Business Hiring Intentions Cool as Minimum Wage Increase Comes Into Focus

- Written by: Gary Howes

Business confidence remains high, but hiring intentions have eased as the April increase in the minimum wage comes into sharper focus, particularly for the UK's smaller companies.

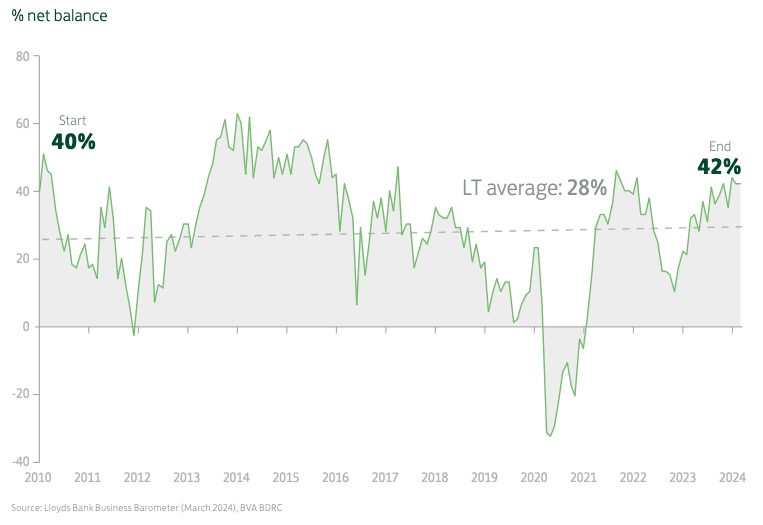

This is according to the March Business Barometer, a survey of business conditions, that finds confidence was unchanged at 42% in March, staying above the survey’s long-term average of 28%.

In signs that the UK economy rebounded at the start of 2024, the report finds trading prospects remained at the second-highest level since 2017, "consistent with stronger activity growth this year".

The net balance for economic optimism nudged higher by 1 point to 35%.

However, hiring intentions cooled, especially for smaller firms, although they remain positive.

"It's possible the impending minimum wage rises in April are beginning to come into sharper focus for businesses – especially smaller firms," says Hann-Ju Ho, an analyst at Lloyds Bank.

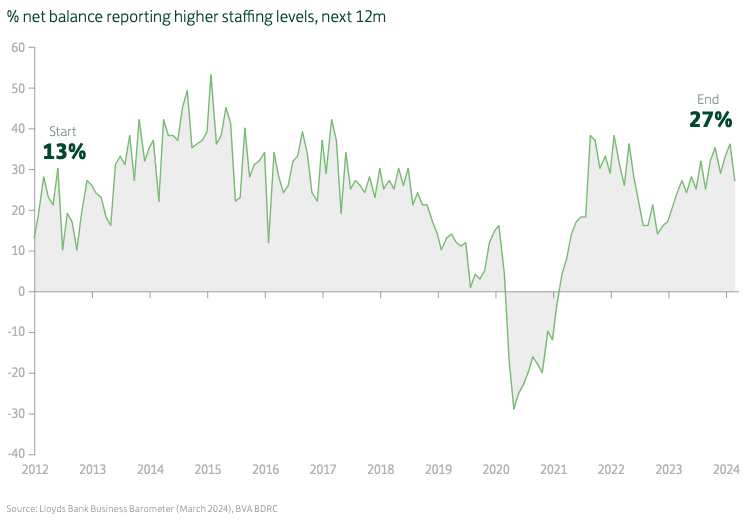

Above: Job prospects moderate from a 2-year high.

In November, the Government announced it had accepted the Low Pay Commission's recommendations to boost the minimum wage rate by 9.8% from April 2024.

The Bank of England has signalled it would want to see the impact of the minimum wage increase before considering cutting interest rates. The Bank is expected to cut rates from the middle of the year, judging that inflationary pressures are falling and that the labour market is 'loosening' i.e. inflation-boosting wage increases are fading as unemployment rates start to rise.

The Business Barometer reports staffing growth expectations remained positive but were the least buoyant for 6 months, which is a potential sign of looser labour market conditions. Hiring intentions cooled particularly among smaller firms with fewer employees and lower turnover.

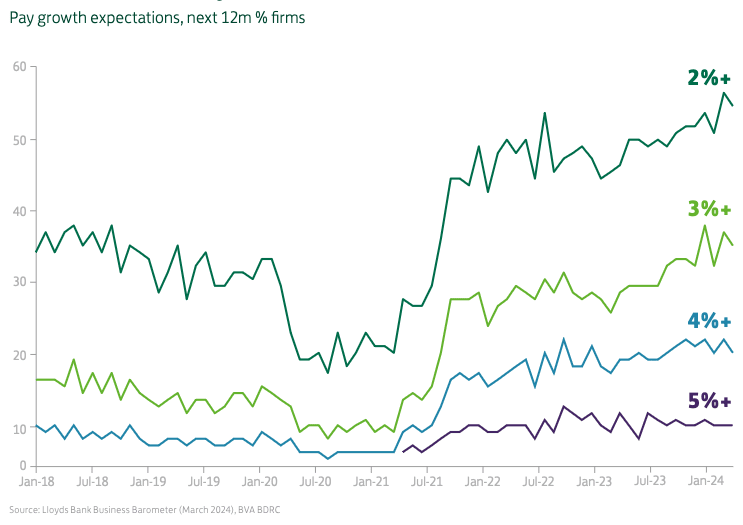

Above: Pay growth expectations still historically high.

That said, the survey's outlook for average wage growth remains relatively elevated, potentially indicating only a gradual deceleration in actual pay growth in the months ahead. The share of firms saying they expect to award 3% or more pay increases in the next 12 months fell slightly to 33% from 35%.

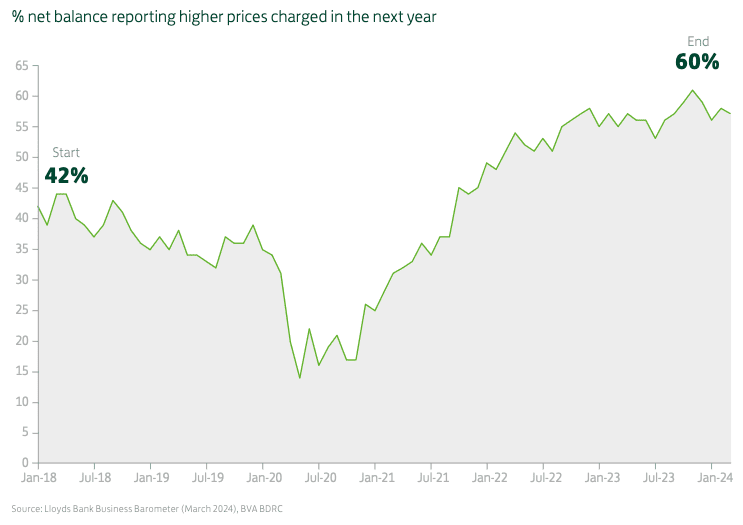

But inflationary pressures in the UK risk staying elevated as nearly two-thirds of businesses (60% down from 61%) expect to raise their prices in the next 12 months, while an unchanged 3% look to reduce their prices.

Above: Price pressures are off their highs but are yet to turn materially lower.

Lloyds says the net balance (57%) remains high from a longer-term perspective, as firms indicate that maintaining or increasing their profit margins is a key strategic priority.

Elsewhere, firms signalled less unease about supply chain disruptions and energy prices than last month, but concerns about political uncertainties and labour shortages increased.