Pound-Australian Dollar Rate Extends Pullback on Lowe Speech, GBPAUD Support Seen Close By

- Written by: Gary Howes

Above: File image of Governor Lowe. Image © Crawford Forum, Reproduced Under CC Licensing.

Australian outperformance extends after the Governor of the Reserve Bank of Australia (RBA) confirmed Australians faced further interest rate hikes in order to battle inflation.

Speaking at the Morgan Stanley 5th Australia Summit in Sydney, Philip Lowe said some further tightening of policy may be required.

"AUD is outperforming slightly in quiet overnight markets after RBA Governor Lowe said the fundamentals for the Australian economy were 'very positive' and the increase in the minimum wage was only one factor in the decision to raise rates this week," says Adam Cole, Head of FX Strategy at RBC Capital Markets.

Following Lowe's speech economists at Commonwealth Bank of Australia (CBA) announced they expect one further 25bp increase in the cash rate for a peak of 4.35% and see it most likely at the August Board meeting.

"The risk is a 25bp rate hike earlier in July. And there is also a risk of 25bp rate rises in both July and August, which would take the cash rate to 4.6%," says Gareth Aird, Head of Australian Economics at CBA.

The RBA raised the cash rate target to 4.10% and said it was open to hiking rates further, a decision that triggered a rally in the Australian Dollar in a decision that was something of a surprise for a market that was leaning towards a no-change call.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Australian Dollar appreciated strongly following the decision as investors react to the higher interest rates Australia now offers.

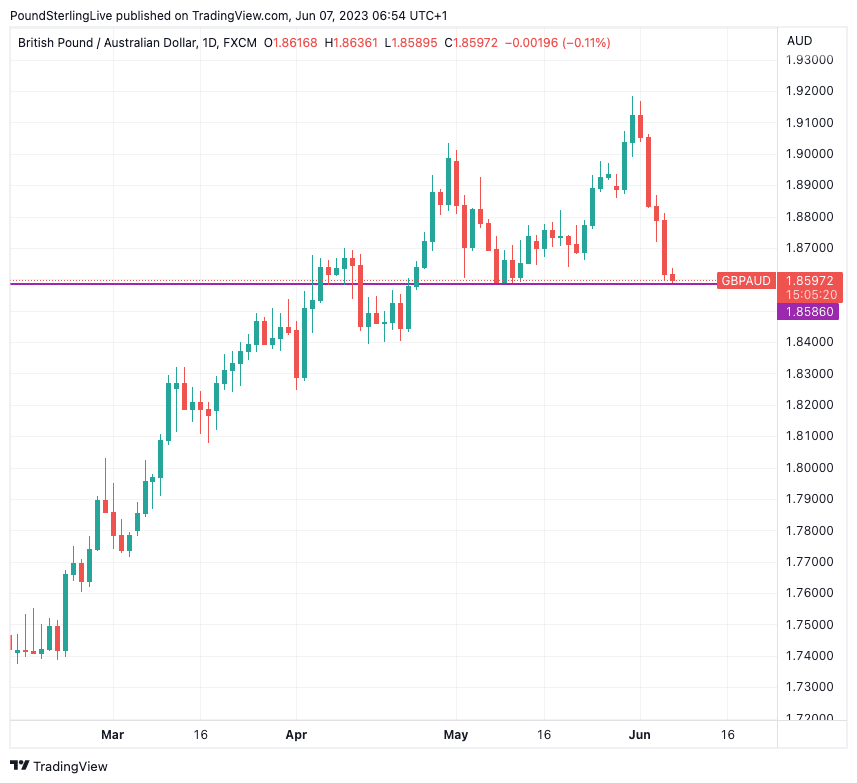

The Pound to Australian dollar exchange rate (GBPAUD) reached its highest level since February 2022 last week at 1.92, a significant resistance point on the charts, but has since slid back.

The pair fell nearly 1.0% in the wake of the RBA decision and follow-on losses in the wake of Lowe's speech see it extend to 1.8595.

It is here, however, that some support might emerge for the Pound as GBPAUD appears to have some support in the vicinity:

Above: GBPAUD at daily intervals.

The Pound has been in an uptrend against the Australian Dollar over the course of 2023 as investors react to a string of better-than-expected economic data releases and the Bank of England's clearer communications on interest rates.

The Bank has simplified guidance and says it will continue hiking interest rates as long as the data warrants.

Given the UK's strong inflation impulse investors see at least a further 75 basis points of rate hikes over the course of 2023, more than any other major central bank, an expectation that keeps the Pound supported.

Until this changes GBPAUD would be expected to remain well supported.

The Australian Dollar meanwhile remains hamstrung by China's lacklustre post-Covid rebound, which will potentially weigh on domestic activity over the coming months.

"The deteriorating global economic outlook and the weakness in the Chinese economy will remain headwinds for AUD/USD in our view," says Carol Kong, a strategist at Commonwealth Bank of Australia.

Economists at Australian wealth manager AMP Limited meanwhile warn the 400 basis points of interest rate hikes already delivered by the RBA means the odds of the economy falling into recession now stand at 50-50.

"The 4% increase in interest rates since May last year means it is becoming much harder for the economy to remain on an "even keel" as the RBA and most are forecasting and runs the real risk of tipping the economy into a recession, which we assign a 50% risk to in the next 12 months," says Diana Mousina, Deputy Chief Economist at AMP Australia.

This is something Lowe himself alluded to in his speech: "The path back to 2–3 per cent inflation is likely to involve a couple of years of relatively slow growth in the economy."

The RBA interest rate hike and subsequent guidance from Governor Lowe therefore offer some near-term support for the Australian Dollar, however, the broader trend still remains one of decline over the medium-term timeframe.

This would be confirmed if incoming Aussie economic data prompts the flip-flopping RBA (recall they paused the hiking cycle in April) to hit the pause button again.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes