"Strong Upside Risk for AUD" - RBC's Latest Forecast Update

- Written by: Gary Howes

Image © Adobe Images

Expect a resilient Australian economy and currency, thanks to improved trade with China and a slow pace of rate cuts at the Reserve Bank of Australia (RBA).

This is according to new research from RBC Capital Markets that tells of "potential strong upside risk" for the Australian Dollar over the coming months.

The research notes that domestic demand in Australia has cooled following the RBA's policy tightening cycle, helping inflation pressures to turn lower.

This leads economists at RBC to pencil in 50 basis points of rate cuts at the RBA this year, meaning the RBA will lag the Federal Reserve, Bank of England and European Central Bank in the timing of its first rate cut and the quantum of cuts.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Foreign exchange markets are currently highly attentive to expectations for the scale of incoming rate cuts, with currencies being favoured where rate cuts are expected to be limited and start later.

If RBC is right, the Australian Dollar can look forward to support from the interest rate channel.

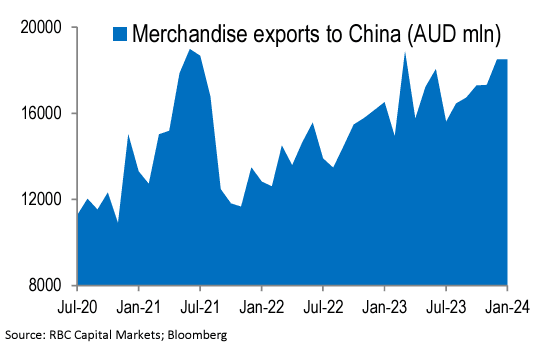

Australia's trade with China - a key source of AUD value - has meanwhile "risen significantly over the past year amid improving diplomatic ties," according to RBC.

Above: "Exports to China rebounded strongly in the past year" - RBC. Track AUD with your own custom rate alerts. Set Up Here

RBC acknowledges that AUD has been held back by a softening in iron ore prices since the new year.

Iron ore - Australia's biggest export earner - has seen prices fall nearly 25% since the early January peak as inventories of the main steelmaking ingredient at Chinese ports increased in March to near a one-year high.

However, RBC says it believes downside risks to China's economy are contained for the time being, and additional major headwinds to AUD from this aspect are unlikely.

If anything, "there is a potential strong upside risk for AUD if China’s economy revives more strongly, with corresponding growth in its imports from Australia," says RBC.

RBC's updated forecast points show AUD/USD at 0.64 by the end of the second quarter, 0.65 by the end of the third and 0.66 by the end of the final quarter.

The Euro to Australian Dollar exchange rate forecast points are 1.66, 1.63 and 1.64.

Based on the bank's GBP/USD forecasts, the Pound to Australian Dollar cross is seen at 1.95, 1.89 and 1.88.