GBP/AUD Rate Week Ahead Forecast: Uptrend Intact, UK Inflation and Aussie Jobs Report Eyed

- Written by: Gary Howes

- GBPAUD uptrend remains alive despite recent pullback

- GBPAUD recovers after Chinese GDP data disappoints Monday

- Midweek UK inflation release is key risk this week

- Watch RBA minutes release no Tuesday, Aus labour market data Thurs

Image © Adobe Stock

The Pound to Australian Dollar rate's (GBPAUD) uptrend encountered a pullback last week, yet the decline has not been deep enough to dent the constructive technical outlook for this pair, although UK inflation data due for release this week poses a major test.

A short-term recovery by the Pound against the Australian Dollar extended at the start of the new week as GBPAUD reached 1.9222 following the release of disappointing Chinese economic data.

The release of Chinese GDP was the first calendar risk facing the Aussie this week as China remains a key consideration for Australian economic performance. Indeed, much of 2023's AUD underperformance has been linked by analysts to underwhelming economic growth in Australia's largest trading partner.

"The only G10 currencies which are likely to go on struggling against the dollar, are AUD and NZD, weighed down by Chinese growth concerns, for now," says Kit Juckes, chief FX strategist at Société Générale.

Chinese GDP rose 6.3% year-on-year in the second quarter, up from a 4.5% in Q1, with base effects (related to the COVID-19 lockdowns of Q2 2022) helping to inflate this rate. This increase was weaker than market expectations (7.3%), "and points towards a loss of momentum during the quarter – as seen in the quarter-on-quarter series – as consumers remained relatively subdued," says Gerard Burg, Senior International Economist at NAB.

"China’s post-COVID rebound has lost steam as the leaders have not been capable of restoring confidence in the economy. We should get used to weak growth numbers," says Tuuli Koivu, an economist at Nordea Bank.

The trend of Australian Dollar weakness can therefore extend until such a time China's economy turns a corner, underscoring why pullbacks in GBPAUD are considered to be temporary, at this stage.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound-Australian Dollar's direction this week will, however, be largely determined by the outcome of the UK inflation release, due at 07:00 BST on Wednesday.

Analysts say an undershoot in inflation could result in broad-based Pound Sterling weakness as investors would be prompted to lower expectations for the scale of upcoming Bank of England rate hikes.

CPI is forecast to have risen 8.2% year-on-year in June, down from 8.7% previously, with core inflation expected to have fallen to 6.8% from 7.1%.

The core inflation release could arguably be the more important figure to watch given it is given greater consideration at the Bank of England.

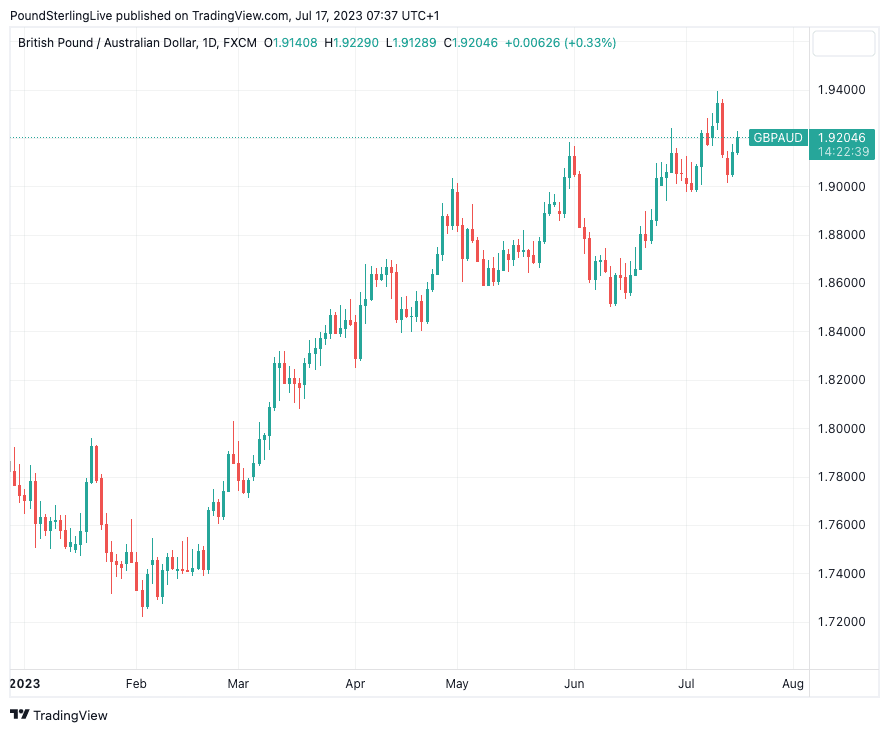

Above: GBPAUD at daily intervals showing an intact uptrend that advocates for further advances over the coming weeks.

But, there is also the possibility that falling inflation boosts UK real bond yields (nominal yields minus inflation), which some analysts say is a supportive development for the Pound.

Furthermore, an undershoot in inflation would boost the UK's economic prospects as the end of the 'cost of living crisis' comes into sight and businesses can anticipate a future of settled interest rates.

This narrative (high inflation = bad) is given credibility by the Pound's lacklustre response to last month's above-consensus data release.

Therefore, the Pound's reaction to the inflation data release is difficult to predict, but this week's release will, at the very least, provide GBPAUD watchers with some heightened volatility.

Australia's week ahead is dominated by the release on Tuesday of meeting minutes for this month's RBA policy decision that saw interest rates left unchanged at 4.10%.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"The key issue to look out for in the RBA minutes is whether there was a discussion between a pause and 25bp, as has been the debate in the prior three meetings. The dovish post-board meeting statement was reinforced by the Governor's speech on 12 July, which suggested that the outlook for inflation is now more mixed," says strategist Alvin Tan at RBC Capital Markets.

Should the RBA minutes convince markets that the RBA can deliver more hikes at the upcoming meetings, then the Aussie Dollar can rise.

Thursday's Australian employment report is the main data release to watch with the market expecting 17K jobs to be added in June, down from 75.9K in May, while the unemployment rate is expected to remain unchanged at 3.6%.

Any undershoot in the labour market data could result in Australian Dollar weakness, while the opposite would be true on a data beat.