Pound Sterling Faces "Crucial Test" on Inflation Release

- Written by: Gary Howes

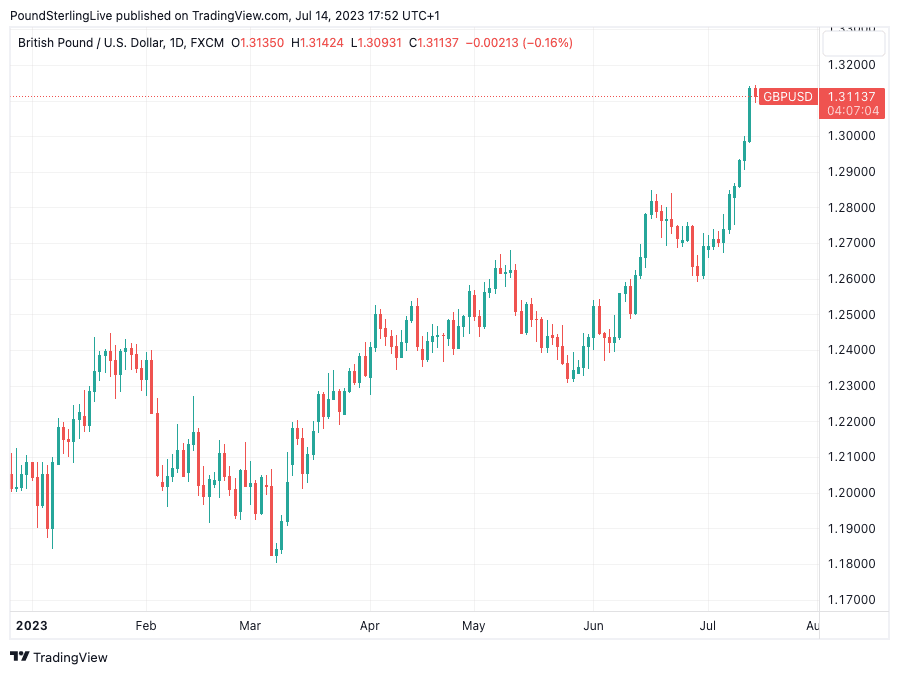

- Pound-Dollar riding multi-month highs

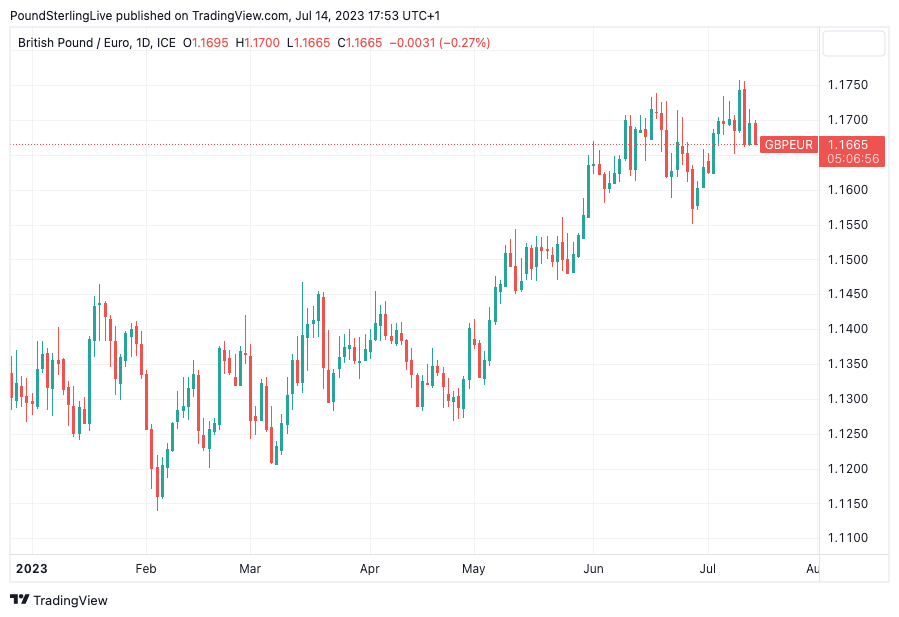

- Pound-Euro consolidating

- UK inflation undershoot could prompt GBP declines

- But GBP reaction to falling inflation uncertain

- As it could support real yields and economic outlook

Image © Adobe Images

The British Pound will on Wednesday encounter another key economic release in the form of CPI inflation for June which will determine whether the Bank of England will deliver a second consecutive 50 basis point interest rate increase in August.

The Pound has rallied through 2023 as UK inflation has proven more resilient than expected and prompted the Bank of England to take a more assertive stance on monetary policy by hiking interest rates and dropping its cautious guidance.

The inflation release "will prove a crucial test for the Pound," says Justin McQueen, a market analyst at Reuters.

CPI is forecast to have risen 8.2% year-on-year in June, down from 8.7% previously, with core inflation expected to have fallen to 6.8% from 7.1%.

"Currently, markets see a 50bp BoE rate hike at the August meeting as more likely than not, however, this will be dependent on (the) inflation figures," says McQueen.

The rule of thumb is that an undershoot in inflation will result in a weaker Pound and an overshoot in a stronger Pound. But as we note in the following article, the opposite reaction might just be true, creating a difficult event to position for in terms of a currency market perspective.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ahead of the midweek release, the Pound looks rich and prone to a pullback: the Pound to Dollar exchange rate hit a new 14-month high on July 14 at 1.3142 in the wake of a softer-than-expected U.S. inflation reading for June that lowered expectations for the peak in the Federal Reserve hiking cycle.

