Pound Sterling Dips Against Euro, Dollar and Others as Retail Sales Muddy Economic Waters

- Written by: James Skinner

Image © Adobe Images

Pound Sterling eased from recent highs against the Euro, Dollar and other currencies in the final session of the week after retail sales were reported to have fallen further than expected in July with declines seen across most product categories but partially attributed to rainy and overcast weather during the period.

Retail sales fell by -1.2% last month when measured by the volume or number of items sold and by -1% when measured by value or selling prices with both numbers coming in below economist consensus forecasts for lesser declines while taking the total volume sales some -1.8% back below its pre-pandemic level.

Sales were 16.4% above their pre-pandemic level when measured by selling prices, reflecting the increased cost of energy, staff and other inputs, though it's the volume or number of items sold that is used by the Office for National Statistics when measuring growth in the overall economy.

"Supermarkets reported that some of the fall was because of the poor weather reducing summer clothing sales. However, food sales in supermarkets also fell back," the Office for National Statistics says.

"Shoppers switching to online shopping because of poor weather and increased promotions led to 27.4% of retail sales taking place online in July 2023, up from 26.0% in June 2023; this is the highest proportion since February 2022 (28.0%)," it adds.

Above: Pound to Dollar rate shown at 15-minute intervals alongside Pound to Euro rate.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Rain and overcast conditions were frequent in July but one economist says the accompanying fall in sales would likely have been even larger had it not been for online discounting associated with an Amazon Prime event, and that further declines could be limited in the months ahead.

"A reduction in non-store [online] sales in August likely will counter only some of the rebound in store sales," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "We continue to expect households’ real disposable income to rise briskly and to be about 2.0% higher in Q4 than a year ago."

The economy, some households and retail spending might be helped in October when a scheduled reduction in the Office for Gas and Electricity Markets (OFGEM) price cap is set to ease downward pressure on incomes for those households not locked into fixed-term contracts for energy bills: This fell by almost £500 in July.

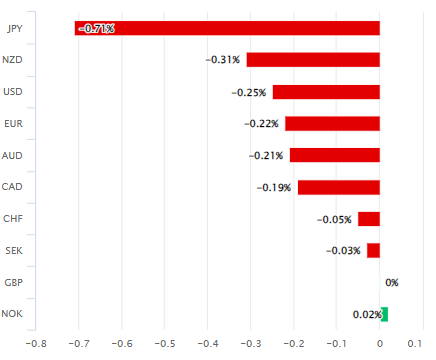

Above: Pound Sterling relative to major currency counterparts on Friday. Source: Office for National Statistics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Spending has also been supported by a near 10% increase in the national minimum wage in April, wage growth in parts of the private sector and public sector pay rises, which have lifted average pay packets by record amounts in recent months: Tuesday's data was a case in point.

"Our economists warn this was primarily the result of a large backward revision to the data for May, as well as the NHS payment bonus," says Rui Ding, a market strategist at Citi FX.

Many analysts and economists reiterated forecasts for further increases in the Bank of England Bank Rate following the employment data and inflation figures out on Wednesday suggesting a substantial moderation last month but one that was slightly less than indicated by the economist consensus suggested.

Above: Pound to Dollar rate shown at daily intervals alongside Pound to Euro rate.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

In addition, the more important core inflation rate - which tends to follow the overall rate - sat unchanged at 6.8% rather than falling to 6.7% but largely due to increases in housing costs associated with interest rates, prices of hotels and prices of air transport.

"Concerns about inflation were compounded on Tuesday by another jump in UK average earnings. Wage growth, excluding bonuses, jumped 7.8% in the three months through to June compared with the same period 12 months ago," says Marc Cogliatti, head of global capital markets EMEA at Validus Risk Management.

However, rising airfares are partly a reflection of increased fuel costs rather than demand while the uplift in prices of hotels has been supported by the taxpayer and government-sponsored accommodation of asylum-seeking migrants and refugees coming from France, which are estimated to cost around £6 million per day in hotel fees.

In addition, Bank Rate has already raised from 0.1% to 5.25% between December 2021 and August 2023, imposing a heavy burden on business and household incomes at a point when average household energy bills remain around £1,500 higher than in April 2020 even with the expected October decline.

"The headline rate of inflation is also likely to tick up in August, reflecting higher fuel and alcohol prices, some unhelpful base effects, and the continued strength of the labour market," warns Julian Jessop, Economics Fellow at the Institute for Economic Affairs.