Canadian Dollar Technicals Biased for Further Gains Against the Pound and US Dollar

The Canadian dollar has mounted a decisive assault on the British pound while also gaining the upper hand against the US dollar. How far can the currency advance?

Despite some suggestions that oil prices and the Canadian dollar have uncoupling in recent weeks, the fact remains that the fortunes of the Canadian Dollar continues to rest heavily with that of oil.

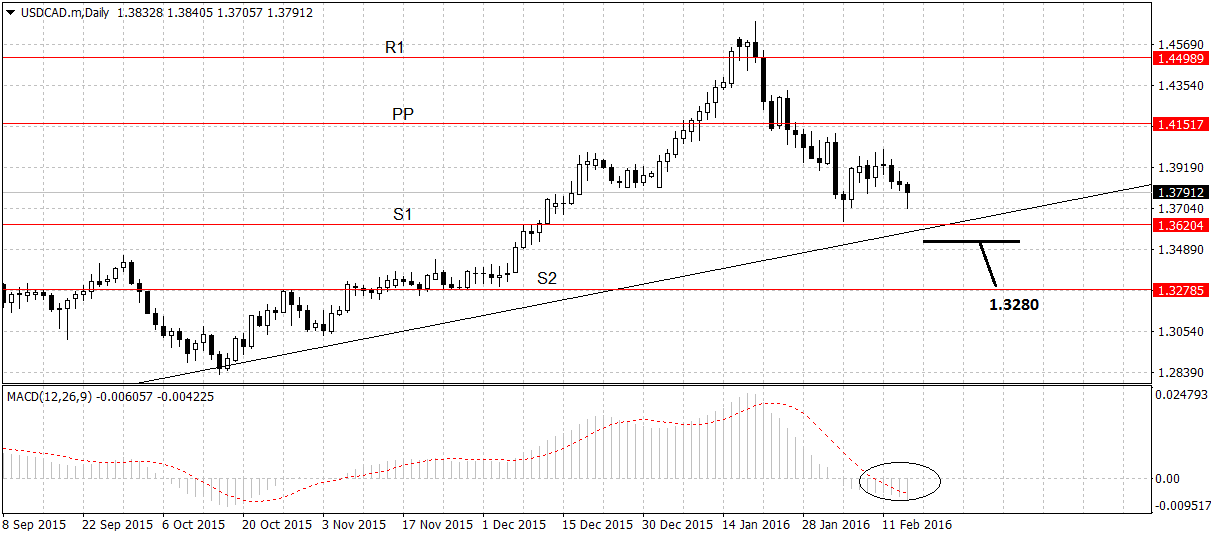

The recent rebound in black gold, following headline about the Saudi’s and Russians meeting to discuss output cuts, correlates clearly with the renewal of the fledgling short-term down-trend on the US dollar to Canadian dollar exchange rate.

It’s still too early to say whether this trend will extend – from a purely technical perspective, there is still a major trend-line in the way at 1.3620, roughly at the same level as the S1 monthly pivot, creating a strong double-layer of support at that level.

A break below 1.3490, however, would confirm a break below these levels and the onset of a much more bearish environment, with the next target probably as low as the S2 Monthly Pivot at roughly 1.3280.

