CBA: GBP/AUD Rate Can Rise Further

- Written by: Gary Howes

Image © Adobe Stock

Foreign exchange strategists at a leading Australian bank say the Pound can extend its recent gains against the Australian Dollar.

Commonwealth Bank of Australia (CBA) strategists have taken a closer look at developments in AUD/GBP and find it to be close to a fair valuation, but a number of factors lead them to expect a recent trend of weakness to extend.

"AUD/GBP has trended lower since reaching its cyclical high at just under 0.58 in early February," says Carol Kong, a strategist at CBA.

The high in AUD/GBP at 0.58 gives a low in the Pound to Australian Dollar exchange rate (GBP/AUD) at 1.7240.

"The turnaround in AUD/GBP coincided with the re‑strengthening in the USD, suggesting the USD has weighed on AUD more than GBP," says Kong.

CBA estimates the exchange rate is currently close to fair value, with AUD/GBP at 0.56 (and GBP/AUD at 1.7860).

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"But we consider AUD/GBP can fall further in the near term," says Kong.

She says China is a potential source of weakness as the government there has set modest targets for economic growth and local government special bond issuance (a financing vehicle for infrastructure projects) for 2023.

The annual session of National People’s Congress (NPC) commenced on Sunday and a growth target of "around 5%" was set for this year, less than the previous year's target of "around 5.5%"

Above: AUD/GBP is close to fair value: CBA.

The Australian Dollar is sensitive to Chinese growth expectations as China is Australia's most important export market. AUD was lower against all its major peers on Monday as markets adjusted for a growth target that was smaller than expected.

"AUD is likely to receive less support from commodity demand than we previously expected," says Kong.

Another factor to weigh on the Aussie against the Pound is the Australia‑UK interest rate differential, says Kong.

The Australian Dollar fell on March 07 after the Reserve Bank of Australia (RBA) raised interest rates but signalled it might slow the pace of hikes.

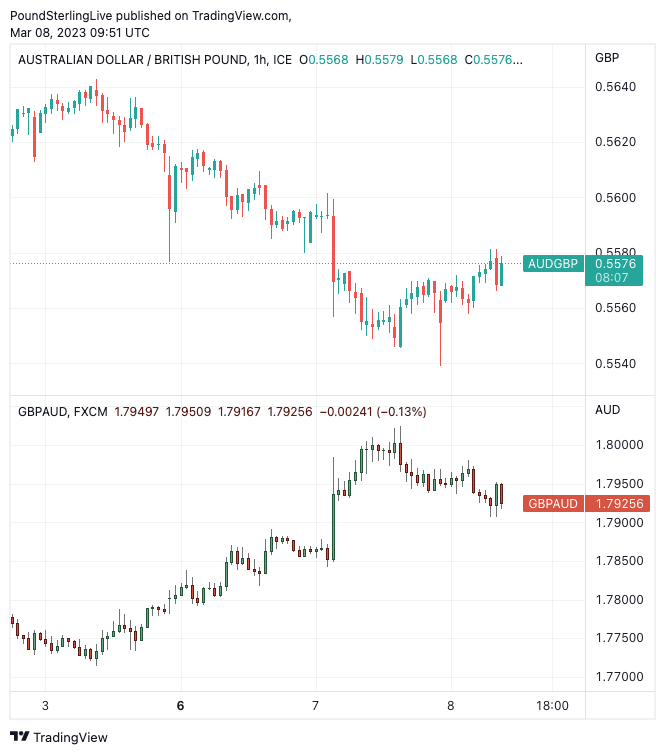

Above: AUD/GBP (top) and GBP/AUD at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

"After yesterday's hike, we expect one final 25bp hike from the RBA. Meanwhile, the risk is the Bank of England will tighten more than 25bp in coming months," says CBA.

We note the Pound has been disadvantaged against the Euro and U.S. Dollar as the Bank of England is expected to hike by less than the Federal Reserve and European Central Bank over the coming months.

But, against the Australian Dollar, the outlook is more constructive given the RBA is a potentially more 'reluctant hiker' than the Bank of England.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes