Swiss Franc Upside Risks Build

- Written by: Gary Howes

Image © Adobe Stock

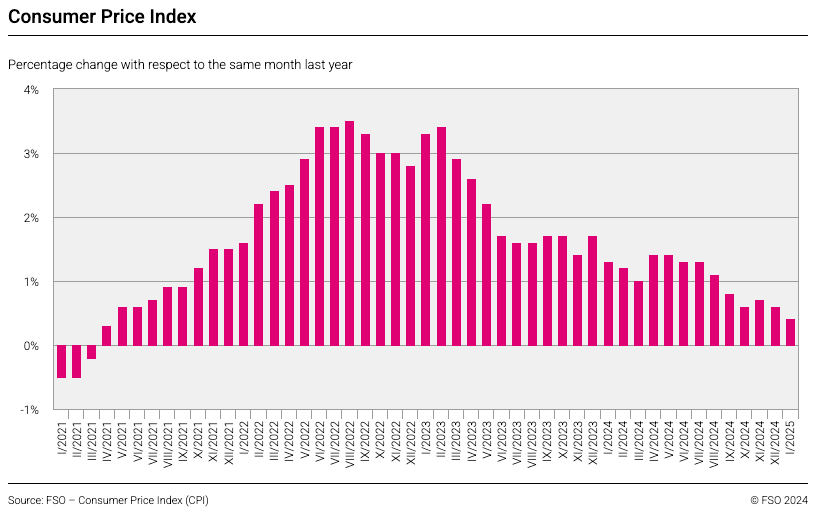

An uptick in Swiss core inflation might have ended the Franc's selloff in the near term.

This is according to analyst assessments in the wake of Swiss inflation data that beat expectations and offers the Swiss National Bank (SNB) the chance to pause its interest rate cutting cycle.

The Franc found buying interest after Switzerland reported core CPI inflation unexpectedly quickened to 0.9% y/y in January from 0.7% in December, beating consensus expectations for a 0.6% gain.

"Switzerland’s January CPI print suggests the Swiss National Bank’s (SNB) can afford to pause its easing cycle at its next March 20 meeting," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.

The developments put a short-term line under a run of losses against the Dollar, Euro and Pound.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

Over the past year, the SNB has reduced its policy interest rate four times, totalling a cumulative decrease of 1.25 percentage points.

In the December meeting, base rates were reduced by 50 basis points to 0.50% but the Bank abandoned a previous reference that "further cuts in the SNB policy rate may become necessary in the coming quarters."

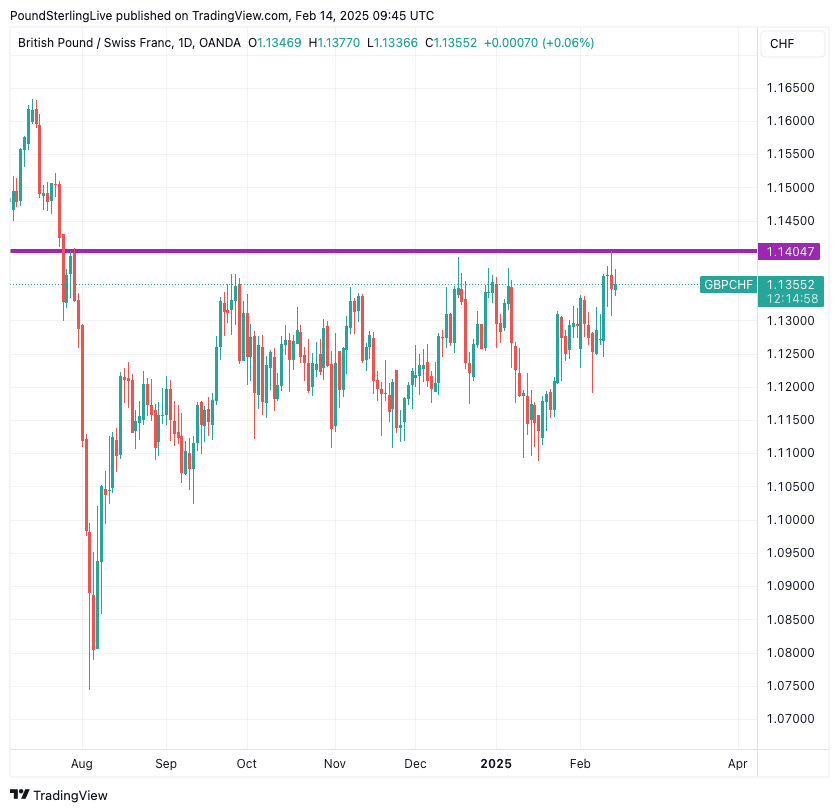

The prospect of a pause to the cutting cycle has helped shore up the Franc: The Pound-to-Franc exchange rate is 0.20% weaker in the period following the inflation release at 1.1351 and looks to be forming an interim peak.

Above: GBPCHF at daily intervals.

Following the data, the Euro-to-Franc exchange rate fell a third of a per cent to reach 0.9452. The Dollar-to-Franc exchange rate dropped by a more sizeable 1.0%, amidst broader USD selling, to reach 0.9012.

"We doubt the SNB will deliver more cuts in the near term and see upside risk to CHF," says Haddad.

Analysts at Crédit Agricole say that as long as Swiss inflation does not already undershoot the 0.2% y/y trough expected by the SNB by the second quarter of the year, CHF money markets should not push for bolder measures than the return to 0% rates already priced in.

Above: Swiss inflation trends.

With pricing for 0% interest rates already well priced, the pressure on the Franc naturally eases.

Looking beyond the near term and further into 2025, Crédit Agricole expects a resumption of weakness as the SNB ultimately takes further steps towards a 0% interest rate policy.

"Zero Interest Rate Policy, or near zero, is indeed due to return to Switzerland this year, as the Swiss CPI is expected to just about settle within positive territory," says Dolci.

He says the Franc's high valuations and contained volatility, should help make it a favoured funding currency once global uncertainties abate, "we look for EUR/CHF to head towards 0.97 later in the year."