Pound Bounces Against Dollar and Euro after Hotels and Airfares Slow Inflation Decline

- Written by: James Skinner

Image © Adobe Images

The Pound rose against the Dollar, Euro and most other major currencies in midweek trade after hotel and plane ticket prices were cited for slowing the decline in UK inflation, which fell notably in July as prices of milk, bread and cereals rose at a lesser pace in annual terms.

Inflation matched the economist consensus when falling from 7.9% to 6.8% for July on Wednesday as household energy costs declined and prices of items like milk, bread and cereals rose at a lesser pace than in the prior period.

But the more important core inflation rate, which excludes energy and food prices, was unchanged at 6.9% and in contrast with economist forecasts for a decline to 6.8% due to increases in housing costs associated with rising mortgage interest rates as well as prices of hotels and passenger air transport.

"This is a highly volatile category, which the BoE itself typically removes from the index when it looks at "core services". The bottom line is that the figures don’t carry huge implications for the Bank of England," says James Smith, a developed markets economist at ING, in reference to the passenger air transport.

"It’s worth saying we get another set of both price and wage data before the September meeting, and another round of numbers before November’s meeting," he adds.

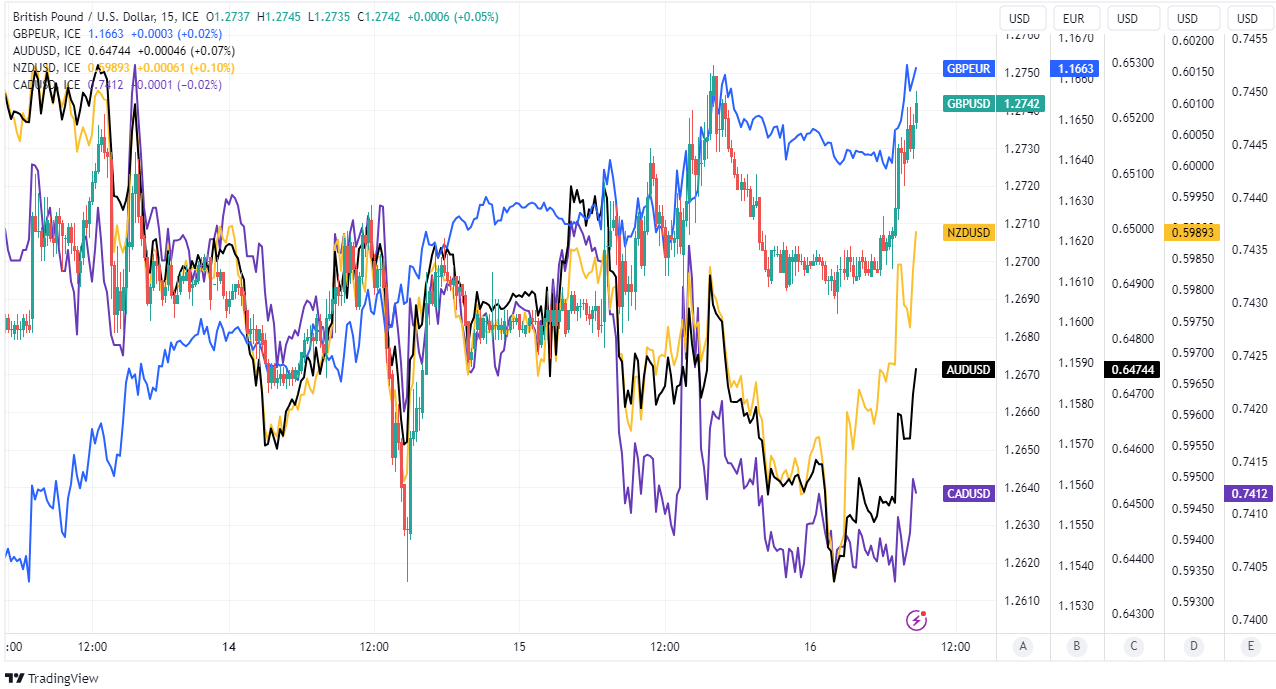

Above: Pound to Dollar rate shown at 15-minute intervals alongside other selected pairs.

