Canadian Dollar: Why Canada Can Avoid Punitive Trump Tariffs

- Written by: Gary Howes

Above: Canada's oil is too important for U.S. refineries for Trump to compromise with punitive tariffs. Image © Adobe Stock.

The Canadian Dollar took a hit when President-elect Trump singled Canada and Mexico for punitive tariffs, but it's too soon to bet on a worst-case scenario.

This is according to FX analysts at UBS, who say they are not yet minded to downgrade their Canadian Dollar forecasts in the wake of recent events.

"We are not in a rush to downgrade our CAD forecast, which already implies some weakness," says Vassili Serebriakov, strategist at UBS.

Trump shocked financial markets on Monday night with a social media rant against Mexico and Canada, who he perceives as facilitating migrant flows into the U.S.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

He threatened both countries with 25% import tariffs unless they got a handle on the situation.

The threat proved a lightning rod to the Peso and Canadian Dollar, which slumped following the developments.

Many analysts had thought the CAD would be one of the better performers in global FX in Trump 2.0 as Canada would largely avoid his tariff agenda.

But Trump has sent a clear signal that he sees tariffs as being part of a wider geopolitical toolbox, which makes forecasting currency movement based on tariffs particularly tricky owing to the uncertainty that this approach implies.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

Analysts at Goldman Sachs say their model examining the historical relationship between exchange rates and terms of trade suggests a 25% tariff could result in a 13% depreciation in the Canadian Dollar's value.

The view at Goldman Sachs is that the CAD isn't yet close to fully discounting punitive tariffs.

UBS agrees that a 25% tariff would be significant: "The economic implications of a 25% across-the-board tariff on ~$420bn of Canadian goods exports to the US would be significantly larger, implying an increased risk of a Canadian recession and of lower policy rates."

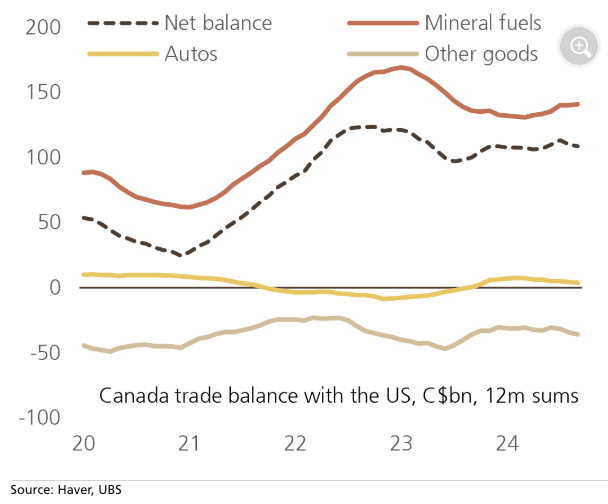

Above: U.S. - Canada trade is already well balanced when oil trade is excluded.

But UBS thinks Canadian officials will put up a defence that will convince the U.S. to refrain from a 25% tariff.

Arguments in Canada's corner include:

- The highly integrated nature of the U.S. and Canadian oil industries, which could be significantly damaged by tariffs U.S. refineries are heavily dependent on Canadian oil imports

- The U.S. actually runs a ~$20BN trade surplus with Canada once oil imports are stripped out

- Canada has already appeared more willing to align with the U.S. demands and concerns over Chinese content in Mexican manufacturing exports

Crucially, UBS suspects Canada will move in the direction of tightening border security, which is where Trump's main bone of contention lies.

"It’s worth noting that tighter border controls are also likely in Canada’s interest as it has been concerned about the potential influx of asylum seekers from the US if the Trump Administration’s deportation plans should compel migrants to move across the northern border," says Serebriakov.

UBS won't rush to downgrade its CAD forecasts as any U.S. backtracking on the tariffs will be supportive.

Also potentially helping CAD in the near term is an improvement in domestic activity data as the government announced an additional C$6.3BN in fiscal support last week.