The GBP/AUD Rate's Out-of-Bounds Foray is Done: The Week Ahead Forecast

- Written by: Gary Howes

- GBP/AUD pulled back into 2023 range

- Further near-term strength is possible

- Watch Aussie labour market stats this week

Image © Adobe Stock

The New Zealand and Australian Dollars are two underperformers at the start of the new week, undermined by a surprise decision by the People's Bank of China to maintain interest rates at unchanged levels.

Markets had bid the two currencies in the latter half of the previous week in anticipation of another hike following the release of below-consensus inflation numbers.

"China’s central bank kept its medium-term lending rate unchanged on Monday, disappointing many investors who were anticipating a small cut," says Raffi Boyadjian, Lead Investment Analyst at XM.com.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Australian Dollar has come under pressure in the opening weeks of 2024, and further softness can be expected, although the release of a bumper Australian jobs report this week could offer a boost.

The Australian Dollar strengthened through the latter months of 2023 amidst rising global equity markets and commodities as investors ramped up bets for U.S. Federal Reserve rate cuts.

But these bets have faded in 2024 amidst robust U.S. data, which has weighed on the Aussie Dollar across the board, including against the Pound.

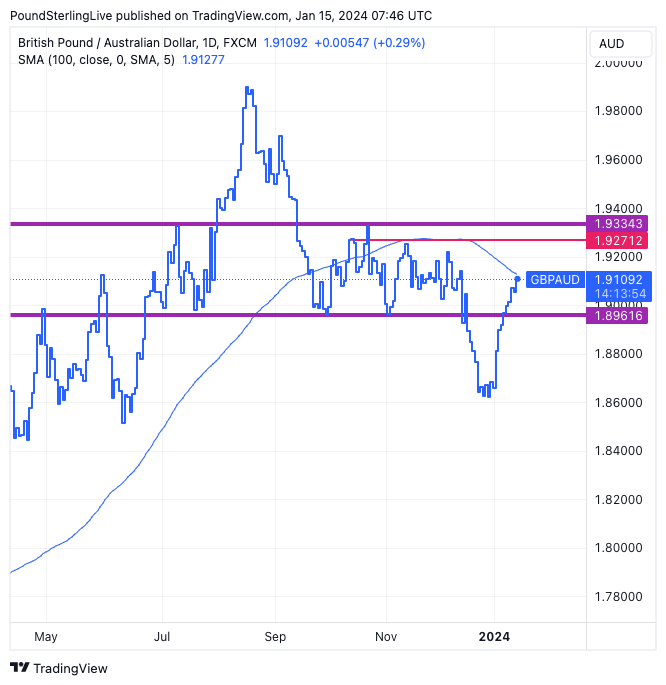

The daily chart shows these developments to have resulted in the Pound to Australian Dollar exchange rate being sucked back into a long-running range, and we see the prospect of further extension of the recent recovery, although the best part of the move is now behind us.

Above: GBPAUD at daily intervals. Track GBP and AUD with your custom rate alerts. Set Up Here.

The above shows the Pound-Aussie exchange rate has broken above 1.8961, which forms the lower bound of the multi-month range.

We see it as adding a layer of crucial support going forward.

The above chart also shows the location of the 100-day moving average is close at hand (at 1.9127), and price action does appear to indicate resistance/support has been located around the 100 DMA in the recent past.

We could, therefore, see the recent rally capped at 1.9127 this week.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

A break above the 100 DMA would indicate improved short-term momentum, ensuring the GBP/AUD rally can extend towards the top of the range.

The upper end of the range is 1.9334, but a test of this October high would require strength to extend on a multi-week basis.

If positive momentum is confirmed, a retest of the 1.9271 level is preferred over the shorter term (next one to two weeks).

Martin Whetton, a currency strategist at Westpac, looks for further weakness in the Australian Dollar against the U.S. Dollar, which can underpin crosses such as GBP/AUD.

"The Aussie's year-end rally fizzled out after the 0.6871 high, following the broad USD trend in a retreat to either side of 0.6700 in recent sessions. Price action indicates little impetus to break ranges," says Whetton.

This observation underpins the above GBP/AUD technical analysis, which suggests the exchange rate will likely remain contained within its range.

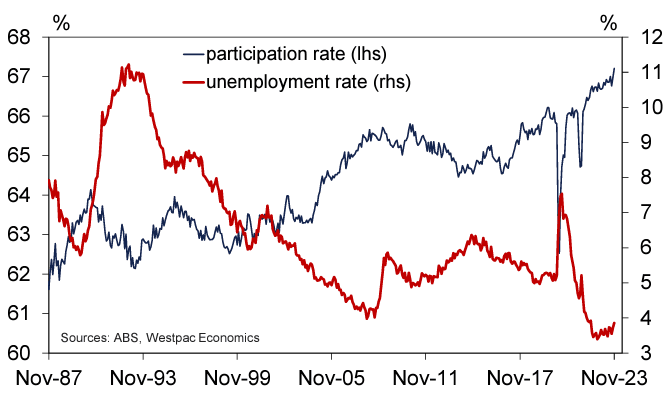

Above: Australian employment. Image courtesy of Westpac.

Turning to the calendar, Thursday sees the release of Australian labour statistics, with the market looking for a reading of +15K to be announced.

The data will be closely watched by the Reserve Bank of Australia for signs of emerging slack, which would allow the central bank to confirm the rate hiking cycle has ended.

Analysts at Westpac are looking for an above-consensus reading at 35K, noting a "lasting resilience in labour demand".

The Australian Dollar can benefit if the figures beat expectations.

Meanwhile, the market expects the unemployment rate to remain unchanged at 3.9%.

Keep an eye on the release of Chinese GDP figures midweek, as China often proves to be the major factor in Australian Dollar price action owing to its status as Australia's main trading partner.

GDP is expected to read at 5.2%, and any surprise deviation could move the Aussie.

We have seen the AUD supported on disappointing Chinese data of late, as this boosts bets for additional stimulus announcements, which suggests downside risks to AUD from the data are limited.

"The headline read will be critical for confidence in the economy, but the partial indicators for the December month will arguably convey more information about prospects going forward," says Westpac.

Regarding the Pound side of the GBP/AUD equation, it is a very busy week ahead, with wage data, inflation and retail sales all up for release.

For a preview of these data and their implications for the Pound, please see here.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes