Q2 Economic Slump Tipped to Weigh on the Pound

- Written by: Gary Howes

- Economists warn of Q2 GDP contraction

- And a pause in Bank rate hikes

- Potentially weighing on GBP

- But there are some positives to consider

Image © Adobe Images

The Bank of England will step back from raising interest rates after May as the UK economy looks set to contract in the second quarter, say economists.

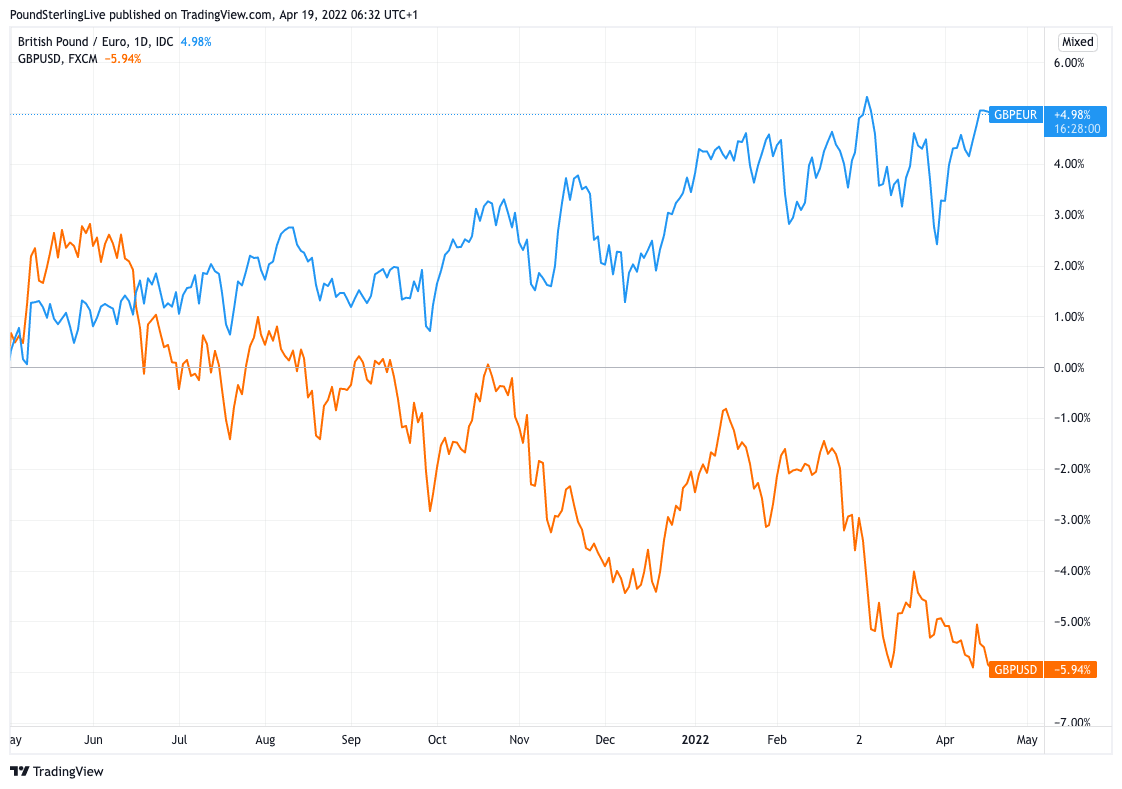

An economic contraction and a renewed sense of caution at the Bank of England could meanwhile weigh on the value of the Pound, which is already under pressure against the Dollar but is buoyant against the Euro.

The UK economy grew just 0.1% in February and headwinds created by rising inflation, global uncertainty linked to the war in Ukraine and lockdowns in China means the economic outlook is particularly challenging.

"We expect GDP at the end of this year to be only 0.5% higher than in February, with an outright decline in Q2," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

A subsequent quarterly decline in the third quarter would mean the UK is back in recession, just two years following the 2020 Covid recession.

Back then the Pound plummeted and reached its lowest valuation against the Euro since the financial crisis of 2008 while against the Dollar it fell to 1.1414.

At the time of writing the Pound to Dollar exchange rate extends a multi-month downtrend to go back below 1.30 again at 1.2990. The Pound to Euro exchange rate however trades above 1.20 and is at 1.2060. (Set your rate alert here).

Above: GBP/EUR (top) and GBP/USD (bottom) performance has diverged since May 2021.

Protecting against downside in Sterling is the Bank of England which is expected by economists to raise interest rates again at the occasion of their May policy meeting, but the economic slowdown leads Pantheon Macroeconomics to expect the Bank to step back from raising rates further.

