Pound to Canadian Dollar Week Ahead Forecast: More Struggle

- Written by: Gary Howes

Image © Adobe Stock

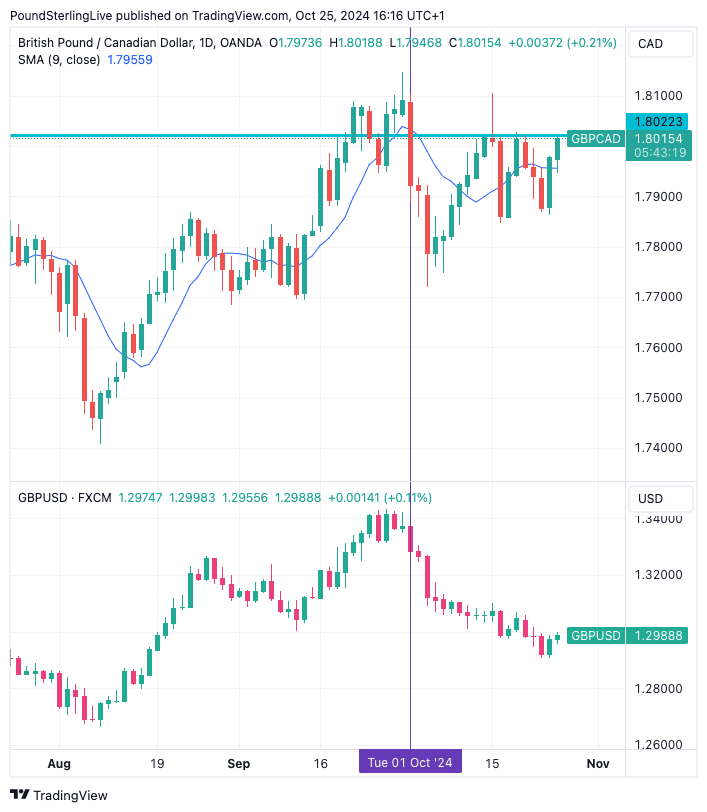

The Pound to Canadian dollar exchange rate (GBP/CAD) is capped by a key technical hurdle and risks a deeper setback if the U.S. Dollar rallies ahead of the U.S. election.

Before we look at the all-important issue of the election, from a technical perspective, the GBP/CAD setup is mildly bullish

Thursday and Friday's recovery took the pair back above the nine-day moving average.

Our Week Ahead Forecast model suggests that the 5-day timeframe can be divined, to a degree, based on which side of the line an exchange rate sits.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

That said, GBP/CAD is looking particularly messy with a lot of chopping and changing around the 9-day MA from around mid-October.

If anything, it suggests the indicator has a gravitational pull, with GBP/CAD tending not to stray too far, meaning it is more of a pivot than support or resistance.

If this state of affairs continues, then we won't see any sizeable directional moves.

A look at the chart also reveals that the GBP/CAD is capped by a horizontal resistance line at approximately 1.8020:

Our previous edition of the GBP/CAD Week Ahead Forecast series dwelled on the significance of this support line, and here we are at the start of another week, still butting our heads against this level.

Failure to break above here in the coming days can invite a pullback to 1.7950 early this week, consistent with the 9-day MA exerting its gravitational pull once again.

A break above 1.8020 would signal that some upside is building again, opening the door to a target at 1.81 (the October 15 high) and the late September resistance point.

It must be emphasised that the technical setup is inconclusive and very much set at 50/50 in either direction.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

We are more certain that GBP/CAD's fate lies with the U.S. Dollar in the coming few days; where the Greenback goes, the Loonie will follow.

This speaks of the importance of USD action for CAD against the European crosses.

The Canadian Dollar doesn't have any compelling fundamentals in its corner, but it does have its bigger southern neighbour to bully a path ahead.

Analysts point out this is because of the close financial and economic links between the two North American neighbours.

CAD was under pressure through September, but October brought about a change in foreign exchange market trends as the U.S. Dollar roared back into contention.

USD strength has since capped GBP/CAD gains and triggered the pullback we saw earlier this month. This is evident on the above chart: note how September's uptrend in GBP/CAD stalled at the start of the month before the pair fell and subsequently entered a choppy action.

Thus, if the coming week sees the USD restart its appreciation trend, we expect GBP/CAD to remain capped or decline.

We have seen the USD strengthen ahead of the U.S. vote due on November 05 as market expectations for a Trump win have risen to above 60% in just two weeks, and this has boosted USD.

Further USD strength can be anticipated amidst rising uncertainty and if the odds of a Donald Trump win rise further.

Also, don't forget that the U.S. labour market report is due on Friday, where a stronger-than-forecast reading will push back against expectations for U.S. interest rate cuts.

This would bolster U.S. bond yields and the Dollar, which would work to support CAD.