Queen's Jubilee to Tip Economy into Decline in 2nd Quarter: Oxford Economics

- Written by: Gary Howes

Image © Adobe Images

The UK economy will contract in the second quarter thanks in large part to the Queen's Platinum Jubilee says Oxford Economics, the independent economics research consultancy.

Economists say the extra Bank Holiday for the Queen's Platinum Jubilee, the rising cost of living and reduced spending on Covid-related health activities will present powerful headwinds to growth in the second quarter.

"Covid testing and vaccinations added just over 1ppt to the level of GDP in February. But with the government ending free Covid testing at the start of April, most of this support to output will disappear during Q2," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The scale of any downturn in growth could impact on how the Bank of England proceeds with raising interest rates, potentially opting to forego hikes beyond May in the event of a sharp slowdown in growth.

This could pose headwinds for the Pound through the mid-year period.

A significant headwind to growth will also come from the rising cost of living owing to the global surge in inflation, largely driven by energy prices.

"The real income squeeze is also intensifying, following the recent surge in petrol prices and the 54% rise in the energy price cap that came into force at the start of this month. So, it was always likely that the pace of growth would be much slower in the current quarter," says Goodwin.

But for Oxford Economics it is the loss of one working day in June that will come about as a result of the Queen's Jubilee that will prove a deciding factor for where growth data lands.

The late-May bank holiday has been moved to June and Goodwin says this could trigger some behavioural changes.

For example, he says, more people may decide to take advantage of the four-day weekend to go on holiday.

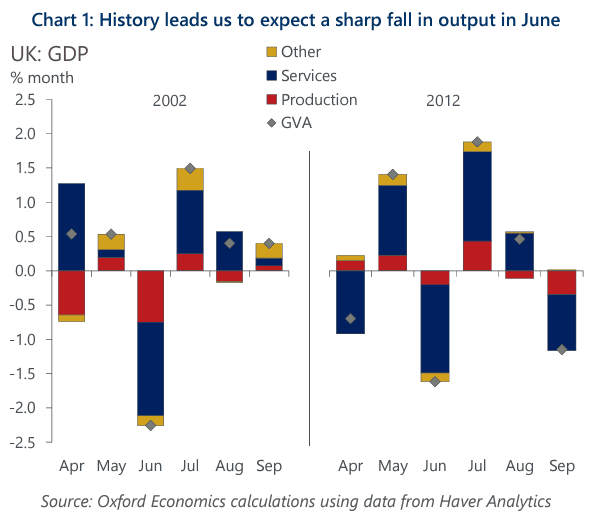

He finds there is some precedent with the jubilee celebrations of 1977, 2002, and 2012 seeing similar changes to the bank holidays.

"Monthly GDP data are only available for the two latter examples, and they show steep drops in output in June," says Goodwin.

The food, accommodation, art and recreation sectors are all tipped to benefit around the time of the jubilee.

"But for most sectors, the impact of the loss of a working day tended to dominate," says Goodwin.

A bounce back in the third quarter is expected, and this should mean the UK avoids entering a technical recession, whereby two consecutive quarters of contraction must be recorded.

Oxford Economics forecast a hit of around 0.3ppts-0.4ppts to growth in Q2.

NHS data meanwhile suggests Covid testing and vaccinations fell by 21% and 38%, respectively, between February and March.

Oxford Economics estimate this will have reduced the scale of Covid-related support to GDP to around 0.8ppts in that month.

And with the government having ended free Covid testing from the start of April, most of the remaining support is likely to drop away during Q2.

Oxford Economics forecast UK GDP will fall by around 0.3% quarter-on-quarter in Q2.