Euro Relief on Macron Win, But Gains to be Limited as France Set for a Tight Run-off

- Written by: Gary Howes

- Macron leads first round of votes

- EUR higher in relief

- But tight second round looms

- No danger of 'Frexit'

- But vote still matters says Goldman Sachs

Above: Emmanuel Macron. GUE/NGL, accessed Flickr, reproduced under CC Licensing.

The Euro was trading higher against the Pound at the start of the new week in an apparent sigh of relief that incumbent Emmanuel Macron appears to have won the first round of voting in the French presidential election, although a close run-off with his rival Marine Le Pen is promised in two weeks which should limit the Euro's upside potential.

We wrote ahead of the first round of voting that the Euro were to benefit on Monday if Macron secured a strong win in the first round.

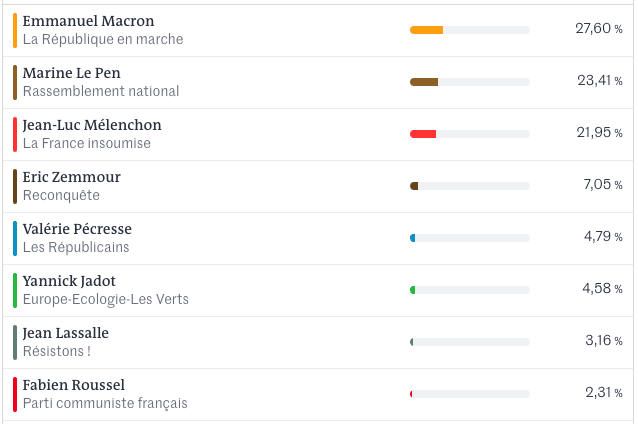

At the time of writing Macron had secured 27.8% of the first round vote, against Le Pen's 23.9%. The Euro opened the week stronger against most major peers.

"The euro is catching a breather after France’s first round election over the weekend showed the incumbent president, Emmanuel Macron, edged his far-right opponent, Marine Le Pen, easing euro-negative political uncertainty," says Joe Manimbo, Senior FX Analyst at Western Union.

But media report the French presidential election is "wide open" with a poll by the Ifop institute for TF1, the French television channel, finding Macron was on course to win the second round by 51% to 49%.

The gap is within the margin of error, meaning the final round of voting in two weeks time looks to be a dead heat.

Image courtesy of Le Monde.

"The outcome of the first round of the French Presidential elections may have seen Emmanuel Macron emerge in front, but sighs of relief could be short lived and investors are set to stay highly wary about the outcome," says Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Where the votes of Jean-Luc Mélenchon (currently 21% in the first round), Éric Zemmour (7%) and Valérie Pécresse (5%) fall in the second round will determine who the ultimate victor is.

