"Substantial Deceleration" in Inflation Beckons as PPI Slides Say Economists

- Written by: Gary Howes

Image © Adobe Images

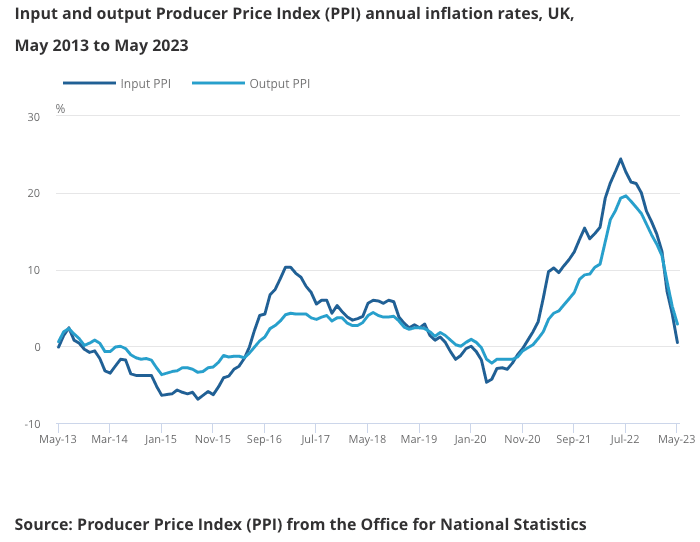

There was some good news contained in the tranche of inflation data released midweek: the price pressure pipeline is weakening as UK manufacturers see falling costs.

This should allow them to pass on ever-smaller price rises and suggests to economists that headline inflation will decline sharply in the coming weeks and months.

The UK Producer Price Index measure of inflation revealed input prices read at -1.5% month-on-month in May said the ONS, presenting a sharper fall than the -0.5% figure the market was anticipating.

This dragged the rise in input prices over the year to May to just 0.5%, a sharp undershoot on the 1.2% expected and a material slowdown on April's 4.2% increase.

PPI inflation shows the changes in the prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased (input prices) and factory gate prices (output prices).

PPI output prices read -0.5% m/m in May said the ONS, undershooting expectations for -0.1% and marking a further retreat on April's downwardly revised -0.2%.

The ONS said the fall in crude oil and petroleum product prices provided the largest downward contributions to the change in the annual rates of input and output inflation, respectively.

"PPI will be proven right, goods deflation is on the way," says Jordan Rochester, strategist at Nomura.

Sandra Horsfield, an economist at Investec, says the good news contained in the PPI data suggests the Bank of England's Monetary Policy Committee might not want to react very aggressively to Wednesday's consensus-beating inflation figures.

"Pipeline pressures in good prices are now easing markedly," she says, "it appears only a matter of time until consumer goods price inflation will head lower too."

Analysis from Pantheon Macroeconomics meanwhile reveals little evidence of profiteering by retailers and, accordingly, food and core goods CPI inflation should fall in order to fully reflect the decline in producer output price inflation over the coming months.

The independent research provider says the headline rate of CPI inflation still looks set to fall sharply over the remainder of this year, probably to about 4.5% by December and to around 2.0% in the second half of 2024.

"PPI data point to a substantial deceleration soon," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics. "Core producer output prices rose at a three-month-on-three-month annualised rate of just 0.8% in May—the lowest since November 2020—pointing to considerable scope for core goods CPI inflation to decline from May’s 6.8% rate."

Regarding the all-important outlook for services sector CPI inflation, Pantheon concedes it likely will take longer to fall back.

"But the latest surveys remain consistent with negligible growth in employment this year, which should result in an increase in labour market slack and a slowing in wage growth," says Tombs.

Pantheon thinks the MPC will not raise Bank Rate all the way to the near-6.00% level priced in by markets, instead, Bank Rate is expected to peak at 5.00%.