GBP/EUR Week Ahead Forecast: Can a Busy Calendar Shatter the Stability?

- Written by: Gary Howes

- Pound-Euro broadly supported

- But in dire need of volatility

- Busy economic calendar looms this week

Image © Adobe Images

Pound Sterling enters a new week as the top-performing major currency for 2024, but this will be challenged if this week's busy economic calendar disappoints.

The Pound to Euro exchange rate ended the year just above its six-week low of 1.1509, and price action over the last nine trading days has seen some buying interest return to the UK currency.

Yet, the going is slow, market participants on both sides of the equation have expressed to us their frustration with regards to the lack of opportunity the exchange rate offers.

The stability seen in Pound-Euro has also not gone unnoticed in the analyst community, with several analysts commenting on the pair's remarkable lack of volatility.

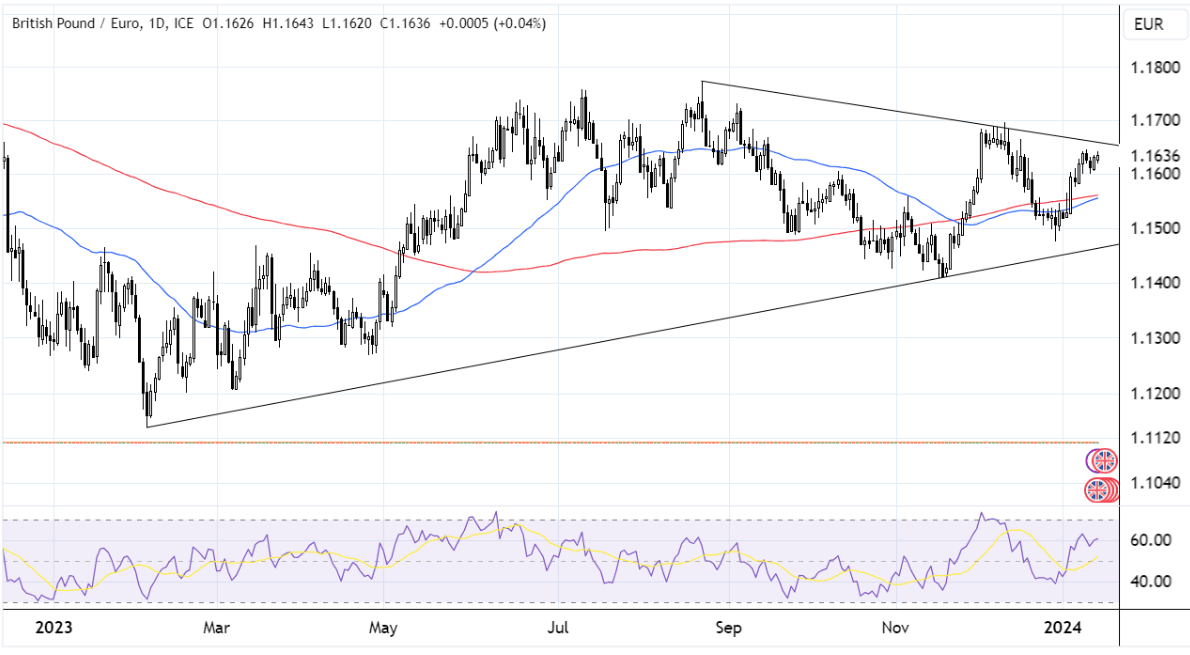

"The degree to which the volatility has (broadly speaking) gone out of this pair is highlighted by the fact that its 50-day and 200-day moving averages are currently following almost the same trajectory (it’s been many years since we last saw something similar)," says Bill McNamara, analyst at The Technical Trader.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

McNamara says a close above 1.1650 would open the door to a return to the peak from the beginning of December, i.e. at 1.1677 – "and that level is starting to look a lot like critical resistance".

"In fact, the chart isn't pointing towards a break higher just yet – further near-term range-trading looks likely right now – but when that level does give way the next target will be the August peak, at 1.173 or so," says McNamara.

Image courtesy of The Technical Trader. Track GBP and EUR with your custom rate alerts. Set Up Here.

