Inflation Expectations Drop, Putting Bank of England in Comfortable Territory

- Written by: Gary Howes

Image © Adobe Images

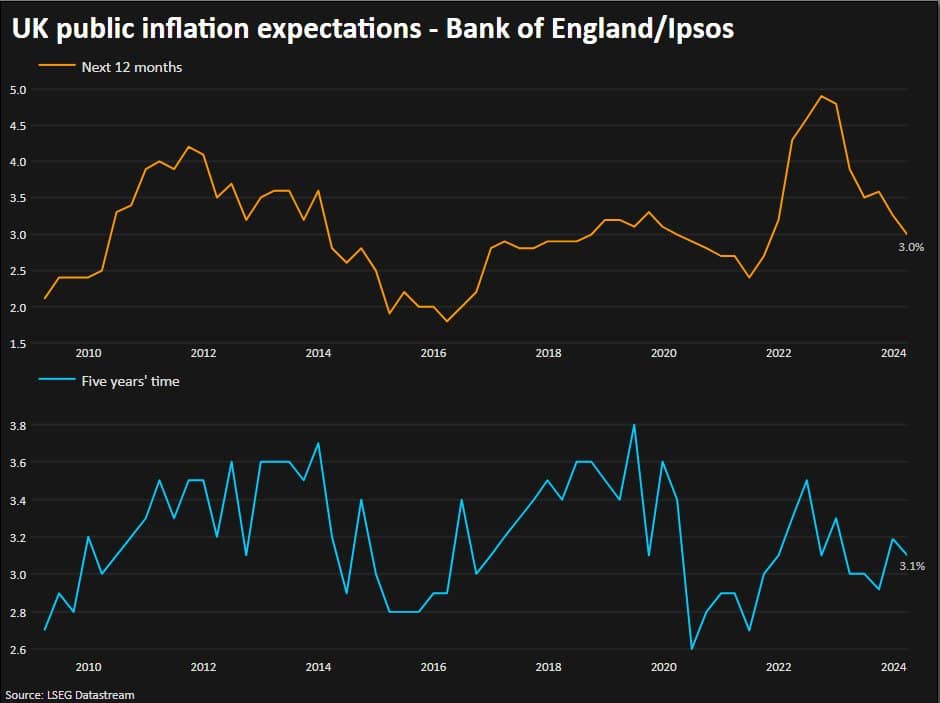

Consumer inflation expectations in the UK have fallen below their long-run average, in a sign the Bank of England is winning the fight against elevated inflation.

The Bank of England/Ipsos survey of public inflation expectations for the next 12 months fell to 3% in February down from 3.3% in January, the lowest level since November 2021.

The five-year ahead measure dropped to 3.1%, amidst signs there was little risk inflation would anchor at levels above the Bank of England's 2.0% target.

Image courtesy of Andy Bruce

Inflation expectations matter as they are a key consideration for workers when negotiating new pay deals. Rising pay can meanwhile stimulate demand in the economy and keep inflation elevated.

Both the one-year and five-year ahead measures have now dipped below their long-run average and 58% of the public expect their earnings to rise by 3% or less in the coming year.

Money markets are fully priced for a Bank of England interest rate cut in August, but we could see the odds of a June hike rising if next week's official inflation release comes in below expectations.

The Pound has rallied in 2024 as market expectations for the timing of the first rate cut and the quantum of cuts receded.

But should expectations come forward again, the Pound could come under pressure.