling rises initially but then slumps

Image copyright Pound Sterling Live, Bank of England.

The British Pound shot higher before retreating more broadly following the release of the Bank of England's first interest rate decision of 2023 and its latest economic forecasts.

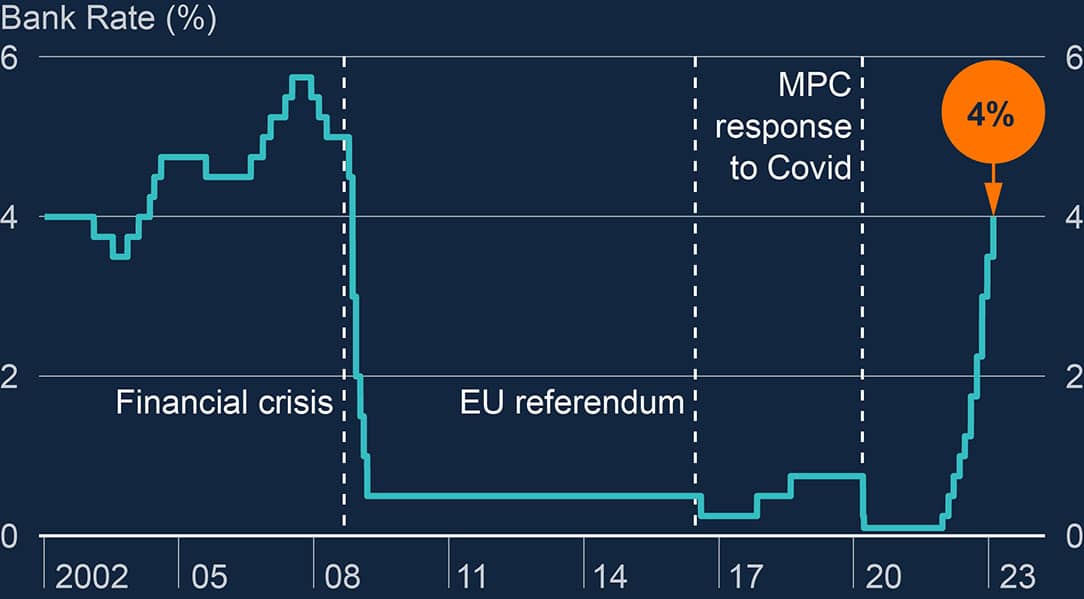

The Bank of England raised Bank Rate by a further 50 basis points to 4.0% in January, with seven members of the Monetary Policy Committee (MPC) voting for the hike, with two members voting for rates to remain unchanged.

The composition of the vote was similar to that of December and surprised markets looking for a greater split in intentions.

This provided the initial 'hawkish' signal to currency markets which promptly bid the Pound higher.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In a statement, the Bank said "UK domestic inflationary pressures have been firmer than expected," as "private sector regular pay growth and services CPI inflation have been notably higher than forecast in the November Monetary Policy Report."

In a further 'hawkish' tilt the Bank says it judges "that the risks to inflation are skewed significantly to the upside."

But a commitment to further rate hikes was a little opaque:

"If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required," added the statement. This specific part of the statement had previously read "it will respond forcefully" on interest rates.

A growing sense that a 25bp hike in March could be the final in the cycle likely contributed to a weaker Pound in the hours following the decision.

"Below-target inflation forecasts, more muted language on future tightening, and a warning about the impact of past rate hikes, all signal that Bank Rate is close to peaking," says James Smith, Developed Markets Economist at ING Bank.

The Pound to Euro exchange rate rallied 0.36% in the minute of the release, before paring the advance to 1.1177, the Pound to Dollar exchange rate spiked to 1.2390 on the decision before retreating back to pre-release levels at 1.2290.

Above: GBP/EUR (top) and GBP/USD at five-minute intervals showing post-BoE price action. Consider setting a free FX rate alert here to better time your payment requirements.

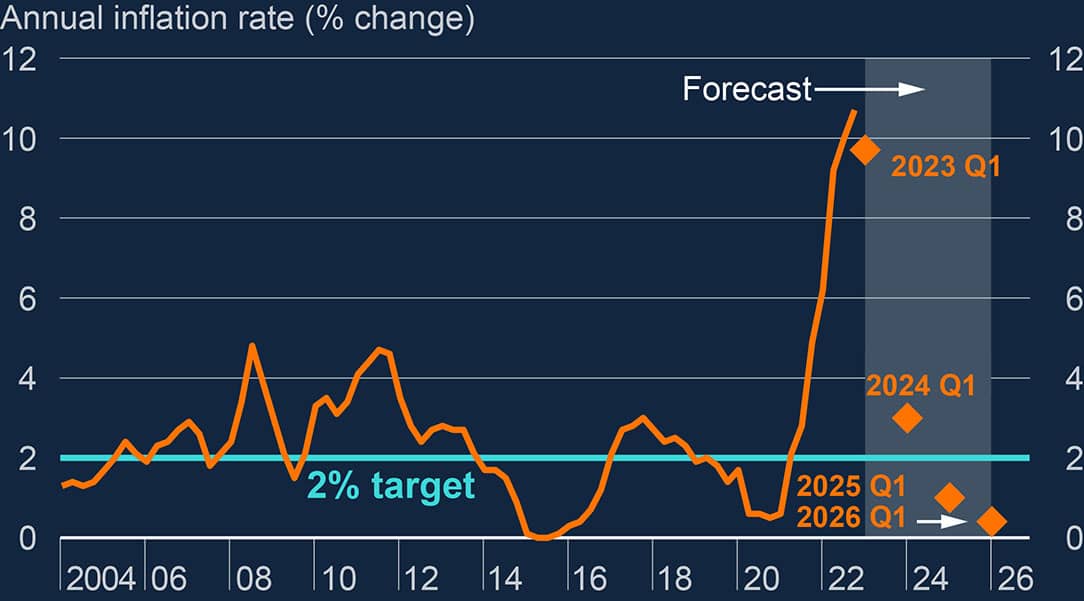

The Bank's MPR also revealed its economists "expect inflation to fall quickly this year" and projections show inflation falling well below the 2.0% target in 2024.

This is based on an assumption that Bank Rate rises to 4.5%, the level money markets are currently pricing the peak in rates.

The underlining implication, therefore, is that the Bank thinks hiking to such levels is therefore not required to achieve its aim of bringing inflation back to 2.0%.

As such, the Bank is hinting to markets that rates might not raise that high, prompting investors to lower expectations.

This creates a downside pull on UK bond yields and Pound exchange rates.

This signalling by the Bank was a persistent feature of its communications in 2022 and the reaction by the currency markets was to typically sell the Pound.

January's MPC is therefore in keeping with the Bank's typically dovish communications and resultant weakness in the Pound.

[If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.]

GDP is forecast to fall "slightly" throughout 2023 and the first quarter of 2024 as high interest rates and inflation continue to weigh on businesses and consumers.

However, the decline is seen to be shallower than the Bank had previously forecast in November, owing to strong ongoing strength in the labour market and falling energy prices.

GDP in the year to the first quarter of 2024 is now forecast to fall 0.7%, which is less severe than the previous estimate of -2.0%.

Inflation is foreacst to fall to 3.0% in the year to the first quarter of 2024, which is down on the previous forecast of 4.0%.

The unemployment rate is expected to rise to 4.4% in the first quarter of 2024, which is less than November's forecast for 5.2%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes