GBP/CHF a Buy says Danske

- Written by: Gary Howes

Image © Adobe Images

The Pound's recovery against the Swiss Franc can extend, according to a new strategy update from Danske Bank.

Analysts at the Scandinavian lender and investment bank see potential for a move higher in GBP as the UK economy continues to outperform, denying the Bank of England the ability to cut interest rates as fast as markets currently expect.

"We find cut expectations for the BoE as too aggressive, and we expect improving risk sentiment to support GBP in the near-term," says Jens Nærvig Pedersen, Director of FX and Rates Strategy at Danske Bank.

The risk-sensitive Pound fell to seven-month lows against the safe-haven Franc earlier in August, exacerbated by deteriorating investor sentiment linked to fears the Federal Reserve had left rate cuts too late and that the world's largest economy would suffer a downturn as a result.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"As concerns about the global economy peaked in late July/early August, sterling came under significant pressure, giving up much of its gains for the year," says Michael Pfister, FX Analyst at Commerzbank.r.

Losses were exacerbated by a Bank of England interest rate cut that prompted investors to book profits on the 2024 rally, prompting a washout of elevated 'long' positions.

The Pound to Franc exchange rate (GBP/CHF) has since recovered the majority of its August losses amidst improved global investor sentiment, which has conversely weighed on Switzerland's currency, which tends to underperform when investors are in investment-making mode.

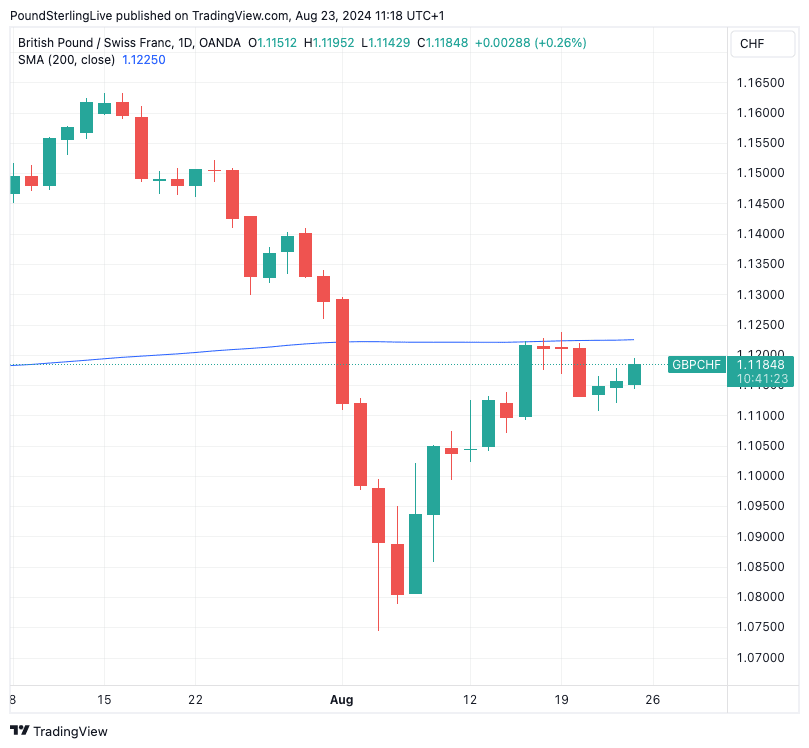

Above: Short-term, GBP/CHF is blocked by the 200-day moving average.

Danske Bank thinks the divergence in central bank policy between the Swiss National Bank (SNB) and the Bank of England (BoE) will accentuate the potential GBP/CHF upside. "We like to play GBP vis-à-vis CHF amid the SNB's frontloaded easing bias and as SNB FX intervention offers a limit to the topside in CHF," says Pedersen.

Danske Bank thinks the divergence in central bank policy between the Swiss National Bank (SNB) and the Bank of England (BoE) will accentuate the potential GBP/CHF upside. "We like to play GBP vis-à-vis CHF amid the SNB's frontloaded easing bias and as SNB FX intervention offers a limit to the topside in CHF," says Pedersen.

Danske looks to buy GBP/CHF spot over a one- to three-month horizon, targeting a potential move to 1.1750.

"We believe the cross has more room to go on the back of UK economic performance, central bank divergence and improving risk sentiment in the near term," says Pedersen.

This week, the Pound's recovery has accelerated after buyers responded to a strong August PMI survey, which confirms the UK economy remains firmly in growth mode. Furthermore, forward-looking components of the report confirm sentiment is improving.

The robust outlook offers little incentive to the Bank of England to cut interest rates again as soon as the September meeting, particularly given the Bank's own economists predict inflation will creep higher into year-end.

Instead, markets think the Bank will opt to wait until November before cutting again.

Some economists warn that the strength of the economy could even put a November cut in peril, which means Sterling can hold onto its yield advantage over other major currencies for longer.

"The latest S&P Global flash PMI signals that the MPC has no need to cut Bank Rate at back-to-back

meetings in August and September," says Elliott Jordan-Doak, Senior U.K. Economist at Pantheon Macroeconomics. "Firms are confident to hire again; the MPC will be wary of employment growth in a tight labour market."

He says the output index of the composite PMI rose to 53.4 from 52.8 in July, suggesting that growth is accelerating.

"We think today’s readings strengthen the case for the MPC to take a gradual approach towards reducing Bank Rate, given the emphasis placed by rate-setters on the need to generate slack to bring down wage growth," says Jordan-Doak.