Australian Dollar: GDP Figures Consistent with September RBA Rate Cut

- Written by: Gary Howes

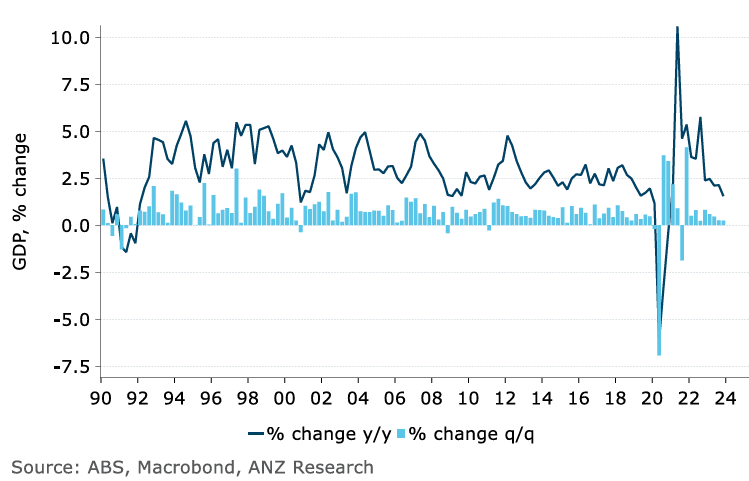

Above: Australian GDP growth "continues to slow…" says ANZ.

The Australian Dollar was broadly firmer on the day Australian GDP data confirmed to analysts that the Reserve Bank of Australia (RBA) is on course to deliver an interest rate cut after the other major central banks.

The Pound to Australian Dollar was a quarter of a per cent lower at 1.9484 after the ABS said Australia's economic output increased 1.5% year-on-year, beating expectations for a 1.4% increase.

GDP grew 0.2% quarter-to-quarter in the fourth quarter of 2023, down from Q3's 0.3% advance and below the consensus estimate of 0.3%.

The Australian Dollar was higher against most peers in the wake of the data, but we suspect this is more reflective of the gains seen across the broader commodity dollar family (including NZD and CAD).

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The headline Australian Dollar to U.S. Dollar exchange rate is quoted a third of a per cent higher on the day at 0.6523. "AUD/USD ignored the on‑consensus Australian Q4 23 GDP print and is trading higher near 0.6515," says Carol Kong, a foreign exchange strategist at Commonwealth Bank of Australia (CBA).

In fact, Kong and colleagues are bearish on the Aussie Dollar outlook, saying today's GDP release reveals signs of economic softness that will prompt a series of RBA rate cuts.

"Real GDP rose by a weak 0.2% q/q in Q4 23 to be up 1.5% on year-ago levels. Real household consumption grew by just 0.1% q/q in Q4 24 and is up by the same amount over the year, much weaker than the RBA anticipated," says Kong.

These data reaffirmed existing market bets that the RBA is on course to cut interest rates for the first time in September, after the Federal Reserve, ECB, and BoE cut. This will keep Australian bond yields elevated relative to peers, offering AUD support.

But analysts at CBA say the market is underestimating the potential economic slowdown that is coming and that the RBA will respond by cutting interest rates faster than currently assumed.

"Our Australian economics team remain comfortable with their base case for an easing cycle to begin in September. The market has also fully priced a September rate cut but expects a much more gradual easing cycle than we expect. An eventual downward reassessment of RBA rate cuts will be a weight on AUD in our view. We expect AUD/USD to weaken further to 0.64 in coming weeks," says Kong.

Further AUD/USD weakness, when combined with the GBP/USD resilience we have seen in 2024, implies further GBP/AUD upside from here.

Looking ahead, the Chinese growth impulse and developments in U.S. interest rate expectations will prove pivotal to AUD's direction. With this in mind, the midweek appearance of Fed Chair Powell before U.S. lawmakers and Friday's jobs report could prove pivotal.

The Australian Dollar and commodity complex peers appear to have caught tailwinds following Tuesday's below-consensus U.S. ISM services PMI report, which had the effect of raising the odds of a June rate cut by the Fed.

Should confidence grow in such an outcome, the likes of AUD can find further upside.