GBP/CAD Could Test 1.7750 This Week

- Written by: James Skinner

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate has recovered further from its early August lows in recent trade and could have scope to test the 1.7750 level in the week ahead, according to the author’s model.

Sterling overcame two notable technical resistance levels against the Canadian Dollar on the charts last week including 50% Fibonacci retracement of its late July fall at 1.7632 and the 61.8% retracement at 1.7684.

Gains came alongside a deluge of important UK economic figures and in a quiet period for Canadian economic newsflow but it was Friday’s US Dollar depreciation that did much of the heavy lifting.

“Trend momentum has shifted negatively for the cross on the daily and weekly studies, however, so it may take some time before the GBP reflects any real additional technical gains (above 1.78),” said Shaun Osbourne, chief FX strategist at Scotiabank, in a review of the Canadian Dollar charts last Tuesday.

Above: Pound to Canadian Dollar rate shown at daily intervals with Fibonacci retracements of late July fall indicating possible areas of short-term technical resistance.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“Support on dips looks firm for now, however, and regaining 1.76+ (which is not that far away) should give the GBP some additional, short-term support at least. Despite the recent setback, I remain constructive on the technical outlook for the GBP here,” Osbourne added.

Close links with the US economy are probably why Canada’s Dollar often rises and falls alongside the broad or trade-weighted US Dollar, which appeared to pull an underperforming Loonie lower on Friday.

This was supportive of GBP/CAD ahead of the weekend and the trajectory of the broad US Dollar will likely remain an important influence on the pair through the days ahead, although this week also marks the release of some important Canadian economic figures including inflation for July and retail sales for June.

“Although we’re a tick above consensus for the headline CPI, that won’t be material if the core measures show moderate 0.2% monthly gains,” said Avery Shenfeld, chief economist at CIBC Capital Markets.

“That will still have the inflation picture moving in the right direction for successive eases by the Bank of Canada at its three remaining decision dates,” he added in a Friday research briefing.

Above: Pound to Canadian Dollar rate shown at monthly intervals with Fibonacci retracements of late 2015 downtrend indicating possible areas of medium and long-term technical resistance.

Any signs of further disinflation in Canada when data for July are released on Tuesday would likely reinforce expectations for the Bank of Canada to continue cutting its interest rate into year-end, and so could prove supportive of GBP/CAD, at least at the margins.

However, Sterling will also be sensitive to the outcome and implications of Thursday’s S&P Global PMI surveys, which are the last calendar highlights ahead of Canadian retail sales figures for June out on Friday, and a speech from Bank of England Governor Andrew Bailey just ahead of the New York close that day.

Any indication of ongoing resilience in the UK economy from the PMIs could help Sterling and likewise if Governor Bailey reiterates the relatively comments made following the BoE’s first rate cut in early August, although markets will be most interested to hear what last week’s UK data deluge means for the outlook.

“A busy data week saw wage and core CPI disinflation continue, strong but easing GDP growth in the second quarter and conflicting signals around labour market quantities. We continue to judge the economy is slowing into the third quarter and the labour market is loosening further,” Barclays economists said on Friday.

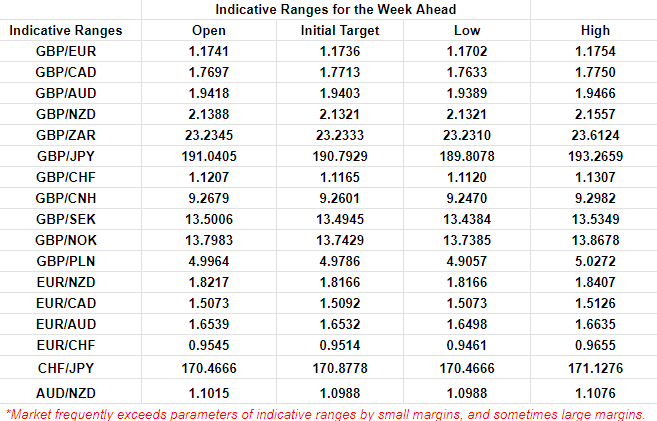

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes