Strong Jobs Report Offers Pound Sterling Support

- Written by: Gary Howes

Image © Adobe Stock

UK unemployment fell to 3.8% in February from 3.9% in January while wages increased, data that should keep alive expectations for further Bank of England interest rate rises and offer the British Pound support near-term.

UK average weekly earnings grew 5.4% in February says the ONS, meeting investors' expectations, but increasing on January's 4.8%.

The data is consistent with ongoing economic momentum - albeit slowing - and persistent wage inflation, which should prompt the Bank of England to raise interest rates again by 25 basis points next month.

Foreign exchange strategist Elias Haddad at CBA says Sterling downside "will be contained this week" because the UK February employment and March CPI "prints will reinforce the case for further Bank of England policy tightening".

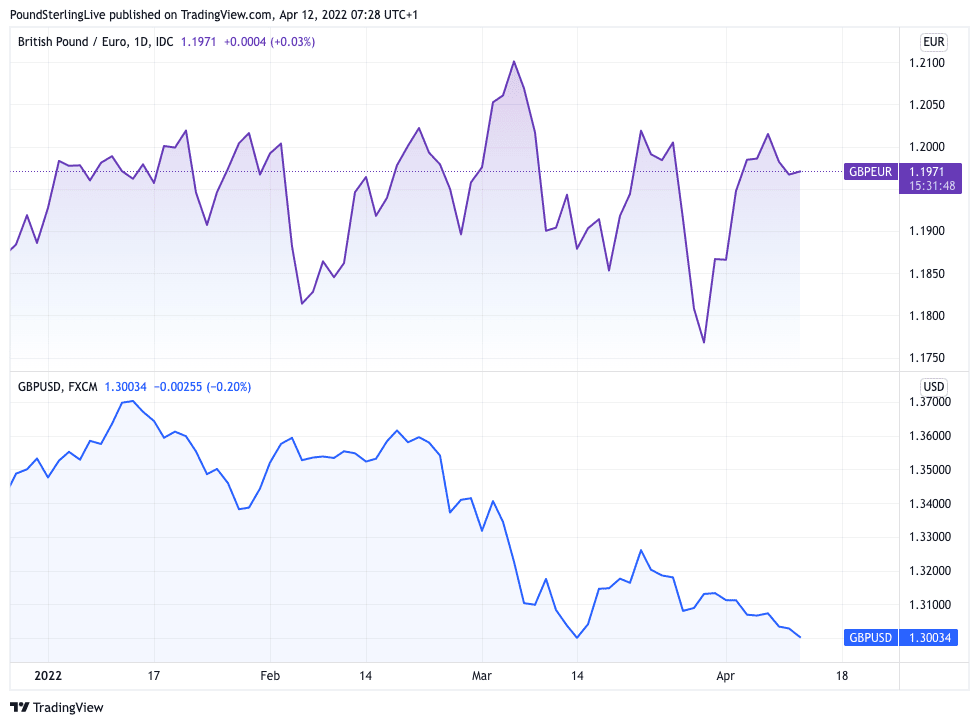

The Pound to Dollar exchange rate remains supported above 1.30 in the wake of the data, although "a more solid backdrop to activity and wages is needed to offset the yield curve pressure and suggest that GBP/USD can hold its now vulnerable 1.30-1.33 range support," says strategist Tim Riddell at Westpac in London.

The big event of the day for Pound-Dollar today will however be the release of U.S. inflation data, due for release at 13:30 BST.

The Pound to Euro exchange rate meanwhile trades near recent levels at 1.1977. (You can set your rate alert here).

Above: GBP/EUR (top) and GBP/USD (bottom).

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Digging deeper into the data shows employment increased by 10K in the three months to February (which is below the consensus forecast for 53K) up from -13K in January.

However, in the month of February employment fell by 89K.

Wage and employment data come amidst a backdrop of falling UK economic momentum amidst surging inflation, something economists say could provide headwinds to Sterling exchange rate upside over the medium-term.

"Confidence data have fallen sharply, and credit growth has risen again, which may suggest less of a savings buffer for consumers to fall back on to continue spending. This may mean

increasing downside risks for growth alongside higher inflation, which is not a bullish combination for GBP," says Paul Mackel, Global Head of FX Research at HSBC.

