Canadian Dollar Slides After Disinflation Trend Continued in July

- Written by: Sam Coventry

Image © Bank of Canada

The Canadian Dollar dropped in value against all its peers after new data showed a continued cooling in Canadian inflation, raising the odds of further Bank of Canada rate cuts in the coming months.

Statistics Canada said headline CPI inflation rose 0.4% month on month in July, which was above expectations for 0.3%, taking the annual rate down to 2.5% from 2.7%.

However, the market tends to react to the core measures of inflation, as they have a greater bearing on the Bank of Canada's decision-making process.

The Pound to Canadian Dollar exchange rate is now 0.20% higher day-on-day at 1.7745 after Statistics Canada reported a 0.1% m/m gain in CPI-trim and CPI-median. This confirms core inflation is tracking a path to undershoot the Bank of Canada's most recent set of forecasts.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Euro to Canadian Dollar rate has reversed an earlier decline and is now slightly higher on the day at 1.5119, while the Dollar has also seen its earlier losses shrink to USD/CAD 1.3624.

Analyst Olivia Cross at Capital Economics says these core inflation readings show that the disinflationary pressures in July were encouragingly broad-based.

"For now, the three-month annualised rate is still 2.7%, down from 2.9%, but if the recent momentum continues, then core inflation would undershoot the Bank’s forecast for the average of CPI-trim and CPI-median to be 2.5% in the third quarter," says Cross.

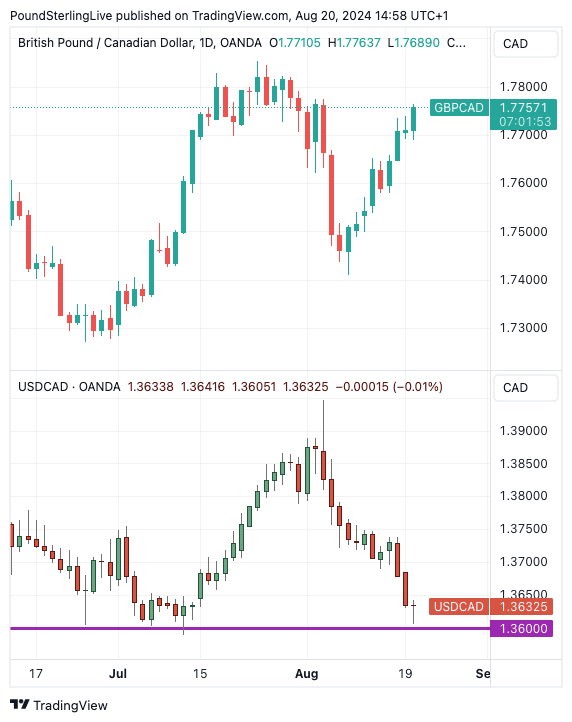

Above: USD/CAD (lower panel) is encountering a major resistance line. Any rebound here could boost GBP/CAD further (top panel). See below for more.

The financial market's reaction suggests these data can allow the Bank of Canada to step up the easing process, potentially cutting interest rates more than previously expected in the coming months.

This shift in expectations is weighing on the Canadian Dollar.

Cross says these data leave the door open for the Bank of Canada to take a larger step later this year if there is additional weakness in the labour market or activity data.

The CAD's post-inflation decline could extend, according to analyst Daragh Maher at HSBC. He explains USD/CAD is potentially bottoming around technical support at 1.36, a level it has rarely dipped below since mid-April.

"The drop in USD/CAD during August is also out of line with the more modest shift in 2Y yield differentials, with a notable divergence over the past week. Perhaps that split reflects the bounce in global equity markets and hopes for a US soft landing, but it does suggest a rather overpriced CAD relative to rate expectations," says Maher.

A USD/CAD recovery, paired with GBP/USD resilience, would allow GBP/CAD to continue its recovery, with our Week Ahead Forecast targetting a potential move to 1.7750.