Australian Dollar in the Red as China Lower's Economic Growth Ambitions

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar was the clear underperformer at the start of the new week following news that Chinese authorities had set annual growth targets at lower levels than the market was expecting, implying demand for Australia's mining exports would not enjoy a substantial boost over the coming months.

The annual session of National People’s Congress (NPC) commenced on Sunday and a growth target of "around 5%" was set for this year, less than the previous year's target of "around 5.5%".

The target was delivered by the outgoing premier Li Keqiang who said this year's priority of supporting growth amid headwinds from "demand contraction, supply shock, and weak expectations".

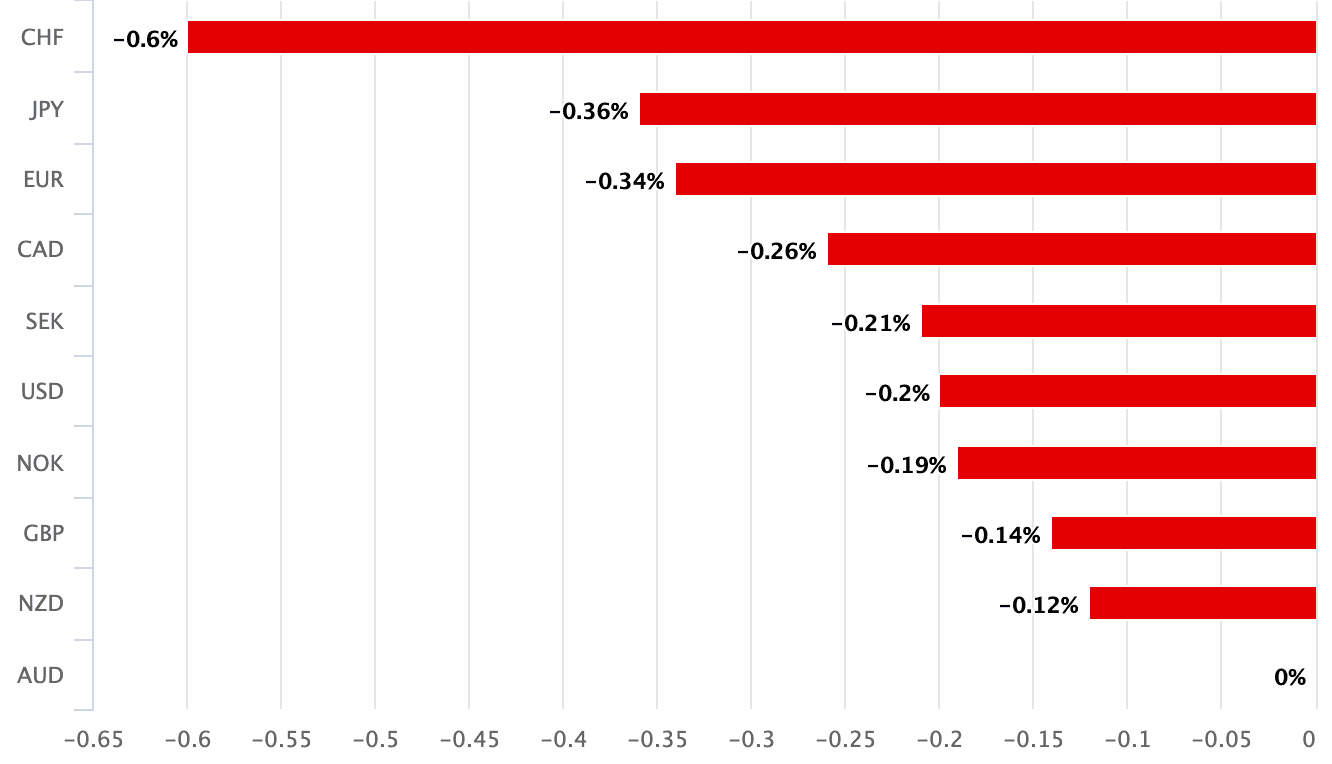

The Australian Dollar is sensitive to Chinese growth expectations as China is Australia's most important export market and was lower against all its major peers on Monday as markets adjusted for a growth target that was smaller than expected:

Above: AUD performance on March 06.

"AUD/USD is slightly lower despite the weaker USD. China’s economic growth target is softer than we had expected and will likely keep a lid on AUD and NZD early this week," says Kristina Clifton, an analyst at Commonwealth Bank of Australia.

The Pound to Australian Dollar exchange rate (GBP/AUD) was meanwhile higher by a quarter of a percent at 1.7821, ensuring bank payment rates were in the 1.7197-1.7322 region, competitive cash and holiday rates around 1.7480 and competitive transfer payment rates at 1.7770.

The Australian Dollar has the Reserve Bank of Australia's March interest rate decision to look forward to on Tuesday, but the broader direction of travel for the currency will likely be determined by global drivers, particularly China.

"The 5% target for growth announced at the National People's Congress was not as high as had been hoped, particularly given the recent resurgence in factory activity and business confidence, indicating there is reticence towards signing off any blockbuster stimulus plans any time soon," says Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

The 'subdued' Chinese growth target, therefore, sets the Aussie on a soft footing as economists had expected a more ambitious target of “above 5%” to be announced, with some even expecting between 5.5% and 6%.

Australia has benefited greatly from China's demand for raw materials, such as iron ore, over recent years as it rapidly built up its infrastructure.

But authorities are now apparently intent to switch away from infrastructure (keen to avoid housing market instability) towards domestic consumption.

"Setting a modest growth target sends mixed signals. It gives the incoming officials more room for manoeuvre. It also suggests that while growth is important, the government cares about other policy objectives such as financial stability," says Tommy Wu, Senior Economist at Commerzbank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"Both the growth target and policy tone are in line with our baseline assumption, but may disappoint some market participants who had hoped for more," says Tao Wang, Economist at UBS.

Sentiment was not helped by the additional announcement China would boost its defence budget by 7.2% to 1.55 trillion yuan (£185BN) this year, with a senior Communist Party figure saying the country should "prepare for war".

During his speech, Keqiang urged the government to “comprehensively strengthen training in preparation of a war”.

China has become increasingly hawkish about the status of Taiwan over recent months as it remains committed to integrating the island with the mainland.

Beijing considers the self-governed island as part of Chinese territory and fears have risen it might soon invade to achieve national unification.

This would pose a significant deterioration in geopolitical stability, further reversing the deflationary trend of globalisation seen in recent decades.