Wednesday's data followed the release of other figures out on Tuesday showing average wage growth rising at a new record pace in July, leading analysts and economists to reiterate forecasts for further increases in the Bank of England (BoE) Bank Rate over the coming months.

However, other factors like the rising unemployment rate, falling job vacancies, improving labour force participation and migration-fueled growth in the workforce all suggested a limited lifespan for such rates of pay growth ahead even before the impact of sharply increased interest rates is felt by companies and mortgaged borrowers.

"Inflation in the UK came in a little higher than expected in July, which after strong wage data will keep the Bank of England focused on their next decision on interest rates. They have no room for complacency and would have been hoping, as we all were, for a bigger improvement," says Neil Birrell, chief investment officer at Premier Miton Investors.

"We are not yet at the stage in the UK that we can say that we are winning the battle on inflation, there are too many pressures. It looks like interest rates are on their way up again at the next meeting of the Monetary Policy Committee," Birrell says in response to Wednesday's figures.

The Bank of England Bank Rate has risen from 0.1% to 5.25% between December 2021 and August 2023 in response to rising inflation, making for one of the three most significant monetary tightening cycles ever implemented, though interest rate derivative markets imply a high risk of it rising somewhat further up ahead.

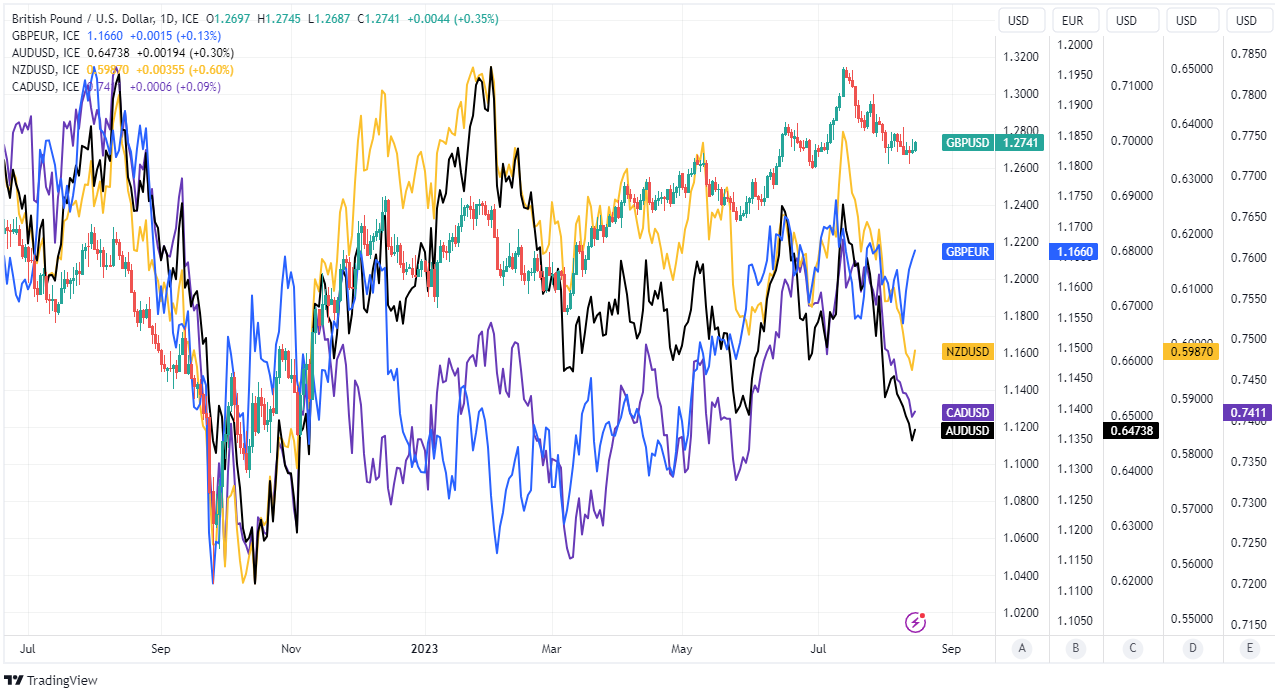

Above: Pound to Dollar rate shown at daily intervals alongside other selected pairs.