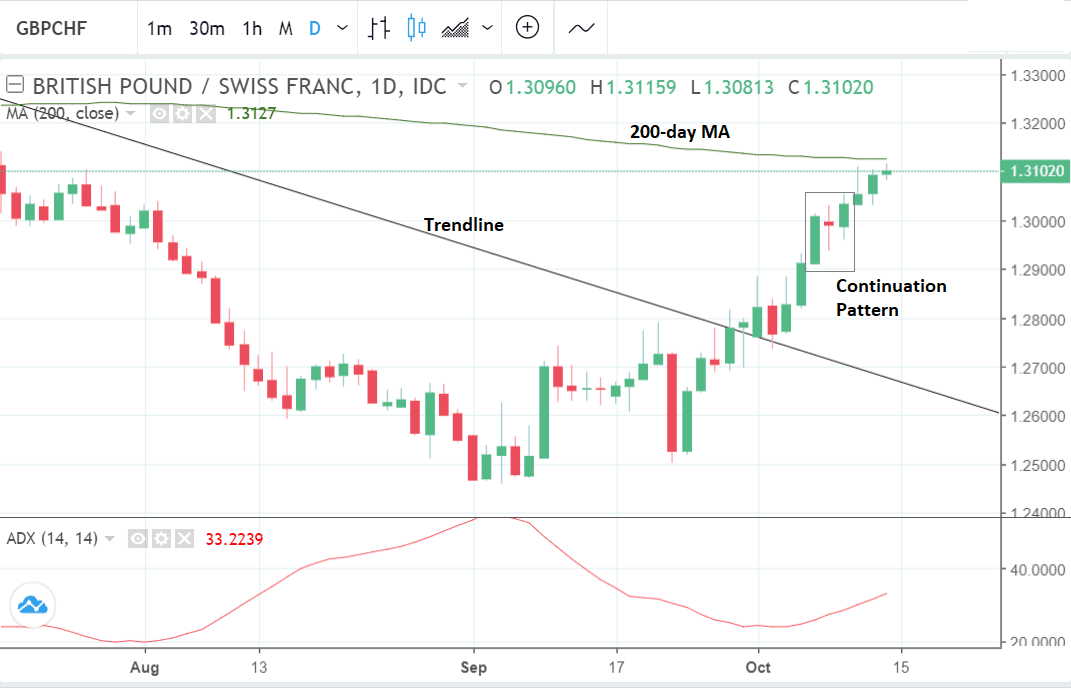

Swiss Franc Tipped to Weaken on 'Good News'; GBP/CHF Nears 200-day MA, Outlook Remains Constructive

Image © Andrey Popov, Adobe Stock

- GBP/CHF up on Brexit risks easing

- Improving global sentiment threatens Franc

- GBP/CHF nearing 200-day MA which could present obstacle

- Confluence of factors could drive pair higher still

The Swiss Franc's decline is picking up speed as a combination of benign trader positioning and a more optimistic market outlook weigh on the traditional safe-haven.

"The franc didn't rally when things were bad and is falling now as they improve," says Jeremy Boulton, an analyst on Thomson Reuters' currency desk.

One of the reasons for the negative CHF outlook is that US-China trade tensions have eased after the White House stepped back from officially branding China a currency manipulator, and following reports of a possible meeting between Donald Trump and President Xi Jinping at the November G20.

The Franc is a safe-haven currency which counter-intuitively tends to rise on bad news and fall on good news. It does this because investors see it as 'safe' and so capital tends to flow into Switzerland in times of crisis.

Another reason for the Franc's expected decline is data from the currency future's market which is showing a relatively low number of bets the Franc will fall. This is what is known in trader jargon as 'positioning data', and it is also used in a counter-intuitive fashion to assess the prospects of the market.

When there are lots of bets the market will go up or down, for example, the opposite tends to happen, and the market goes respectively down or up. Thus the information that the market is not betting heavily against the Franc is actually a negative indicator for the Franc.

GBP/CHF is set to rise in line with the forecast of more Franc declines. We recently wrote an article highlighting a high-probability continuation pattern on the pair which indicated possible gains to between 13155-1.3205.

The pair is currently trading at 1.3105 and seems to have lost some upwards momentum. This may be attributable to the 200-day moving average (MA) at 1.3127, providing a formidable obstacle to further trend extension. Major moving averages can be tough barriers to break through as they attract a lot of short-term technical short-sellers trying to take advantage of the fact prices often pull-back or even reverse after touching the MA.

Clearly, this poses a risk factor against expecting the exchange rate to reach the target generated by the continuation pattern. Yet, overall the continuation pattern is quite a reliable indicator so it's target may still be reached, nevertheless, some traders may wish to deleverage their exposure due to the 200-day in the way.

One analyst who also seems further weakness on the cards for the pair is John Hardy of Saxo Bank.

He also highlights the location of the 200-day MA but suggests the Franc is overall likely to weaken further as Sterling "catches a bid" and the Franc falls out of favour.

"Sterling is catching a bid again this morning and plenty more room for GBP strength if markets are generally stabilising and we get the positive Brexit headlines the market is gunning for next week. Note GBP/CHF trading up at its 200-day moving average near 1.3100 and for perspective, consider that the 200-week moving average doesn’t come in until close to 1.3500," says Hardy.

The fact that EUR/CHF is looking particularly bullish despite negative headlines regarding Italy and slower Eurozone data, is a negative sign for CHF, says Hardy:

"The franc’s recent weakness despite worse-than-wobbly risk appetite and EU existential stress sticks out like a sore thumb. EUR/CHF making an interesting go above the local pivot level of 1.1440 and eyeing the perhaps psychologically more important 1.1500 level," adds the Saxo bank analyst.

From a fundamental standpoint there is a compelling argument for forecasting GBP/CHF to eventually break above the 200-day MA, based on a combination of GBP strength due to easing Brexit risk premia, and talk of a deal being brokered as early as Monday next week, and CHF weakness, for the reasons outlined above.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here