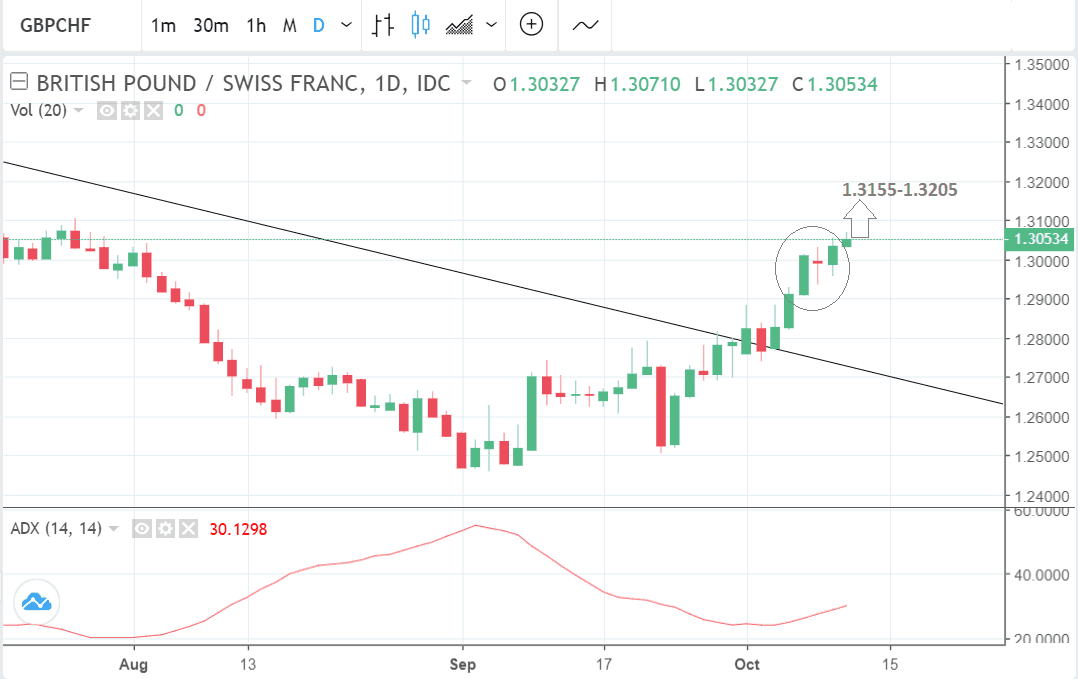

Pound-Swiss Franc Rate Forms High Probability Continuation Pattern and Targets 1.3155

Image © Adobe Stock

- Three-bar pattern forms on charts suggesting more upside on the cards

- Likely to extend the trend by between 100-150 pips

- Sterling seen higher amidst rumours of a Brexit deal as early as Monday

The Pound is forecast to continue its climb versus the Swiss Franc after forming a high probability continuation pattern on the daily chart.

The three-bar pattern (circled below) suggests a 100-150 pip rise in GBP/CHF. This would take the exchange rate to between 1.3155 and 1.3205, subject to confirmation.

The rising ADX indicator in the lower pane further corroborates the set-up. ADX is short for 'Average Directional Index' and measures how strongly a price is trending.

The fact it is rising adds further insight into the nature of the market and argues for a persistence of the trend.

A break above the 1.3055 highs would confirm a rise up to a conservative target at 1.3155.

The Pound has made more gains across the board on talk the U.K. and the E.U. could agree on the terms of a Brexit divorce by as early as Monday, according to reports from the Dow Jones newswire, citing unidentified diplomats saying the announcement of the deal will precede a meeting of E.U. leaders on October 17.

Whilst some had expected an announcement after the summit, no-one had expected an announcement as early as Monday.

1.33 had been cited as an initial upside target for GBP/CHF following the unveiling of a deal.

Dow Jones report both parties have narrowed their differences around the Irish border, but that some differences still remained.

Last week diplomatic sources told Reuters that a Brexit deal with Britain was "very close".

GBP/CHF surged after the news and in the process met our previous upside targets calculated from the break above the major trendline and we were cautious about forecasting further gains, however, the signal today has reinvigorated the uptrend.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here