Swiss Franc in the Red as Odds of Negative Rates Rise Following Inflation Slump

- Written by: Gary Howes

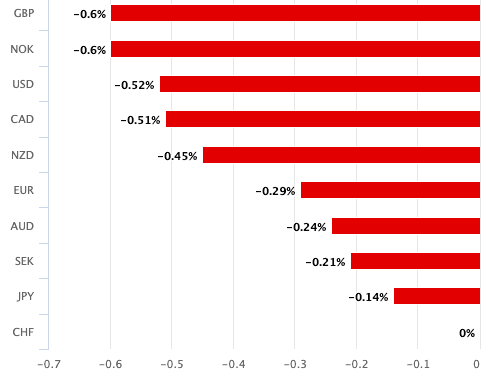

Above: CHF performance on November 01.

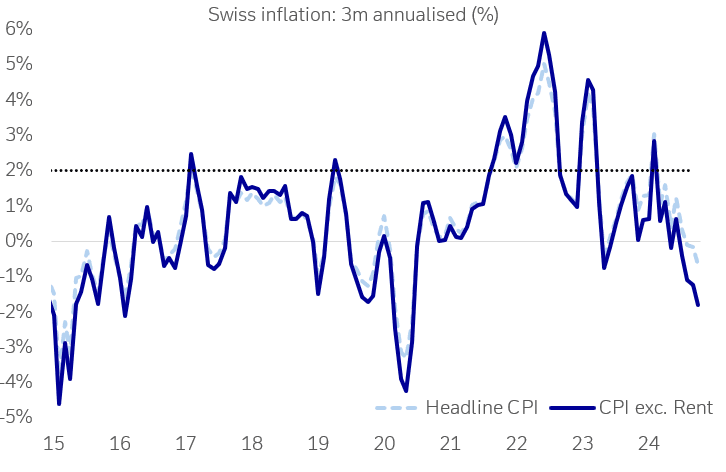

Swiss inflation takes another dip and raises the prospect of negative interest rates at the Swiss National Bank (SNB).

The Swiss Franc fell against all G10 peers after it was reported Swiss CPI inflation fell 0.1% month-on-month in October, taking the year-on-year measure to 0.6%. This was notably below the SNB's expectation for 1.0% on average in Q4.

"Swiss inflation numbers fell deeper into deflation territory and we think that the odds of negative rates are rising again," says George Saravelos, FX analyst at Deutsche Bank.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

The decline in the headline figure was driven by falling fuel prices that followed a slide in global oil prices in recent months.

Core inflation, which is more relevant to the SNB, fell by 0.2pts to 0.8%, as private services inflation, excluding rent, continued a sharp descent.

The fall in the franc reflects expectations for lower interest rates at the SNB at the December 12 policy decision and beyond.

"Another larger-than-expected fall in both headline and core inflation in Switzerland will increase concerns that the country could temporarily enter deflation next year. This will pile on pressure on the SNB to act decisively and increases the chance of a 50bp cut at the next meeting in December," says Adrian Prettejohn, Europe Economist at Capital Economics.

Franc exchange rates are down across the board, with the Pound to Franc conversion rising 0.65% to 1.1211 following the data. The Euro to Franc is 0.43% higher at 0.9427 and the Dollar to Franc is half a per cent higher at 0.8682.

"The current SNB policy rate is already very low in nominal terms, at just 1.0%, leaving less room to ease and remain in positive territory," says Saravelos.

Image courtesy of Deutsche Bank.