Consumer Borrowing Points to Economic Revival

- Written by: Gary Howes

The outlook for consumers continues to brighten, say economists, following the release of the Bank of England's monthly lending figures.

The Bank of England reported that consumers took out £1.9BN in loans in January, which was more than expected by a consensus of economists at £1.5BN.

"Excluding last November, when consumer credit surged by £2.09bn, this is the largest monthly increase since 2017. Nearly half of the consumer credit increase was due to rising levels of credit card debt, which may be a sign of consumer confidence to take on more debt," says Kathleen Brooks, research director at XTB.

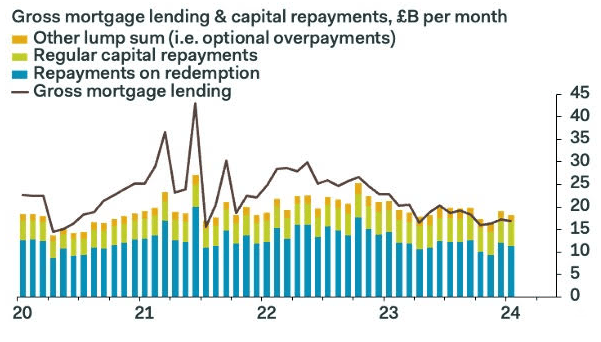

Image courtesy of Pantheon Macroeconomics.

The amount households store in banks and building societies increased by £6.8BN in January, which is above the £4.8BN average month-to-month increase in the two years prior to the pandemic.

"The light is shining more brightly at the end of what’s been a long and difficult tunnel for consumers and companies. This era of high interest rates has been punishing, pushing down spending and freezing up the housing market, but pressures finally seem to be easing," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

The Bank of England also revealed households repaid £1.1BN of mortgage debt, while mortgage approvals for house purchases rose from 51,500 in December to 55,200.

"Falling mortgage rates played a major part in reinvigorating the market. At the end of January, the average 2-year fixed rate mortgage was just a fraction over 5.5%, according to Moneyfacts, down from just over 6% at the start of December and almost 7% in August," says Sarah Coles, head of personal finance at Hargreaves Lansdown.

Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics, says the outlook for consumers continues to brighten; "we think households will be willing to spend more this year."

The Details

Savings

Households paid £6.8 billion into banks and building societies in January.

Households paid in £7.2 billion into easy access accounts – while the amount paid into fixed accounts fell to £0.1 billion.

Households withdrew £0.8 billion from NS&I. So overall, it meant we paid in £6 billion – slightly over the average for the previous six months (£5.3 billion) but well down from October’s level of £7.4 billion.

The average rate on a fixed account fell 27 basis points to 4.53% and the average easy access rate rose 4 basis points to 2.07%.

Mortgages

We repaid £1.1 billion of mortgage debt.

Mortgage approvals for house purchases rose from 51,500 in December to 55,200.

The total outstanding on mortgages fell 0.2% - a new series low

The average rate on new mortgages fell 9 basis points, to 5.19% - the second consecutive monthly drop – after rising for the previous two years.