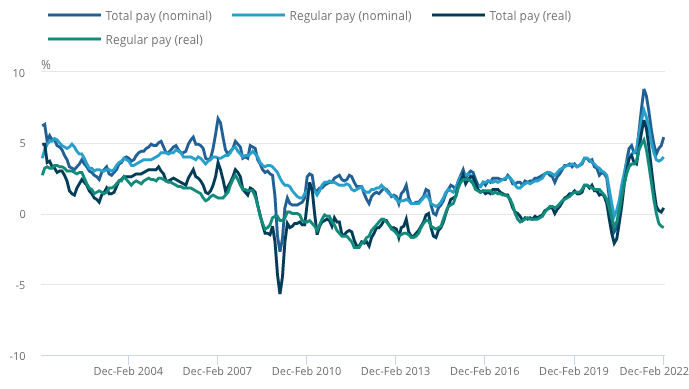

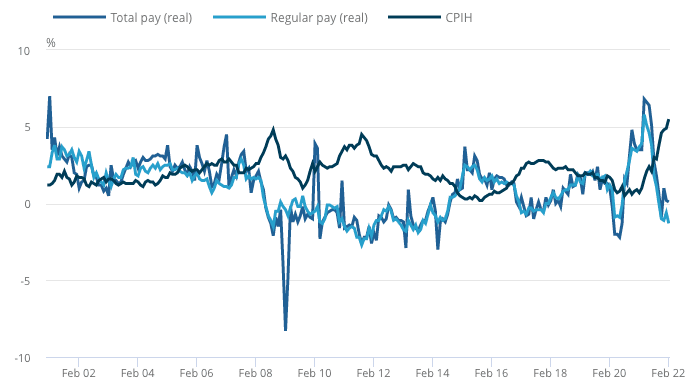

Rising inflation means that in real terms, growth in total pay was 0.4% (this includes bonuses; the ONS says strong bonus payments over the past six months have kept recent real total pay growth positive), but regular pay fell on the year at negative 1.0%.

Above: Real vs. Nominal pay. Source: ONS.

Above: Real pay falls as inflation rises: ONS.

Economist Fabrice Montagné at Barclays says the expected trajectory of UK economic data means the Bank of England will hike by another 25bp at its next meeting in May but could hold at subsequent meetings.

"We retain our view that the hiking cycle will end there, although as we have previously flagged, we see risks of another hike by the summer, designed to address the potential for high inflation expectations becoming entrenched. By and large, however, we continue to see little ground to hike rates as much as expected by the market (ie, 2% by end of 2022)," says Montagné.

Pound exchange rates are priced on a view the Bank of England will deliver a Bank Rate of around 2.0% by year-end, therefore any disappointment that sees rate expectations come down would be consistent with a lower Pound.

Interest rate hike expectations would begin to adjust lower - and pressure the Pound - should data releases disappoint going forward.

"We see the risk of the market having to lower its rate hike expectations, which is likely to put pressure on Sterling," says You-Na Park-Heger, FX and EM Analyst at Commerzbank.

"There are increasing concerns in Great Britain that the British economy is facing a recession. And for that reason, the BoE has sounded more hesitant about monetary policy tightening recently," says Park-Heger.

But the ONS also said the number of job vacancies in January to March 2022 rose to a new record of 1,288,000 which should ensure a robust jobs market, even if the rate of growth in vacancies continues to slow down.

"Labour demand, however, likely will grow at a slower rate soon, in response to this month’s increase in employers’ national insurance contributions and the squeeze on the amount of money that households have left to spend on domestically-produced goods and services from higher energy prices," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

