GBP/AUD Week Ahead Forecast: Constructive, RBA In Focus

- Written by: Gary Howes

- GBP/AUD pointed higher

- RBA is week's key domestic focus

- But plummeting Chinese stocks a concern

Image © Adobe Images

The Pound to Australian Dollar exchange rate remains in a positive setup that advocates for further upside, but the Reserve Bank of Australia (RBA) could prove a setback this week.

The GBP/AUD exchange rate has risen for six weeks in succession now as global markets lower expectations for the amount of central bank interest rate cuts to be delivered in 2024.

This means the Aussie Dollar's relative interest rate disadvantage (the RBA has been relatively timid when raising interest rates) is unlikely to disappear anytime soon, which can underpin a trend of AUD weakness.

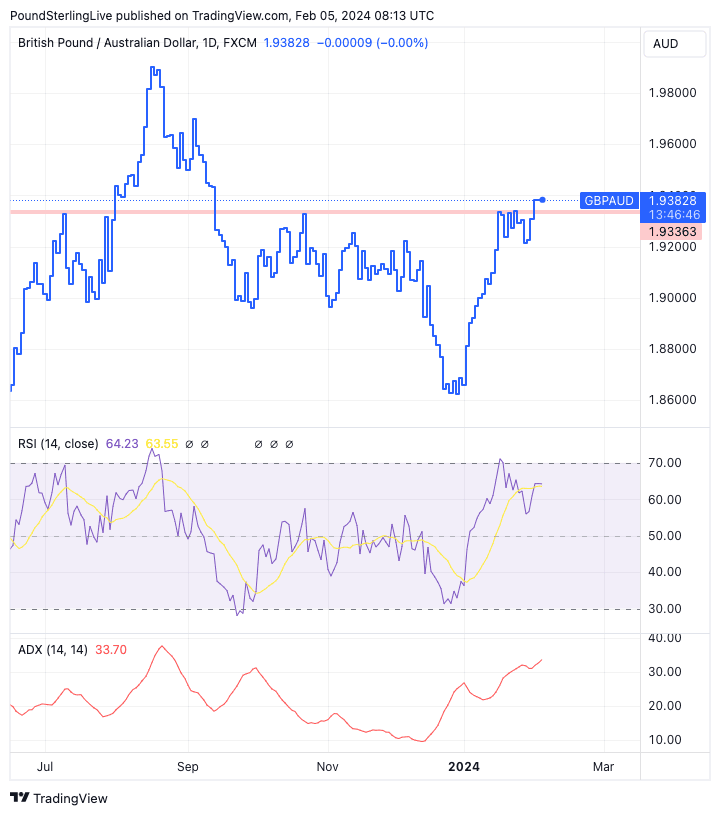

GBP/AUD has risen above the resistance line at 1.9363 (note it has struggled to close above here on a daily basis for much of 2023-2024), which confirms the broadly constructive setup.

Above: GBP/AUD at daily intervals with RSI and ADX momentum indicators. Track the AUD with your own custom rate alerts. Set Up Here

Momentum indicators, as measured by the RSI and ADX, are both positive and advocate for further upside, with a test of last week's highs at 1.9458 possible in the coming days.

A rally to the 2023 high at 1.9971 remains a possibility for the coming weeks and months if momentum remains positive and the global backdrop doesn't shift materially.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This backdrop includes concerns over the Chinese economy where data continues to disappoint and stock markets remain under pressure (see more below).

The Aussie has also struggled as the market realises the Federal Reserve won't cut interest rates as early as March owing to ongoing robust domestic data releases.

This underscores the view that it is China and the U.S. Fed that continue to matter greatly for the Aussie Dollar.

That said, the RBA will also be a factor to watch, and this week we receive another update from Australia's central bank.

The RBA announces its February decision on Tuesday at 3.30am London time, and economists expect it to drop any references to needing to raise interest rates again.

Track the AUD with your own custom rate alerts. Set Up Here

In December, the RBA said it considered raising interest rates further, but the release of lower-than-expected inflation figures in January offers the RBA the chance to drop this tightening bias.

Financial markets have upped bets for rate cuts this year, now pricing in a c.80% chance of a June rate reduction. This is consistent with Aussie Dollar underperformance in 2024.

