Pound to Canadian Dollar Week Ahead: Hard Ceiling Limits Gains

- Written by: Gary Howes

Image © Bank of Canada

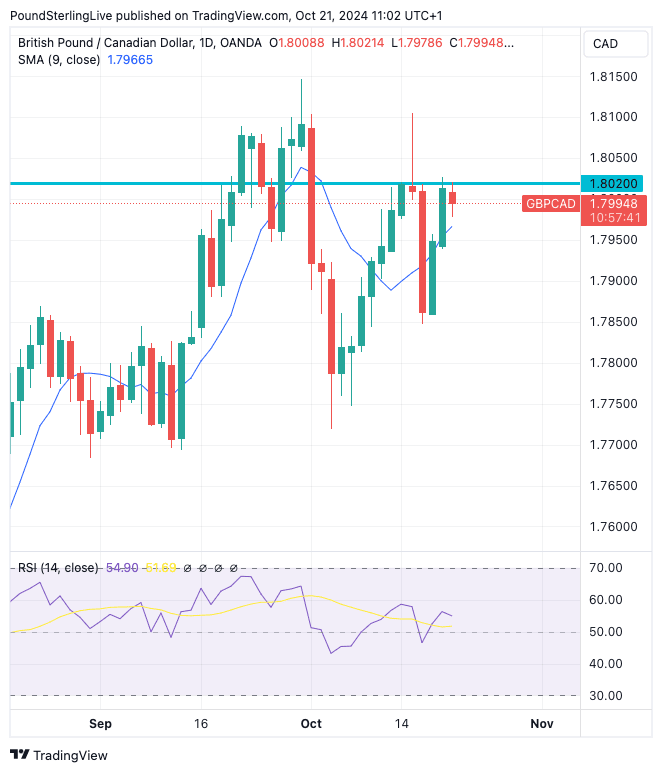

The Pound to Canadian Dollar exchange rate (GBP/CAD) is capped by a couple of significant technical resistance layers amidst focus on this week's Bank of Canada interest rate cut.

GBP/CAD is well supported ahead of what is expected to be a decision by the central bank to reduce the policy rate by 50 basis points.

"A string of soft data releases should give the Bank of Canada the necessary confidence to step up the pace of monetary easing with a 50bp cut at its meeting next week," says Bradley Saunders, North America Economist at Capital Economics.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The Canadian Dollar has been relatively well supported ahead of the decision, outperforming most G10 peers in the course of the past week.

This suggests the BoC's decision has been absorbed by the foreign exchange markets and, in isolation, is unlikely to materially dent the CAD's prospects.

Helping the Canadian Dollar has been its close correlation with the U.S. Dollar, which is the best-performing major currency of the past month and week.

So often in 2024 have we seen the CAD track the USD, suggesting a North American bloc that moves in unison.

With the Dollar in the ascendency again, the Canadian Dollar is outperforming its peers, and could continue to do so for as long as the Dollar remains supported.

The GBP/CAD exchange rate is nevertheless liable to see further gains in the coming days, with technical readings on the daily charts advocating for ongoing support.

The daily chart shows that 1.8020 is proving an immediate source of resistance that must be overcome before a test of 1.81 and the 2024 peak at 1.8146 is back in play.

Interestingly, should GBP/CAD fall from current levels (1.7990) and fail to retest the September highs, then a bigger turning point for the exchange rate could be underway.

This is because we would have seen a 'lower high' develop, which could be a precursor to a deeper and more enduring pullback that signals the end of the multi-year rally.

For now, however, we are inclined to think GBP/CAD is likely to remain well supported.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

Key to how the week evolves will be the tone of the Bank of Canada and how this impacts pricing for future Bank of Canada policy.

A 'dovish' guidance could weigh on CAD and allow GBP/CAD to test recent highs.

"The Bank of Canada is expected to accelerate the pace of interest rate cuts with a 50-basis point reduction to the overnight rate to 3.75% from 4.25% on Wednesday," says Nathan Janzen, Assistant Chief Economist at Royal Bank of Canada.

RBC expects the BoC will ultimately need to go further than that to prevent the softening in the Canadian economy from stretching into the second half of 2025.

"Our base case assumes another 50 basis point cut in December and reductions down to 2% by mid next year," says Janzen.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The BoC is now seen as the G10 central bank that is likely to cut rates the most, by over 160bp in 2025. At least another 25bp rate cut to 4.00% is expected by the BoC on Wednesday, with the likelihood of a 50bp move rising after the drop in Canadian CPI inflation for September. USD-CAD is set to trade above 1.38," says Ronerto Mialich, FX Strategist at UniCredit Bank.

Such a profile of cuts could keep CAD under pressure, particularly if the Bank of England maintains a cautious approach to cutting interest rates.

A number of Bank of England policy makers are due to speak this week and shed light on whether the Bank will cut just once more in 2024 (November) or twice with a follow-through cut in December.

Bailey caused a sizeable slump in GBP exchange rates at the start of October when he said the Bank could be more "activist" in cutting rates if the inflation data warranted.

Last week's inflation data certainly had a feeling of vindication for Bailey, undershooting expectations handsomely.

"We will also be listening closely to comments from BoE officials in the week ahead, including Governor Bailey, for any further encouragement that they are becoming more willing to speed up rate cuts in light of the weaker inflation and wage data in September," says Lee Hardman, an analyst at MUFG Bank Ltd.

But, the UK economy remains firm and the government is due to announce its budget next week, which would suggest Bailey would like to retain an air of caution.

As such, any post-Bailey moves in GBP/NZD should be faded.