Both the Dollar and Pound have benefited from a 'hawkish' repricing in central bank expectations, with investors lowering expectations for the scale of rate cuts that are likely to be delivered in 2024.

This has resulted from a run of resilient data from the U.S. and UK over recent weeks. On this front, it is the Pound that is in the spotlight over the coming days, given the busy data docket that must be navigated.

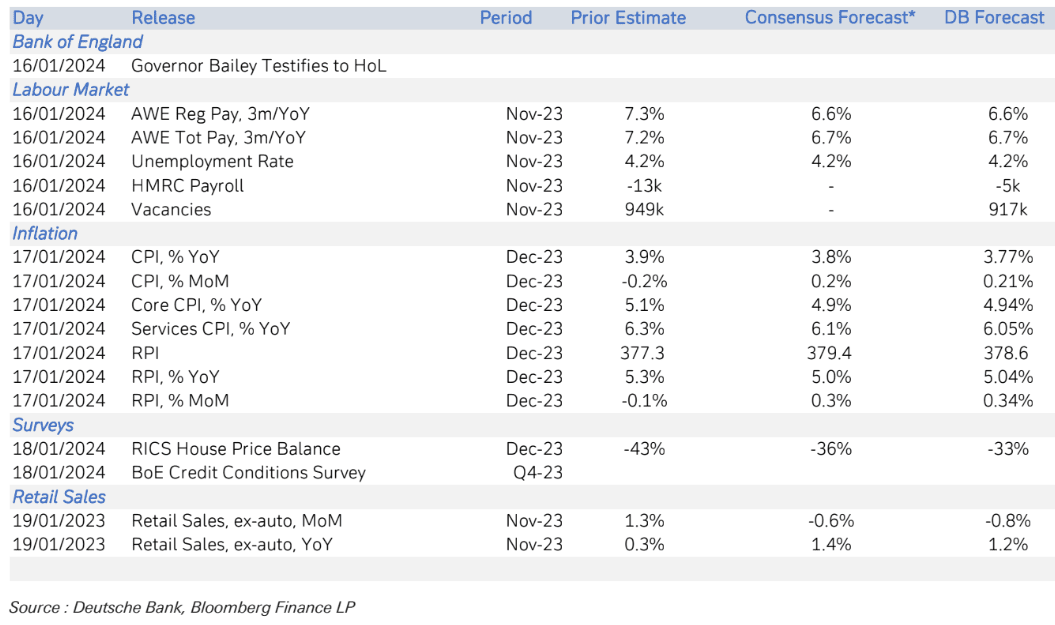

Tuesday sees the release of UK wage data, with the consensus prepared for a reading of 6.6% y/y in the three months to November.

When bonuses are included, the figure expected is 6.8%, with both representing a slowdown in wage growth from the previous reading.

Note that the ONS is not releasing a full employment report, which means the market focus is squarely on earnings. Expect investors to buy the Pound should earnings beat expectations, as this lowers the odds of an early rate cut at the Bank of England.

Wednesday sees the release of UK inflation numbers, with the consensus eyeing a reading of 3.8% y/y in December, down from 3.9%.

The core CPI reading is expected at 4.9%, down from 5.1%. Should the data beat expectations, the Pound can rally as markets lower bets for rate cuts.

Note that inflation has materially undershot expectations in the past two outings, and we would not be surprised if the Pound ends the midweek session lower on a repeat.

Friday sees the release of UK retail sales for December, with a 1.1% y/y expansion expected as the m/m figure prints at -0.5%.

A beat on expectation would signal the UK economy ended the year with momentum, which would support Sterling.

Euro Week Ahead:

The Eurozone's coming week features the release of industrial production figures on Monday, with markets looking for a sobering print of -5.9% y/y for November.

We don't expect a strong market response to the numbers given Germany's November industrial production data was released just last week.

Germany is in focus Tuesday with the release of the more timely ZEW economic expectations survey results for January, which can impact the market.

The sentiment component is expected to read at 12.7, and the current situation component at -77. Any uptick could underscore evidence that Germany's economy has reached a nadir and form the kind of positive surprise that can boost the Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes