Pound / Dollar Forecast: July Will Mark a Turning Point says Westpac

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate could only make a meaningful rebound around the middle of 2022, according to new analysis.

The Dollar will see its multi-year trend of appreciation come to an end and begin to retreat from July according to Westpac, the Australia headquartered multi-national bank and financial services provider.

In a new research note Westpac Senior Economist Elliot Clarke says the Dollar is already showing signs of flagging as rallies become less potent.

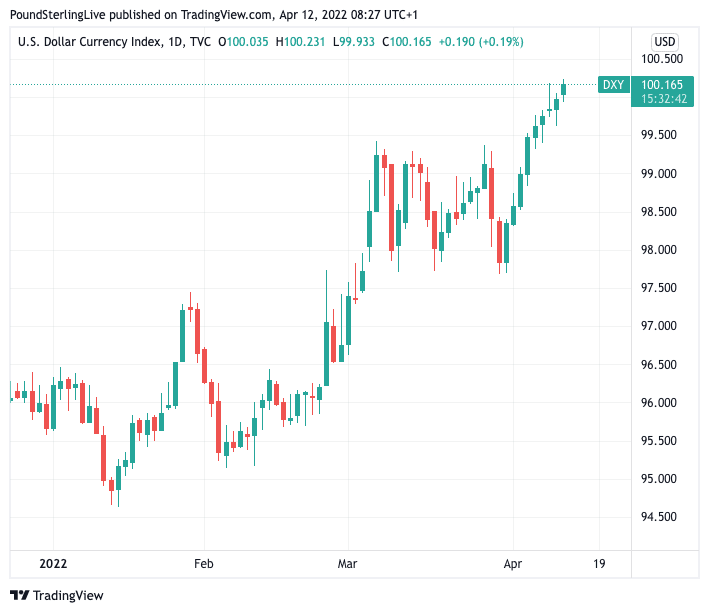

He has looked at the Dollar index - an overall measure of Dollar strength based on a basket of Dollar exchange rates - and finds "arguably of greater significance than the outright level of the US dollar is the difficulty it has experienced in achieving it."

"As has been the case through 2022, for the vast majority of the past month, the DXY index has largely marked time between 98 and 99.5, having failed at each previous attempt to get near let alone break through 100," says Clarke.

Above: The Dollar index is making another push higher.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Drivers of the Dollar's ongoing strength include the superior yields offered on U.S. bonds, courtesy of the Federal Reserve's race to hike interest rates.

The Fed is anticipated to raise rates by 50 basis points at its next two meetings, thereafter incremental rises of 25 basis points are expected.

But investor fears related to the war in Ukraine is also driving demand for the highly liquid Dollar which tends to benefit when demand for cash increases.

But with a frantic pace of rate hikes due to come out of the Fed and amidst surging inflation "risks for US growth are likewise becoming aggressively skewed to the downside," says Clarke.

The Westpac economists sees downside growth pressures building on an unwinding of fiscal support and a material decline in real wages, as well as the rapid tightening of monetary policy.

"These realities are behind our expectation that the US dollar is close to a peak, with a downtrend likely to set in from July once the FOMC has delivered a further 100bps of federal funds rate increases and quantitative tightening commences," says Clarke.

At this point the British Pound could find itself in a better position to appreciate.

"Sterling will also weigh on the US dollar over the period, with GBP/USD seen at USD1.37 mid2023 from below USD1.31 at present," says Clarke.

The Pound-Dollar exchange rate has fallen from a peak of 1.4250 in May 2021 to current levels near 1.30, with an imminent break below 1.30 now looking possible.