Pound to Canadian Dollar Forecast

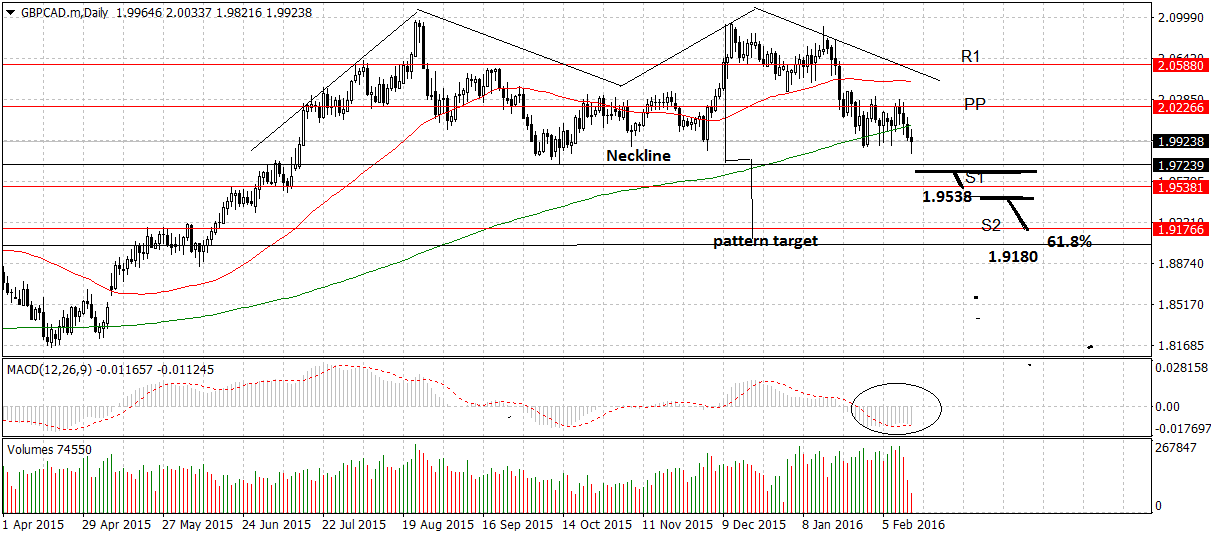

For GBP/CAD it is a different story with a similar ending, as the large bearish double top pattern which has formed at the highs indicates more downside on the horizon, but the many close tiers of support below indicate it may not be a ‘smooth’ descent.

At the moment the pair is trading at the level of the 200-day Moving Average, which has provided support and kept the exchange rate at around the 2.0000 now for several weeks.

The 2.0000 level itself has a support value due to its psychological significance so that it is bound to attract clustering’s of bids around it.

If the rate was to break clearly below, the next key level is the neckline of the double top situated at 1.9725, and not far below the S1 Monthly Pivot at 1.9538.

For confirmation of a breach of the neckline, a break below the 1.9640 level would be necessary, which would then generate a target at 1.9010.

First top down would be the S1 at 1.9538, followed by the S2 at 1.9177.

Crude in Command

As mentioned before Oil remains the main influencer of the value of the Canadian Dollar, and during this week this may be even more the case, as there is so little data from Canada until Friday, when there is a flurry, including Retail Sales for December (1.6% prev), CPI (-0.5% prev mom and 1.6% prev yoy), and Core Inflation which stood at -0.4% mom previously and 1.9% yoy previously.

The other big impactor on CAD is the rate differential between Canadian Government bonds and U.S Treasury’s, however, ever since the market woke up to the possibility of negative interest rates following Janet Yellen’s surprise statement that they were something “we are still looking into,” at the Senate Banking Committee, the markets – according to a note from Scotiabank - have now reduced rate expectations to no more than a 5% chance of a 25bps this year. As such the differential has closed and this remains a limited influence.

Going forward all eyes are on the outcome of a meeting in Doha between the oil ministers of Saudi and Russia, the two largest producers in the world.

Saudi have said repeatedly that they will only condone a supply cut if non-Opec members such as Russia join them, so this meeting could be the start of a deal which could see output cut and oil recover.

Obviously if this were the case the CAD would no doubt strengthen on the news.

However, according to a recent report by Bloomberg, Russia is unlikely to cut its output, because its oil is extracted in Siberia and the harsh conditions there preclude ‘turning off the taps’:

“Reducing the flow of crude might damage Russia’s fields and pipelines, require expensive new storage tanks or simply take too long.”

The article goes on to explain why in more detail:

“The oil and gas that flows from wells always contains water, so once pumping stops, pipes may freeze,” Mikhail Pshenitsyn, who has worked for more than 10 years in the Russian oil industry, said by e-mail.

“The problem goes away in summer, but there’s still the risk of a long-term reduction in output because a halted reservoir can become polluted with salts and residues,” he said.”

There is insufficient storage space to store the oil and introducing higher taxes to curb production would take too long to get passed.

Taking the Bloomber analysis on face value seems to indicate talks will probably break-down with no supply cut deal - and therefore weakness for the CAD.