PMIs Confirm Inflationary Pressures Alive and Well

- Written by: Gary Howes

Image © Adobe Stock

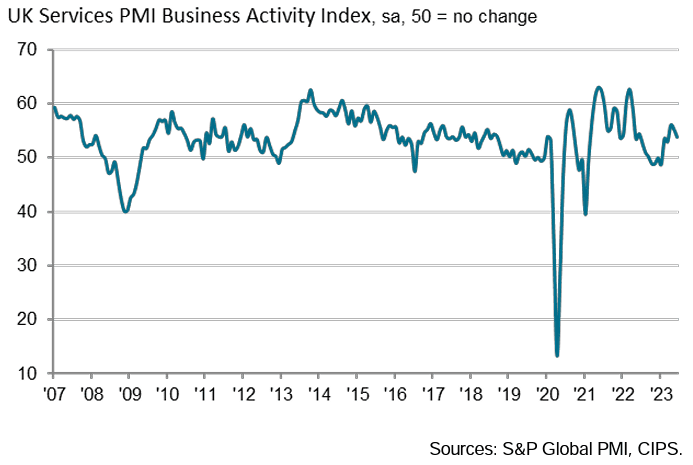

The UK economy continued to slow in June according to a survey that also revealed significant inflationary pressures remain embedded in the economy.

"The latest survey illustrated another solid upturn in the service economy, whereas manufacturers continued to underperform as production volumes declined for the eleventh time in the past twelve months," said S&P Global, adding "steep rate of prices charged inflation persists in the service economy."

The S&P Global reported the economy grew in June as the Composite PMI read at 52.8 (expected: 53.6) as the Services PMI showed growth in the dominant services sector by printing at 53.7 (exp. 54.8).

Manufacturing disappointed again with the Manufacturing PMI reading at 46.2 (exp. 46.8). Manufacturers continued to underperform as production volumes declined for the eleventh time in the past twelve months, said S&P Global.

Inflation trends are perhaps the most important aspect of today's report as they confirmed a sharp slowdown in manufacturing pressures, but further increases in services inflaton.

"Manufacturing companies signalled an outright reduction in factory gate charges for the first time in more than seven years. Service providers meanwhile recorded a further steep rise in their average prices charged, and the rate of inflation was only slightly softer than in May," said S&P Global.

This reflects the sharp downturn in Producer Price Index inflation reported by the ONS this week, a development that suggests pipeline inflationary pressures in the economy are fading.

It also confirms the services sector remains the main driver of inflation and reflects the Bank of England's concern that inflation here could become embedded.

It is this fear that prompted the Bank to hike by a surprisingly large 50 basis points on Thursday.

Indeed, a central banker's worst nightmare would have been confirmed by the PMI report assessing that "there were again widespread reports of higher staff costs, which had been passed on to clients."

"The service sector experienced the opposite effect. Wage demands contributed to another upward spiral in the costs of doing business. Almost 40% of service providers experienced higher business expenses in June as rising salary payments more than offset falling fuel and energy bills," says John Glen, Chief Economist at the CIPS.

Curiously, services sector respondents reported a rise in new orders, albeit at the slowest rate in the current five-month period of growth.

"Service providers reported a solid overall upturn in new orders, despite many noting that cost of living pressures and higher interest rates had curtailed demand," said S&P Global.

This solid demand comes as UK consumer confidence continues to recover, according to GfK, and as the ONS reports a set of better-than-expected retail sales figures for May.