Meanwhile, the Pound to Euro exchange rate remains locked below 2023 highs on account of the strong up-move in EUR/USD and signs the European Central Bank is set to raise rates on a further two occasions before the year is out.

Central bank policy therefore matters, and no input into their decision-making process is more important than inflation.

UK headline inflation is expected to ease with the continuing fall in energy prices "but it's the core number that will be in focus, particularly after this week's higher-than-expected wage numbers," says Thanim Islam, Head of FX Analysis at Equals Money.

"An upside surprise to core inflation can easily push BoE pricing back up and lead to further GBP gains," says Carol Kong, a foreign exchange strategist at Commonwealth Bank of Australia.

Above: GBPUSD at daily intervals showing the rally to date for 2023.

The inflation data release comes amidst outperformance in Pound Sterling that leaves it looking richly priced on near-term timeframes against the Dollar, therefore the downside potential to any negative surprises is potentially greater than the upside.

Investors also remain concerned the UK economy will fall into recession owing to higher interest rates over the coming months, and the impact of the inflation release can potentially add to these concerns, undermining the Pound.

"On a year-to-date basis the pound remains the top performing G10 currency but the lagging performance in July may be an early sign that investors are possibly becoming more cautious over the scale of further appreciation from here," says Derek Halpenny, Head of Research for Global Markets at MUFG.

Halpenny says he is not yet ready to fight the move in the British Pound but he remains wary of a reversal. He notes the speed of turnaround in the U.S. inflation which could serve as a possible example of what could unfold in the UK at some stage.

"Inflation is still set to fall sharply with utility bills and food prices set to slow," he says.

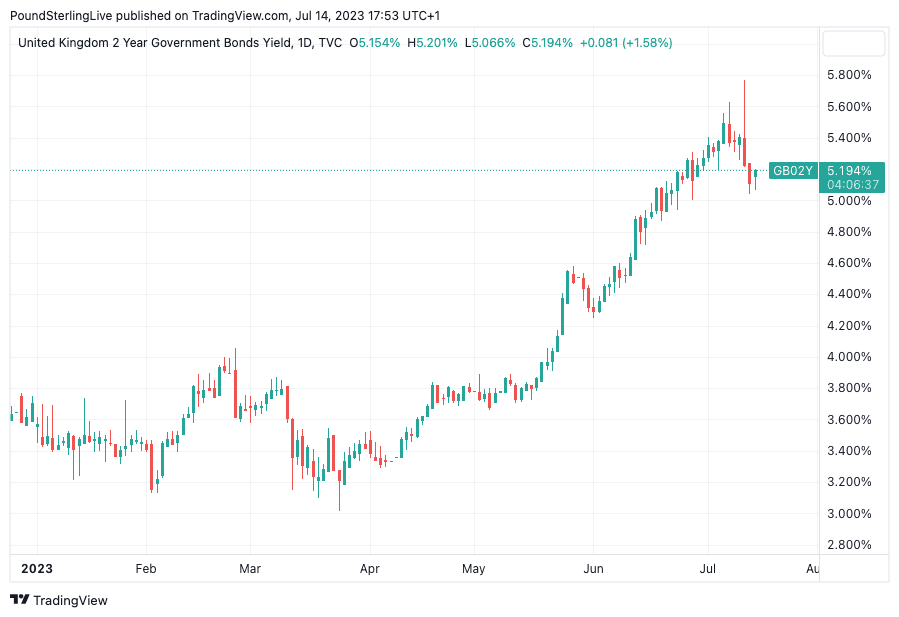

Should inflation come in softer than the market is anticipating, there is the prospect of Bank of England rate hike expectations falling sharply, weighing on UK bond yields which could result in a weaker Pound. A readjustment lower in rate hike expectations "could result in renewed GBP underperformance," says Halpenny.

Above: GBPEUR at daily intervals showing the recent consolidation.

But some analysts argue that what really matters for currencies like the Pound are real yields i.e. nominal 'headline' yields minus inflation.

Falling inflation could therefore underpin UK real yields, even if nominal yields fall.

Indeed, the Pound tracked UK yields lower last week as markets lowered Bank of England rate hike expectations in tandem with falling global inflation expectations after the release of U.S. inflation figures for June came in softer than anticipated.

Above: UK two-year bond yields have fallen from recent highs as markets pare back Bank of England rate hike expectations.

"The UK has been at the front of the firing line of any volatility in interest rate markets over the past fortnight. Last week, the story was one of firming rate expectations – at one stage the forward curve priced in a terminal rate of 6.50%6.75%. This week, market sentiment has turned 180 degrees. Domestic markets are currently pricing in a Bank rate peak a touch below 6.25%," says Philip Shaw, an economist at Investec.

A scenario where rising UK real yields - resulting from falling inflation - boosts the Pound highlights the many moving parts to consider and why predicting the outcome of this week's release is unusually difficult.

Falling inflation would also boost the UK economic outlook as the pressure on households and businesses eases and the prospect of growth-sapping rate hikes at the Bank of England fades.

Another interesting consideration heading into the inflation release comes from a research note from Deutsche Bank which points out that over the last two years, UK mid-cap stocks and the Pound have, on average, seen bigger moves on U.S. CPI days than when the UK's own inflation data comes out.

"And that's despite UK inflation generally proving the trickier of the two to predict of late," says economist Shreyas Gopal at Deutsche Bank.

Could the inflation release, therefore, result in little drama for Pound exchange rates despite all the hype ahead of its release? This could well be the most unexpected outcome.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes