Bank of America Survey Shows Improved Consumer Confidence and Stable Unemployment Rates

- Written by: Gary Howes

Image © Adobe Images

A Bank of America survey of UK consumers shows an uptick in confidence this September, amidst a steadying unemployment rate and expectations for improved personal finances.

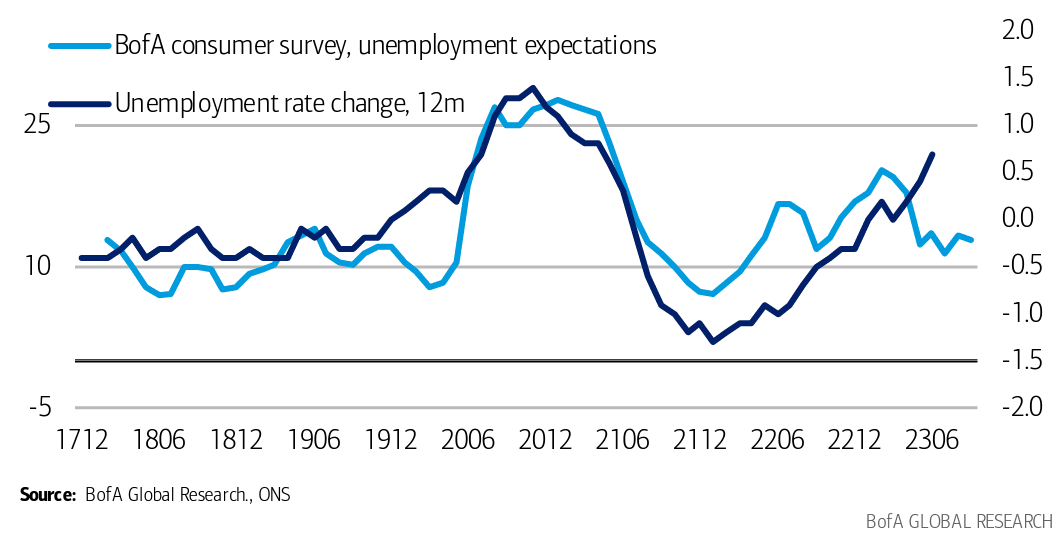

Bank of America's monthly proprietary consumer confidence survey suggests unemployment has been stable, and that "consumers have in the past been good judges of the state of the labour market".

"Indeed, our broader consumer confidence indicator rose slightly this month as views on personal finances improve. Major purchase intentions also rose," says Robert Wood, UK Economist at Bank of America.

The Bank of England on September 21 kept interest rates unchanged, saying unemployment will grow steadily over the coming months and in the process pull wages down, thus tempering inflation.

Above: "Consumer confidence says unemployment not going to keep rising quickly" - BofA. Chart shows Consumer confidence says unemployment not going to keep rising quickly.

The Bank of America survey comes alongside news the ONS has upgraded its UK economic growth readings for 2023 which leaves UK GDP some 1.8% above pre-Covid levels and means the UK is by no means the G7 laggard that had been assumed.

The Lloyds Business Barometer was also released Friday, showing business confidence remains in an uptrend with the UK labour market remaining 'tight' amidst still-elevated hiring intentions and wage settlement expectations.

The Bank of America survey and Business Barometer - when taken alongside the GfK consumer confidence survey for September which reached a 20-month high - create survey evidence that points to ongoing economic growth.

The Bank of America survey shows households' mortgage rate expectations eased, possibly in response to the Bank of England pausing rate hikes.

"Households’ spending plans also improved. We show that planned and actual spending cuts increase substantially when households expect mortgage rates of 5% or higher. The average expected mortgage rate in our sample is 4.3%, down from 4.6% in August, below prevailing rates," says Wood.

A potentially concerning finding for the Bank of England will be that 1-year and 5-year ahead inflation expectations held steady above pre-Covid readings.

However, the proportion of people expecting very high inflation continues to fall, now down to mid-2021 levels.

The percentage of people expecting inflation between 1% and 4% remains below pre-Covid levels at 27%, while 39% of people say they don’t know where inflation will be, a new record high for our survey.