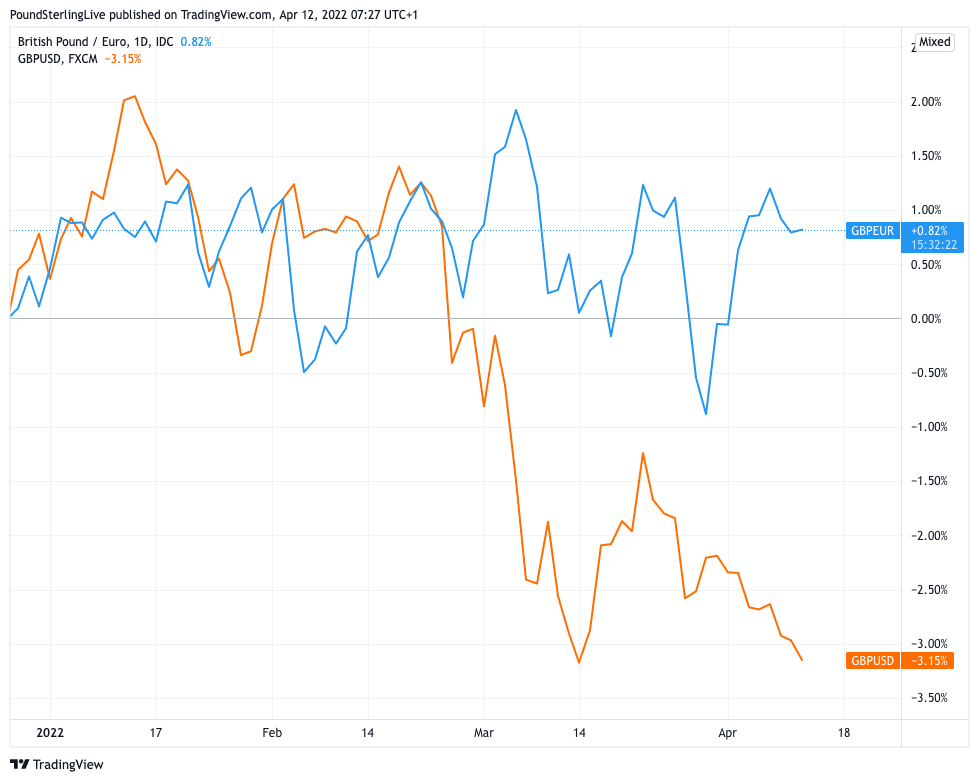

Above: Change in GBP value against EUR (top) and USD (bottom) in 2022.

Regarding the outlook for pay, Pantheon Macroeconomics do not expect pay growth to surge in response to the jump in CPI inflation this year.

"For a start, the year-over-year growth rate of the timelier PAYE measure of median pay only edged up to 5.9% in March, from 5.8% in February," notes Dickens. "In addition, the median pay settlement held steady at 3% in February, well below the expectations of firms surveyed by the Bank of England’s agents in January."

The Pound-Euro exchange rate was under pressure heading into the release of employment numbers as markets welcomed French President Emmanuel Macron's topping of the first round of the presidential election.

"The euro is catching a breather after France’s first round election over the weekend showed the incumbent president, Emmanuel Macron, edged his far-right opponent, Marine Le Pen, easing euro-negative political uncertainty," says Joe Manimbo, Senior FX Analyst at Western Union.

But Euro upside will likely be contained by ongoing concerns Marine Le Pen could yet win the second round of the vote in two weeks time.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Indeed, one poll by the Ifop institute for TF1, the French television channel, finding Macron was on course to win the second round by 51% to 49%.

Analysis from Goldman Sachs finds France's election remains critical, "even without ‘Frexit’ risks".

In a weekly foreign exchange briefing analyst Zach Pandl at Goldman Sachs in New York says:

"We have previously argued that the stakes for this year’s election should be markedly lower for FX markets than in 2017, when ‘Frexit’ was front-and-centre, but the recent shift in the geopolitical backdrop changes that somewhat."

Goldman Sachs says the war in Ukraine and European energy crisis have put the focus squarely on the prospect for further European fiscal easing and possible institutional integration, which forms a key tenet of their bullish Euro view.

"We think a change in the French presidency would lower the market’s expectations for further integration and a possible coordinated fiscal response to the energy crisis, which could more than unwind the overvaluation in peripheral spreads, and in turn weaken the Euro," says Pandl.

As such, Goldman Sachs forecast a 2.0% depreciation in the Euro as a result of a Le Pen win.

"It would be a knock against our bullish Euro outlook," says Pandl.