Bank of England's Base Interest Rate Tipped for 1.50% by Jan. 2023

- Written by: Gary Howes

Image source: Bank of England. Credit Laura Bell.

A leading economist says the Bank of England is underestimating the extent to which wages will grow in the future and that the basic lending rate will sit close to 1.50% by the time 2023 gets underway.

Such findings would underpin the market's expectation for up to five more hikes to be delivered by the Bank over coming months, which is in turn proving a source of sustained support for the Pound.

"More rate hikes incoming," says Mikael Olai Milhøj, Chief Analyst at Danske Bank, "we continue to believe that risk is skewed towards more rate hikes."

The call follows the Bank's decision to hike interest rates 25 basis points on February 03 in response to the UK's surging inflation rate.

Danske Bank says there is now the potential for UK wages to surprise to the upside and this could keep inflation levels elevated for longer than the Bank anticipates.

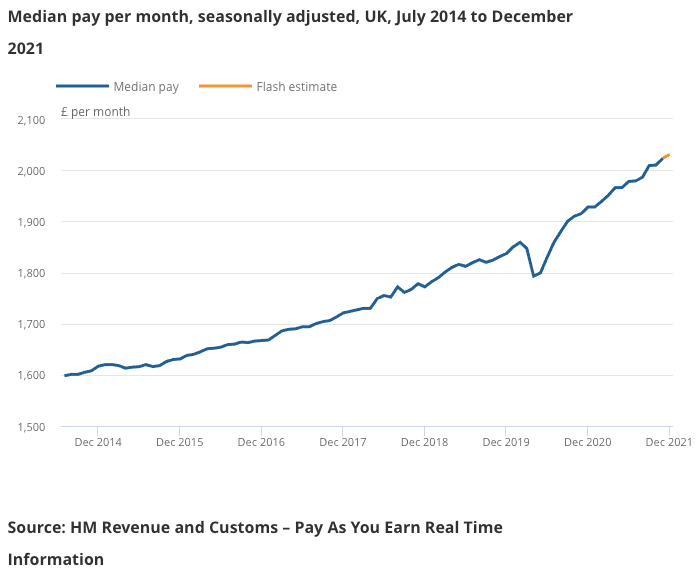

Wages are one of the most important sources of domestically generated inflation and UK weekly earnings remained elevated by historical standards, even if they are coming off post-pandemic rebound highs.

Weekly earnings, with bonuses included, read at 4.2% in November according to the ONS; in October earnings stood at 4.9%.

"We believe the BoE’s wage growth projection is to the low side," says Milhøj.

Above: "Median pay decreased sharply in April 2020, but has returned to the previous trend" - ONS.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

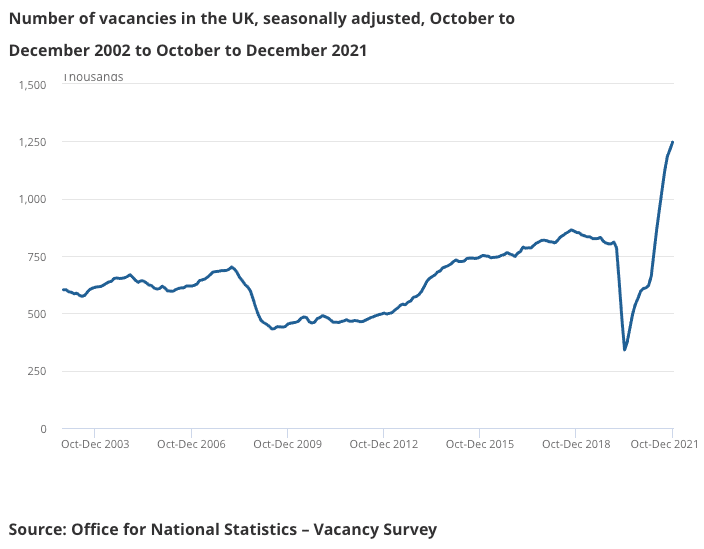

The labour market will likely remain robust as the number of job vacancies in October to December 2021 rose to a new record of 1,247,000, an increase of 462K from its pre-coronavirus January to March 2020 level, with most industries displaying record numbers of vacancies.

Danske Bank now expects the Bank of England to deliver four additional 25bp rate hikes this year (March, May, August and November) versus two additional hikes previously.

This implies Bank Rate starts 2022 at 1.50%.

Their new call remains slightly less aggressive than markets pricing, where five rate hikes are priced in.

But, "we continue to believe that risk is skewed towards more rate hikes (and also a probability of a 50bp rate hike). BoE is now likely to announce some details on 'active QT' in connection with the May meeting," says Milhøj.

Above: "Vacancies rose to a record 1,247,000 in October to December 2021" - ONS.

The Bank of England triggered a sharp rally in UK bond yields and the value of the Pound after revealing the Monetary Policy Committee (MPC) was just one vote away from a 50 basis point hike in February, which boosted expectations for future rate hikes.

But the Pound and rate hike expectations eased again after Bank of England Governor Andrew Bailey cautioned in a press conference it would be a mistake to assume rates are on an inevitable long march up.

The MPC also reiterated "some modest tightening" is needed in their guidance.

The Bank therefore looks keen to keep expectations in check lest they push the cost of financing in the economy too high, too fast.

Key to the outlook is the extent to which they can keep the current rate hiking cycle short-lived, or whether they have to hike for longer.

Economists at Credit Suisse say they see a relatively long hiking cycle that could take Bank Rate as high as 2.0%.

Such a prediction would validate existing 'hawkish' market expectations and potentially underpin the Pound going forward.

"Our view is that despite the fall in inflation in H2 2022, further monetary tightening is warranted," says Sonali Punhani, Chief UK Economist at Credit Suisse. "We think the drop in inflation is likely to slow the hiking cycle, but not stop it".

This is because Credit Suisse share Danske Bank's finding that the UK labour market is tight and therefore won't allow the Bank to step back; they expect the labour market to continue to tighten on the back of strong labour demand and squeezed labour supply.

"Strong wage pressures should keep underlying inflationary pressures intact, even as pressures from energy and goods prices subside," says Punhani. "There is a risk wage growth broadens out as inflation ramps up pay demands in the midst of a tight labour market."