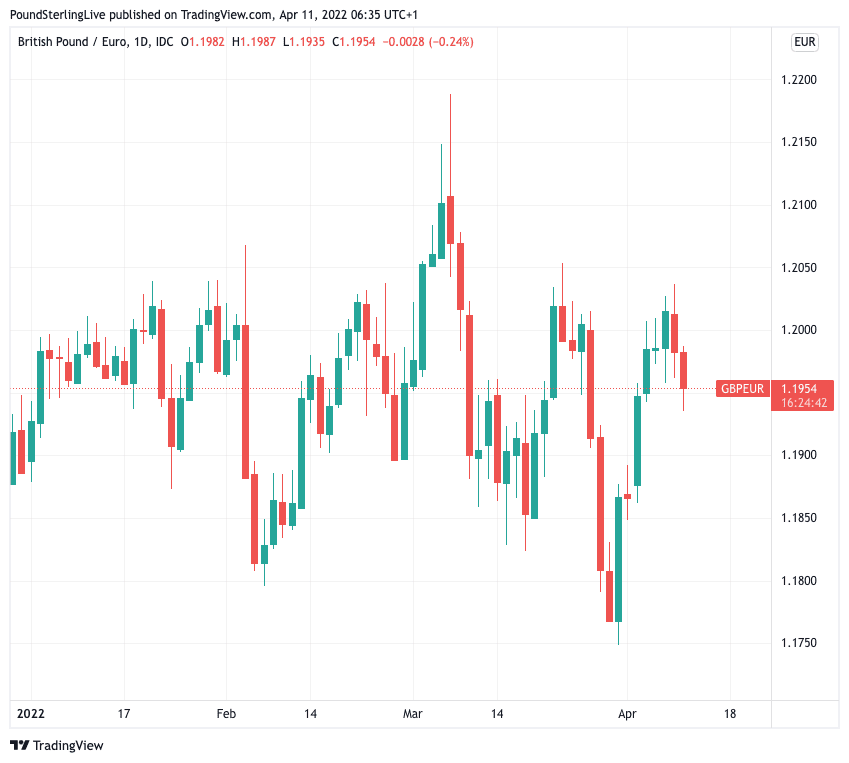

The Euro-Dollar exchange rate opened half a percent higher at 1.0919 on Monday before retracing the move back to 1.0818, the Euro-Pound exchange rate opened at 0.8343 and is at 1.8363 at the time of writing. The Pound to Euro exchange rate is at 1.1957, having been back above 1.20 on Friday. (Set your rate alert, here).

Above: GBP/EUR at daily intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Euro had been carrying some anxiety heading into the weekend, underperforming major rivals with analysts saying the tightening in polls and proximity of the Sunday vote could have been a factor in the Euro's underperformance.

"FX markets had possibly remained too complacent with regards to the French political risks," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, when observing the Euro's lacklustre performance of recent days.

"The economic malaise wrought by the war in Ukraine, political uncertainty in France, the bloc’s No. 2 economy, and expectations for the Fed to raise rates more aggressively than the ECB over the coming year have been the driving forces behind the euro’s retreat," says Manimbo.

The Euro's upside potential will almost certainly be crimped over coming days as investors opt to retain an air of caution towards the outcome of the second round of voting.

"By softening her hard line image Marine Le Pen of the far right Front National has victory within her grasp, and in the run off in less than two weeks, her promises of slashing fuel duty and scrapping income tax for the under 30s will prove alluring for millions of voters facing the intense cost of living squeeze," says Streeter.

However, a Le Pen win would not be the shock to the Euro that it would have been in previous years, given she is no longer seeking to take France out of the European Union.

"It has to be noted though that the stakes do not seem as high as five years ago, as importantly none of these candidates have campaigned on the threat to leave the Eurozone. Therefore, any eventual jitters should remain relatively contained," says Marinov.

Therefore any election-related anxiety tying Euro exchange rates down might prove short-lived and broader issues such as European Central Bank policy and the war in Ukraine will remain the key drivers.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Nevertheless analysts are of the view that a Le Pen win is still not without risk for the Euro.

"A vote for Le Pen risks isolating France from the beating heart of the European bloc, with her promises to cut EU budget contributions and renegotiate treaties," says Streeter.

Analysis from Goldman Sachs finds France's election remains critical, "even without ‘Frexit’ risks".

In a weekly foreign exchange briefing analyst Zach Pandl at Goldman Sachs in New York says:

"We have previously argued that the stakes for this year’s election should be markedly lower for FX markets than in 2017, when ‘Frexit’ was front-and-centre, but the recent shift in the geopolitical backdrop changes that somewhat."

Goldman Sachs says the war in Ukraine and European energy crisis have put the focus squarely on the prospect for further European fiscal easing and possible institutional integration, which forms a key tenet of their bullish Euro view.

"We think a change in the French presidency would lower the market’s expectations for further integration and a possible coordinated fiscal response to the energy crisis, which could more than unwind the overvaluation in peripheral spreads, and in turn weaken the Euro," says Pandl.

As such, Goldman Sachs forecast a 2.0% depreciation in the Euro as a result of a Le Pen win.

"It would be a knock against our bullish Euro outlook," says Pandl.