Australian Dollar: Inflation Falls Faster Than Expected

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar was put on the backfoot after domestic inflation figures for the final quarter of 2023 fell faster than markets were expecting, giving rise to hopes for a Reserve Bank of Australian interest rate cut.

Money market pricing showed bets for an earlier cut increased after Australia's headline CPI inflation rose 4.1% year-on-year in the final quarter, down from 5.4% previously and undershooting expectations for 4.3%.

The quarter-on-quarter figure dropped to 0.6% from 1.2% previously, which was below the 0.8% increase the market was looking for.

"December Quarter CPI suggests the inflation dragon may have been tamed," says Justin Smirk, an economist at Westpac.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The RBA Trimmed Mean CPI - which is a core measure of inflation the RBA watches - stood at 4.2%, down from 5.2% and below expectations for 4.3%.

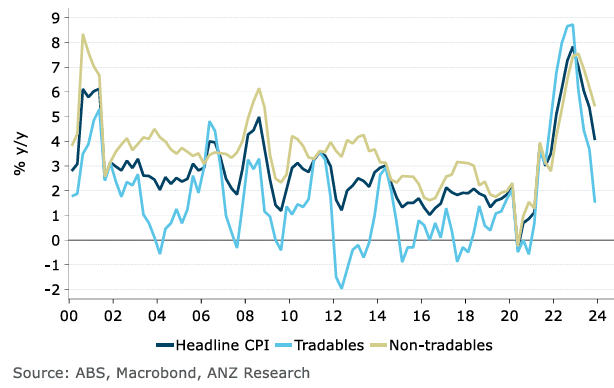

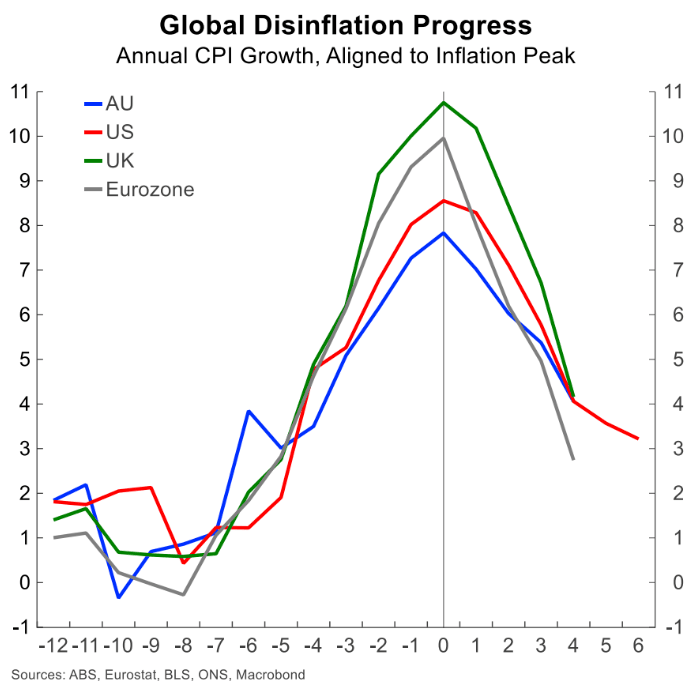

"The moderation in inflation is occurring more quickly than expected," says Pat Bustamante, Senior Economist at St. George Bank in Sydney. "The global disinflationary impulse has arrived. For the first time in three years, the prices of globally traded goods declined."

The news prompted a broad-based decline in the value of AUD: the Pound to Australian Dollar exchange rate is quoted 0.36% higher on the day at 1.9304, the Australian to U.S. Dollar exchange rate is lower by 0.60% at 0.6563, and the Euro to Australian Dollar is up 0.35% at 1.6484.

The decline in inflation was driven mainly by a fall in energy costs, with electricity bills falling –5.7 m/m in December.

However, some economists warn it is too soon for the RBA to 'pivot' its policy stance towards interest rate cuts as inflation in some key areas remains a concern.

Non-tradables inflation remains elevated at 1.3% q/q, with the six-month annualised rate at 5.4%. Services inflation was also elevated at 1.0% q/q.

"This will likely see the RBA maintain its tightening bias and hawkish tone in the February statement," says Catherine Birch, an economist at ANZ Bank.

ANZ has not changed its view that Australian interest rate cuts won't begin until late this year, making the RBA one of the last to cut.

If so, this would offer the Australian Dollar support via the interest rate channel over the coming months.

"That said, risks might be starting to skew toward an earlier commencement of rate cuts," says Birch.

St. George Bank says the inflation release confirms Australia's disinflationary journey is on par with that of global peers.

Image courtesy of St. George Bank.

With these global peers looking to cut rates by mid-year, the scope for the RBA to fall in line grows.

St. George Bank expects inflation to be running at 3.2% over 2024 in both headline and core terms.

"Today's outcome suggests that there are some downside risks to these forecasts. It also suggests that when the RBA reviews their forecasts, they could even start to tilt the balance of risks for inflation to the downside with the potential for inflation to be back to around the mid-point of the band within their forecast horizon," says Bustamante.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes