Unemployment Hasn't Risen as Fast as Economists Expected, but a Dark Winter Looms

- Unemployment data better than consensus estimates

- But redundancies hit record high

- Economists gloomy about outlook

Image © Adobe Images

The UK economy is shedding jobs, but not as fast as economists had been expecting.

The Office for National Statistics on Tuesday announced that 144K jobs had been lost during the three months to October, which is less than were lost in the three months to September (-164K) and far less than the consensus expectation amongst economists (-250K).

The unemployment rate stood at 4.9%, which is higher than the 4.8% reported in September but lower than the 5.1% expected by economists.

The numbers seeking out of work benefits did however rise faster than expected with November seeing 64.3K people apply, against the previous month's reduction of 29.8k. Economists had expected a figure of 50K to apply.

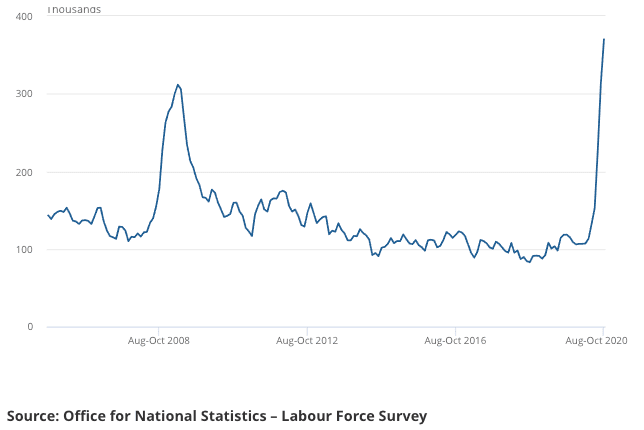

The number of people reporting redundancy in the three months prior to interview increased by a record 217K on the quarter to reach a record high of 370,000:

Above: UK redundancies, people aged 16 years and over (not seasonally adjusted), between August to October 2005 and August to October 2020.

"These figures reflect the tightening of COVID restrictions in October, with the introduction of the tier local lockdown system. This meant that certain sectors were shut down, like hospitality and non-essential retail, resulting in businesses adjusting to lower levels of demand," says Hannah Audino, economist at PwC.

Audino says there are however some tentative positive signs in the latest data.

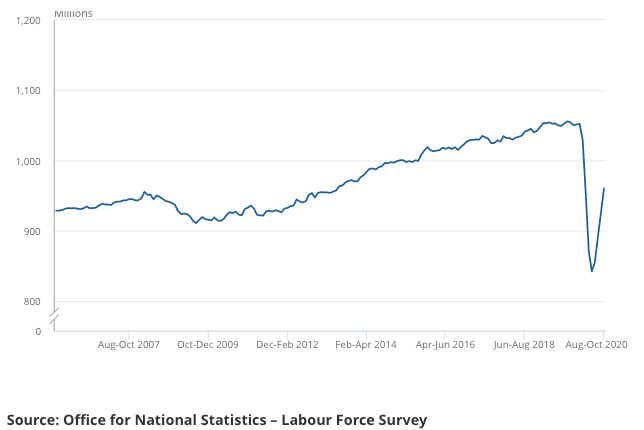

"Despite the tightening of restrictions in October, total hours worked continue to recover, increasing 12% on the quarter. Vacancies also continue to increase. For the three months to November, there were 547,000 vacancies, representing a quarterly increase of 110,000. Levels do remain 32% below what we were seeing pre-pandemic, and this is most acute for larger businesses, for which vacancies are almost 40% below pre-COVID levels," says Audino.

Above: UK total actual weekly hours worked (people aged 16 years and over), seasonally adjusted, between August to October 2005 and August to October 2020.

"The outlook for the labour market will depend on the impact of the second national lockdown in England in November, compared to the positive impact of the re-introduction of the more generous furlough scheme. The certainty of support for furloughed employees until the end of March, combined with the rollout of a vaccine in the UK, may provide businesses with the optimism and confidence to keep employees on the payroll, despite tighter lockdown restrictions causing another shock to demand."

Earnings data meanwhile came in stronger than expected with average earnings, without bonuses included, rising 2.8% in October, up from 1.9K in the month prior. The market consensus was for an increase of 2.8%. With bonuses included, earnings rose 2.7% in October, higher than the previous month's 1.3% and ahead of expectations at 2.2%.

But, the positive data on pay could be flattering. The ONS says while annual growth in employee pay continued to strengthen - as more employees returned to work from furlough - the estimated growth in average pay is also impacted by compositional effects of a fall in the number and proportion of lower-paid employee jobs.

Data from the ONS meanwhile shows vacancies have continued to recover in the latest period but are still below the levels seen before the impact of the coronavirus pandemic.

Despite data beating expectations, the UK is facing a significant increase in unemployment, which will likely continue to grow given the government's decision to move London and much of the South East into a Tier 3 lockdown.

Concerning the outlook, Matthew Percival, CBI Director of People and Skills, said a tough winter awaits:

"Another bleak set of figures this month, with a steep rise in unemployment and more redundancies showing households were still being hit hard, even ahead of England’s second national lockdown.

“While news of a vaccine has provided hope, many firms are still finding it difficult to operate within the toughest Covid restrictions. With millions more expected to be living under the toughest tier before the end of the week, the Government must continue to do what it can to help businesses get through winter."

Economists at ING are warning that a late surge in unemployment will befall the country by year-end.

James Smith, Developed Markets Economist at ING says the unemployment figure will rise from October's 4.9% to 6% by year-end, despite the unprecedented government wage support which probably meant over four million people were furloughed during the November lockdowns.

"We think that unemployment will have risen further in the final months of 2020, and could reach 6% by the end of the year. There is a risk of a more pronounced rise in 2021 depending on how/when the current level of wage support is removed - and whether those sectors that have remained fully closed since March (eg nightlife, events etc) are able to reopen at that point," says Smith.