This would massively disappoint markets that are expecting up to 130 basis points of interest rate hikes to be delivered over the remainder of the year.

For those hoping for a stronger Pound over coming days and weeks any pushback against Bank of England rate hike expectations could prove a disappointment as it would imply a mechanical retracement lower in the UK currency, all else being equal.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Economy is Slowing

"All activity data thus far (including today's print) pre-date the start of the Russia-Ukraine crisis and it remains the case that activity is set to slow sharply from Q2 onwards when households' real disposable incomes take a sharp hit from higher prices and the hike in NI tax rates," says economist Fabrice Montagné at Barclays.

Barclays' central scenario remains that the Bank will hike by another 25bp at the upcoming May meeting, taking the Bank Rate to 1%, before then stopping, "far short of where markets expect".

Economists at ING Bank expect UK second-quarter growth to come in slightly negative in the second quarter, on a combination of falling health spending, the 'cost of living crisis', falling confidence and the presence of an extra bank holiday.

"With the growth backdrop deteriorating, we expect the Bank of England to pause its tightening cycle by the summer following one or two more 25bp rate rises," says James Smith, Developed Markets Economist at ING.

UK GDP grew 1.0% in the three months to February but just 0.1% in February; "the news that the economy was hardly growing at all in February suggests the economy had a little less momentum in Q1 than we had previously thought," says Ruth Gregory, Senior UK Economist at Capital Economics.

"The pace of the recovery was already going to slow once the post-Omicron bounce faded and the squeeze on household real incomes intensified. But we hadn’t expected it to slow so much so soon," she adds.

Capital Economics forecast the economy to grow by 0.2% quarter-on-quarter in the second quarter, but acknowledge risks are "tilted to the downside."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But there are Some Positives

Employment data out on April 12 revealed an economy that continues to add jobs with unemployment falling to 3.8% in February from 3.9% in January.

Importantly, the ONS said the number of job vacancies in January to March 2022 rose to a new record of 1,288,000 which should ensure a robust jobs market, even if the rate of growth in vacancies continues to slow down.

In addition high-frequency data shows the UK economy remained resilient through to the end of March.

Flight departures have recently surged to their highest since the COVID-19 crisis, reflecting a rebound in those sectors that were most impacted by Covid and associated lockdown measures.

The ONS said in its February GDP report services sector growth in February was mainly driven by tourism-related industries with increases in both travel agency, tour operator and other reservation service and related activities.

What Will Happen to the Pound?

While there is a sense of gloom as to the outlook there are, as shown above, some signs of resilience that could mean some positive surprises cannot be ruled out going forward.

The British Pound will likely trade according to where the data goes: an economic slowdown is certain but should the economy avoid a recession by recovering to growth in the third quarter the currency can potentially end the year stronger.

Indeed, this is the working assumption of Elliot Clarke, Senior Economist at Westpac.

"Sterling will also weigh on the US dollar," says Clarke in a recent currency strategy briefing, "with GBP/USD seen at USD1.37 mid-2023 from below USD1.31 at present."

Should the Bank of England meet the market's elevated rate hike expectations then Sterling can remain supported.

Although economists at Capital Economics flag the risk of slowing economic growth they still anticipate the Bank to continue hiking.

"With high inflation feeding through into higher price/wage expectations, we doubt this will prevent the Bank of England from raising interest rates further to 1.00% at its next meeting on 5th May, and to 2.00% next year," says Gregory.

If this is the case downside risks to Sterling are reduced.

Foreign exchange strategists at Crédit Agricole retain a "relatively constructive" view on the British Pound for the rest of 2022, expecting UK consumers to dip into their large stockpile of savings to weather the negative impact of the country's surging inflation levels.

"The GBP remains close to recent lows as investors continue to see the currency as a useful stagflation and risk aversion hedge," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

But Crédit Agricole's FX strategists also see some positives for the economy and its currency that should be in play for 2022.

These include expectations for the UK economy to outperform this year, with the consensus market expectation for UK GDP growth in 2022 being second only to that for the G10 energy exporter bloc of Australia, Canada and Norway.

Marinov says "this comfortably exceeds the growth expectations for the Eurozone, the US and Japan".

He cites the Bank of England in saying UK households can rely on approximately £200BN of excess savings amassed during the pandemic to help provide a cushion against the damaging consequences of the cost of living crisis.

"In addition, the UK has now almost fully reopened its economy and its huge services sector stands to benefit as the number of Covid infections starts falling again into the summer months," says Marinov.