Eurozone's Inflation Data Hints at Lingering Challenges for ECB

- Written by: James Skinner

Image © Adobe Images

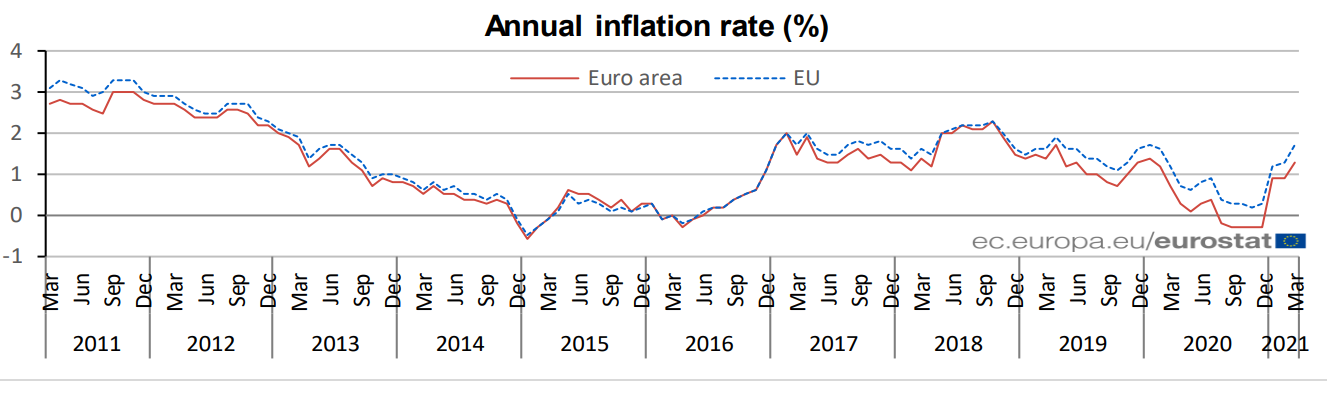

Eurozone inflation rebounded further out of its 2020 trough in March, data from Eurostat confirmed on Friday.

The increase was however tepid and left a yawning gap between price pressures across the bloc and those seen recently in the U.S., which could keep the European Central Bank (ECB) in policy easing mode for a while yet.

Europe’s main consumer price index rose at an annualised pace of 1.3% last month, a final Eurostat reading of the barometer confirmed this week, while the more important core inflation rate advanced by 0.9%.

Both numbers were in line with expectations for Friday’s figures, though initially came as a mild disappointment to economists when released at the end of March.

"The lowest annual rates were registered in Greece (-2.0%), Portugal, Malta, Ireland and Slovenia (all 0.1%). The highest annual rates were recorded in Poland (4.4%), Hungary (3.9%), Romania and Luxembourg (both 2.5%). Compared with February, annual inflation fell in three Member States, remained stable in three and rose in twenty one," Eurostat says.

Almost all countries’ saw most measures of economic activity decline markedly in 2020 as the coronavirus and resulting containment measures took hold of the global economy, and all are expected to be erratic over the coming months as statistical “base effects” generate large rises and falls.

These are widely tipped by economists to obscure underlying trends in comparative economic performances for a while yet although in terms of inflation at least, March figures offered prospective evidence of a tentatively yawning gap between price growth in the Eurozone and those seen in the U.S., which may trouble the ECB.

Image © Eurostat

“We need to wait until stores are fully open to pass judgement on retailers' price-setting behaviour, especially as it relates to the—hopefully—post-pandemic economy later this year. The problem is that goods inflation will go haywire to the upside in the second half of the year, due to base effects from the temporary VAT cut in the second half of 2020, so separating the signal from the noise will remain difficult,” says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

U.S. inflation rose to 2.6% in March while the more important core measure of price growth, which is often taken as a better reflection of true inflation because it ignores energy prices that are influenced by commodities as well as changes in regulated price items like alcohol, rose to 1.6%.

On both counts U.S. price growth was almost twice that seen in the Eurozone last month and although forthcoming data could yet change perceptions, the latest figures offer tentative evidence that old economic ailments are returning and potentially with vengeance.

The world’s largest economy has been pumped full of unprecedented stimulus including the handout of what isn’t far off of ‘helicopter money’ from government and although this is expected to eventually benefit the global economy including the net-exporting Eurozone on the whole, it won’t necessarily do much for some troubled Mediterranean economies and any benefit that does materialise may not be seen until after the gap between European and U.S. inflation has widened further.

Image © Pantheon Macroeconomics

This is even more likely in the event of a renewed 2021 appreciation in Europe’s trade-weighted exchange rate, which makes imported goods cheaper for Europeans to buy and can at the margins eat away at the little inflation generated by the bloc’s economy.

It was exactly these concerns that motivated ECB President Christine Lagarde and other policymakers at the Bank to protest last year’s Euro-Dollar rally from September and most notably, in January 2021, which ultimately gave way to a months long correction lower by the single currency.

"We expect the Governing Council to stress that the inflation outlook remains well below its aim despite the recent increase in the inflation numbers. We believe the subdued inflation outlook will be a key theme in the strategy review, which we expect to conclude with a symmetric 2% aim and a “soft” form of average inflation targeting, in which the ECB places more weight on persistent inflation misses in its forward guidance," says Sven Jari Stehn, chief European economist at Goldman Sachs, referring to the April 22 ECB monetary policy decision.

As a result, it’s likely that while European currencies benefit from a renewed Dollar downtrend now underway, while analysts contemplate the ideal timing of a domestically driven Euro exchange rate recovery, the ECB will likely be contemplating the risks to its inflation target and watching the single currency closely.

The bank’s next policy decision is due out on Thursday, 22 April.

The Bank said in March that it would carry out government bond purchases under its €1.85 trillion Pandemic Emergency Purchase Programme (PEPP) at a “significantly higher pace during the second quarter, a programme that has a limited shelf life but which supplements the earlier and ongoing Asset Purchase Programme which buys 20bn per month of European government bonds.

In addition rates charged or paid on main refinancing operations, the marginal lending facility and bank's deposit facility have been left unchanged at 0.00%, 0.25% and -0.50% respectively.