Pound Has More Fuel in the Tank says Commerzbank

- Written by: Gary Howes

Image © Adobe Images

Will the Pound continue to rise against the euro and where will it end the year? According to a new analysis from a European investment bank, Pound Sterling will continue to rise against the Euro "for the time being".

"We continue to expect sterling to strengthen in the coming months on the back of continuing inflation, a recovering real economy and the prospect of a more stable government," says Michael Pfister, FX Analyst at Commerzbank.

The call comes as the Pound to Euro exchange rate recovers losses made earlier in the month, having fallen sharply amidst a downturn in global investor sentiment and an interest rate cut from the Bank of England.

"As concerns about the global economy peaked in late July/early August, sterling came under significant pressure, giving up much of its gains for the year," says Pfister. "This was not surprising, as part of sterling's strength was based on the fact that the UK economy had recently recovered somewhat. Logically, when concerns about the economy arise, some of this strength is lost."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The losses raised questions about whether 2024's top-performing G10 currency had seen its outperformance come to an end. GBP/EUR retreated from highs near 1.19, but analysts think this level can be tested again before the end of the year.

The Bank of England's decision to cut rates by 25 basis points was not fully expected and explains why the Pound lost value on August 01 and 02. Pfister confirms the interest rate cut "certainly did not help the pound in this environment."

Above: GBP/EUR has moved back above its 200-day moving average, which adds evidence that the Pound is back in appreciation mode.

Nevertheless, he thinks the Pound can see further upside potential in the coming months. "We continue to believe that sterling should outperform the euro for the time being."

There are three reasons to back the Pound, according to the analyst:

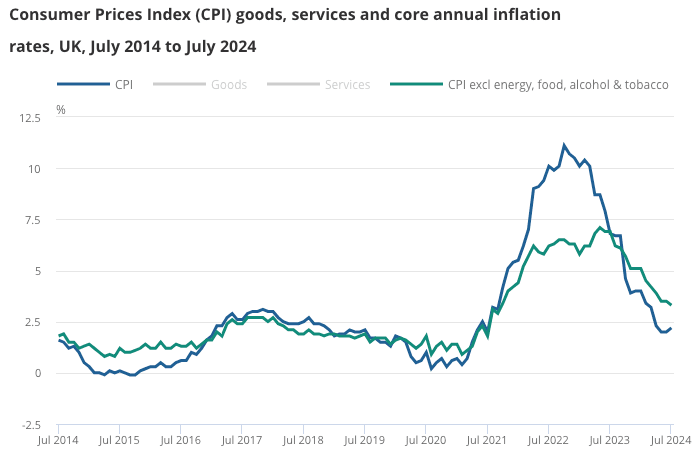

1) Core inflation in the UK remains much more persistent than in other G10 countries.

2) UK growth finally seems to be picking up. This was underpinned by Thursday's release of PMI survey data for August, which showed the UK economy continues to comfortably expand, while forward-looking components of the report confirmed improving confidence amongst the country's businesses.

3) There is still optimism that the new Labour government will undertake much-needed reforms that will also boost the UK's long-term growth potential. "Although there is still a long way to go, fundamental optimism is currently supporting the pound," says Pfister.

Commerzbank forecasts the Pound to end 2024 around 1.19 against the Euro.

Risks to the Pound's outlook include a slowdown in UK economic growth, and the government's poor finances could leave the new government struggling to enact reforms that can boost growth.