However, analysts at the Commonwealth Bank of Australia (CBA) say it could be too soon for the RBA to drop its tightening bias, which would amount to a surprise for markets that can boost AUD in the short.

"The Reserve Bank of Australia (RBA) policy meeting and press conference could have a large influence on AUD/USD," says Kristina Clifton, a strategist with CBA.

CBA expects no change in the cash rate as is widely expected, also expecting the RBA will keep its tightening bias.

According to Clifton, this could possibly push up AUD/USD up by half a cent, which would result in GBP/AUD weakness, all else being equal.

"While the Australian rates market has little chance of a rate cut priced in, it is priced for nearly 60bp worth of rate cuts in 2024. Pricing we view as too aggressive. We see significant risk the RBA pushes back against this pricing," says David Forrester, Senior FX Strategist at Crédit Agricole.

CBA meanwhile expects the RBA to cut its cash rate by more than the market is pricing, particularly in 2025. "If we are right, AUD/USD has further downside to 0.6300 in coming months," says Clifton. Such a move would advocate for further GBP/AUD upside back towards the 2023 highs.

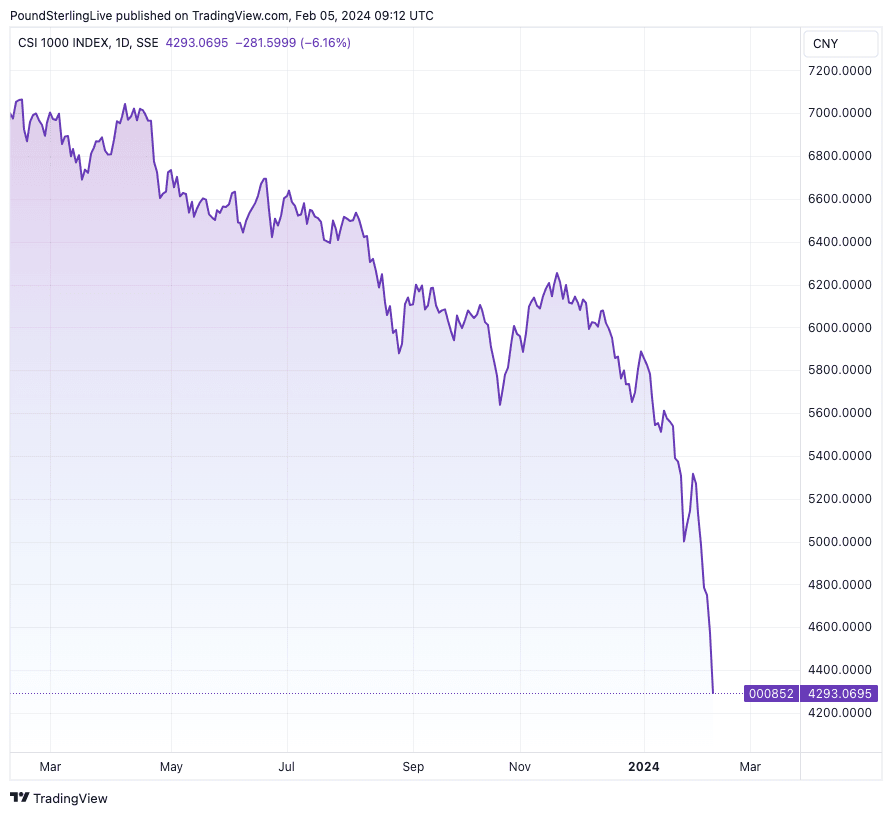

Risks to the Aussie outlook were on display Monday after China's CSI 1000 index declined 8% on the day, taking it 30% lower in the first month of 2024.

Above: China's CSI 1000 index.

Over the last 10 days, China's CSI 1000 index is down a massive 21% as the market catches up with the woes facing the country's struggling property sector.

The declines prompted China's government to pledge again to help stabilise markets.

Already in 2024, we have seen similar pledges that helped steady markets and boost China-linked assets such as the Aussie Dollar, but Monday's move does feel reactionary and a little desperate.

Last week, Evergrande, China's largest property developer, was ordered to be liquidated by a Hong Kong court.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes