USD to CAD: More Canadian Dollar Gains Still Favoured, But there are Caveats

The US dollar to Canadian dollar exchange rate has broken through a key support line increasing the probability of a continuation of the infant down-trend.

Heading into March there remain reasons to stay positive on the Canadian dollar.

CAD continues to strengthen against most majors over the medium-term timeframe and has breached a major trend-line versus the U.S Dollar, increasing expectations of even lower USD/CAD rates to come.

It wasn't a convincing end to February for the Canadian dollar though which underperformed all of the G10 currencies with the exception of CHF.

"Near-term CAD risk appears balanced to the downside as we consider the broader tone of uncertainty with a focus on global growth, post-G20 disappointment, and China’s RRR cut," says Shaun Osborne at Scotiabank.

Caution also returned for the currency on the eve of critical fourth quarter data from Canada’s that’s forecast to show the economy stalled.

"If the Q4 GDP should fall below zero it would stir anew the Bank of Canada rate cut debate, a scenario that could trigger a renewed bout of loonie weakness," says Joe Manimbo, analyst at Western Union.

Roy Mendes at CIBC says that while the outlook for Canada has certainly improved, the US dollar should maintain the edge thanks to outperforming US interest rates.

"In Canada, the use of fiscal instead of monetary policy, a bottoming out in oil prices and a more dovish Fed mean that the CAD’s worst days are behind it," says Mendes.

But, "as the US interest rate increases come into clearer view, the loonie will depreciate modestly, albeit not to the depths seen in January."

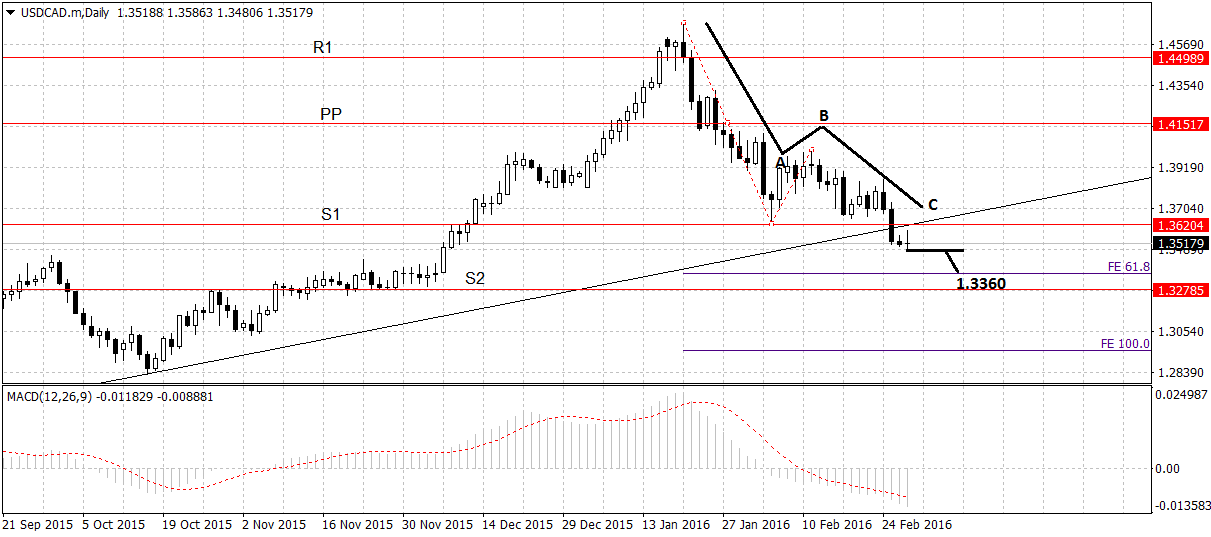

Technical Outlook for USD/CAD Suggests More Gains Possible

"In Canada, the use of fiscal instead of monetary policy, a bottoming out in oil prices and a more dovish Fed mean that the CAD’s worst days are behind it," says Royce Mendes at CIBC in Toronto.

The minimum price target for the USD to CAD pair is now at 1.3360, which is at the 61.8% extension of leg A of the current A-B-C pattern down from the highs, but it could go even lower, to 1.3275 using another method of calculating the target, which extrapolates the height of the move before the trend-line break lower for a post-break target.

A break below the 1.3480 lows might provide confirmation of further downside to the aforesaid targets.

Widespread expectations of a flat Q4 GDP reading to be released on Tuesday March 1, however, may indicate some short-term recovery in the pair, with a typical return move back up to the trend-line for a metaphorical ‘kiss goodbye’, one possible technical scenario fitting with the fundamental outlook.

Swissquote Bullish Longer-Term

Swiss Online lender Swissquote, meanwhile, highlight minor support at 1.3505, in their currency note on Monday February 29:

“USD/CAD is now pausing after last week's sharp decline. The pair is now pausing above 1.3500. Hourly support is given at 1.3505.”

They continue to be bullish longer term, citing the break above the key 1.3065 resistance level as the original game-changer:

“In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening.”

The break below the trend-line comes at the start of a potentially volatile week for the pair.

Tuesday 1 March see’s the release of Canadian GDP, which Joe Manimbo, Senior Market Analyst at Western Union is expecting to undershoot expectations:

“Caution also returned for the loonie on the eve of critical fourth quarter data from Canada’s that’s forecast to show the economy stalled.

“If the Q4 GDP should fall below zero it would stir anew the Bank of Canada rate cut debate, a scenario that could trigger a renewed bout of loonie weakness.”

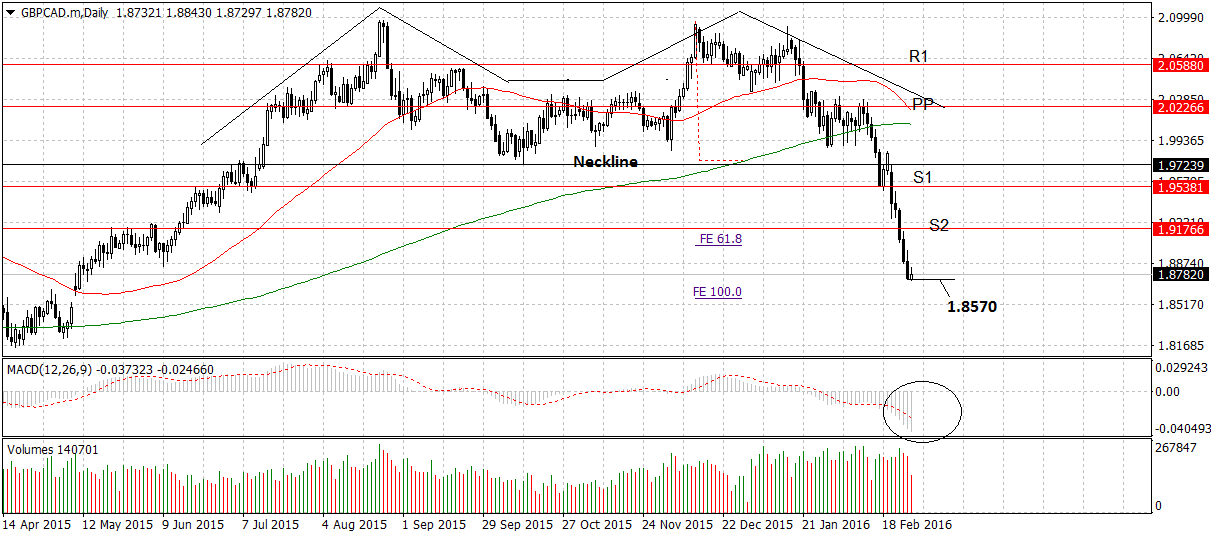

GBP/CAD - Target Now Met Though Still Going Lower

As far as the outlook for the British-Canadian pair goes, the down-side potential is not as apparent, and the porbabilities have increased that the recent steep sell-off in the pound could pause, since a significant price target has now been achieved.

The GBP/CAD pair broke down below the neckline of a double-top reversal pattern and moved lower, towards a minimum target at the 61.8% extension of the height of the double-top, at 1.9025, which was achieved (the pair is currently trading at 1.8845).

Since the minimum target has been achieved there is now an increased chance the pair could pause, stall or even reverse and start to recover.

MACD - a momentum indicator nevertheless continues to show strong bearish momentum, favouring more loses.

The pair is now targeting the 100% extension of the double-top, at roughly 1.8600. A break below the 1.8729 lows would be a strong signal of continuation lower, towards the aforesaid target.