UK Deflation Now A Looming Threat: IEA

- Written by: Gary Howes

Image © Adobe Images

The Bank of England will cut rates to as low as 4.0% by year-end as recession and deflation threaten the UK economy, according to the Institute of Economic Affairs (IEA).

The headline rate of inflation remains on track to fall to the two per cent target in April, says the IEA, and potentially dropping further over the coming months.

The call comes after the ONS reported headline CPI inflation stayed at 4.0% year-on-year in January, underwhelming against market expectations for 4.0% and printing below the Bank of England's 4.1% forecast.

"UK inflation unexpectedly remained at four per cent in January, despite unhelpful base effects from some unusually weak price changes a year earlier. This will be a relief to the Bank of England and the Treasury, both of whom had been warning of a rise," says Julian Jessop, Economics Fellow at the IEA.

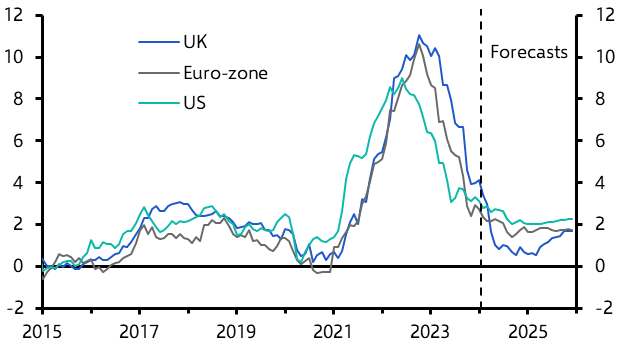

Above image courtesy of Capital Economics.

For now, the Bank of England sees inflation dropping to 2.0% in April before trending higher again to around 3.0% by the end of 2024.

The IEA joins a consensus of economists to expect headline inflation will fall to the t2% target in April, when the Ofgem cap on energy bills will be lowered sharply, and it may well drop further later in the year.

"Recession and deflation could soon be the bigger threats," says Jessop.

Looking at the data, the headline rate was held down by a further fall in food price inflation and weakness in 'furniture and household goods' and 'clothing and footwear', suggesting that December's slump in retail sales has prompted some heavier discounting.

"This is market forces at work," explains Jessop.

He adds that money and credit growth is subdued, which should continue to dampen inflation in the months ahead.

"Interest rates are probably on hold until May, but when the Bank of England does move it is likely to move quickly, with rates ending the year at around four per cent," says Jessop.

UK headline CPI inflation might be running at double the Bank of England's 2.0% target, but if we look closer at the data we see a strong disinflation is underway in the UK, opening the door to interest rate cuts.

In the below charts, Berenberg Bank analysts compare year-on-year and six-month annualised calculations of headline and core inflation.

The charts show that while the y/y change remains well above the Bank of England's 2% target for both aggregates, the picture is completely different on a six-month basis.

With almost no change in the overall price level between August and January, six-month annualised inflation has hovered around 1% in the previous three prints.

Kallum Pickering, an economist at Berenberg Bank, explains that due to the rapid acceleration in price growth through 2022 and H1 2023, y/y inflation rates still remain inflated by base effects, "and hence give a distorted picture of the recent trend in prices".

He says short of another major supply shock to prices, y/y rates of headline and core inflation look set to fall rapidly further over coming months as base effects fully wash out.

"We expect headline y/y inflation to fall to 2% in spring and to slightly below 2% through Q3. Today’s inflation print keeps the BoE on track for five cuts in 2024 starting in June," says Pickering.