Pound Rallies Against Euro After PMIs Show Diverging Economic Fortunes

- Written by: Gary Howes

Image © Adobe Images

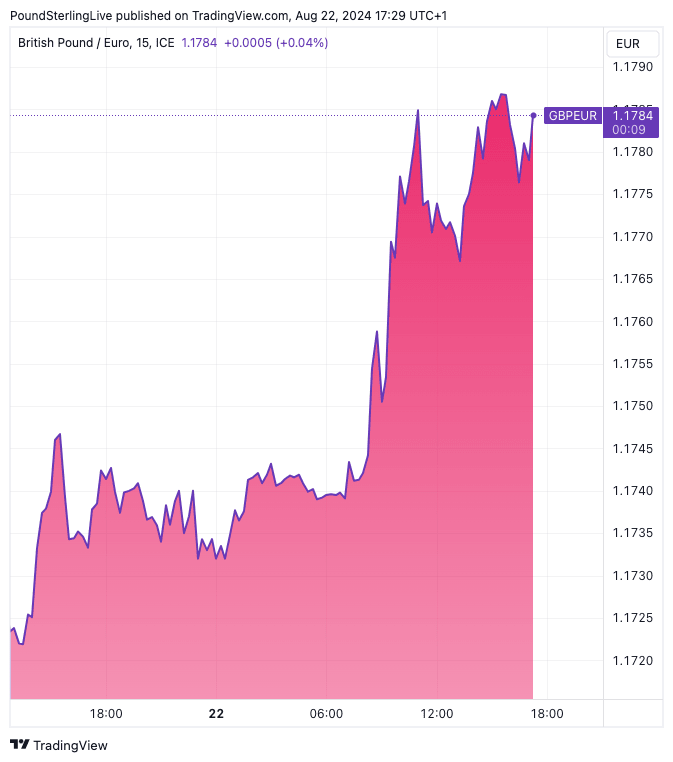

Pound Sterling rose after a survey of the UK economy beat expectations and eclipsed that of the Eurozone.

The Pound to Euro exchange rate rallied to 1.1760 - its highest level since August 02 - after UK PMIs for August convincingly outperformed expectations and those from the Eurozone.

The UK composite PMI rose to 53.4 from July's 52.8, exceeding estimates for 52.9. The beat was driven by both services and manufacturing, with the services PMI rising to 53.3 in August from 52.5 in July, outstripping expectations for 52.8.

"The British pound continues to stretch higher against most peers," says George Vessey, Lead FX Strategist at Convera. "Better-than-expected flash PMIs across both services and manufacturing continue to show that the UK economy continues to fare well in 2024."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Manufacturing pulled its weight with a 52.5 outturn in August, which was above July's 52.1 and ahead of consensus at 52.1. This means UK manufacturing continues to expand, which marks a stark contrast with the Eurozone's manufacturing PMI of 45.6 (a reading below 50 is consistent with contraction).

Although the Eurozone's headline PMIs beat expectations, the details show this was likely due to a temporary bump caused by the Olympics. In fact, Germany's PMI results suggest the bloc's largest economy is once again flirting with contraction.

The divergence in performance neatly explains why Pound-Euro is trading higher in the wake of the releases.

The data outturn and the currency market reaction were predicted by strategists at JP Morgan, who initiated a short EUR/GBP trade in anticipation of another divergent PMI print:

"We add a short position in cash and see the upcoming PMIs as a key catalyst for downside in the pair if the UK metric were to again outperform vs Europe," said a note released by JP Morgan at the end of last week.

"With EUR/GBP now screening rich on our fair value metrics, we add a short position in cash and see the upcoming PMIs as a key catalyst for downside in the pair if the UK metric were to again outperforms vs Europe," added the report.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

S&P Global - compilers of the report - said August PMI data signals another solid expansion of UK private sector output, supported by a robust upturn in new order intakes.

The forward-looking components of these surveys are particularly relevant to foreign exchange, and here things are looking up for the UK:

"Positive sentiment towards the near-term business outlook was also a factor helping to underpin a gradual acceleration in employment growth. Business activity expectations for the year ahead were relatively upbeat in both the manufacturing and service sectors," said S&P Global.

UK firms noted improving sales pipelines and hopes of increased domestic investment spending. They also cited reduced political uncertainty and the prospect of further interest rate cuts, alongside more favourable economic conditions.

By contrast, Eurozone businesses reported waning confidence regarding the future outlook for output.

"Sentiment dropped to the lowest in 2024 so far and was below the series average. Reduced optimism was widespread, with confidence lower across Germany, France and the rest of the eurozone, as well as in both monitored sectors," said S&P Global's Eurozone PMI report.

The Eurozone Central Bank will likely cut interest rates again in September, which can help shore up sentiment and activity, but it will potentially limit the Euro's ability to strengthen.

"Weak industrial activity and some easing in services price dynamics increase the European Central Bank’s room for monetary easing. We expect another rate cut at the next meeting in September," says David Kohl, Chief Economist at Julius Baer.